U.S. Retail Sales Post Huge Downward Surprise, Economic Recovery Finally Over

Economics / Recession 2015 Jan 15, 2015 - 03:07 AM GMTBy: Mike_Shedlock

So much for those allegedly strong Christmas sales. In fact, sales of nearly everything were down in the today's Commerce Department Retail Sales Report for December 2014.

So much for those allegedly strong Christmas sales. In fact, sales of nearly everything were down in the today's Commerce Department Retail Sales Report for December 2014.

Retail sales were down 0.9% compared to November vs. economist expectations of a 0.1% decrease. November was revised from +0.7 percent to +0.4 percent.

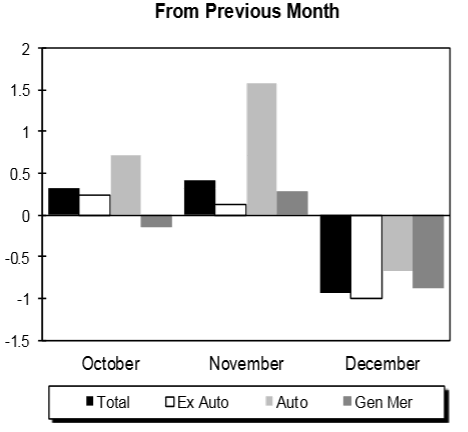

Retail Sales vs. November

Month-over-month retail sales, autos, general merchandise, and ex-auto sales are all lower.

The report shows store retailers down 1.9%, building materials & garden supplies down 1.9%, electronics & appliance stores down 1.6%, motor vehicles and parts down 0.7%, and general merchandise down 0.9%.

Food services and drinking was up 0.8%. Home furnishings posted a 0.8% gain as well. Gasoline was down 14.2%.

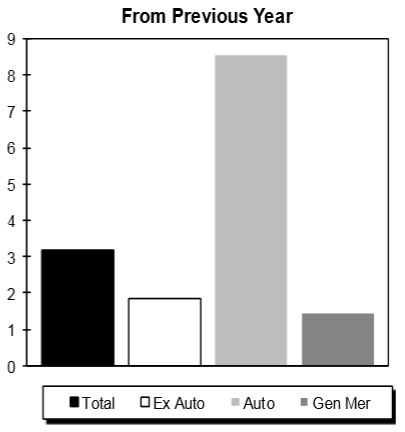

Retail Sales vs. December 2013

Take a good look at autos, one of the key drivers of overall sales growth for the past year.

Commerce reports "auto and other motor vehicle dealers were up 9.8 percent from December 2013, and food services and drinking places were up 8.2 percent from last year."

Economists Upbeat Despite Factory Orders

Once again economists were surprised when they should not have been.

Please consider a few snips from my January 6, 2015 report Economists Upbeat Despite 4th Consecutive Decline in Factory Orders; Auto Orders vs. Expectations.

Economists are among the most optimistic groups on the planet. Year in, year out they project improvements in growth.

So today, despite 4th Consecutive Decline in Factory Orders, it's no surprise that economists remain optimistic.

Auto Orders vs. Expectations

Automobiles orders down 2.0% and heavy duty trucks down 4.4% are standouts. Those numbers suggest the auto party is over or will soon be.

I have a simple question: Who wants a car, needs a car, can afford a car, and does not have a car? Subprime auto loans are a key reason car sales were as robust as they have been.

Nonetheless "Auto sales are expected to reach their highest level in a decade this year, bolstered by strong job gains and cheap gas."

Economists Easy to Surprise

The factory order evidence was right there, staring economists in the face, but they could not see it.

Surprise! Surprise! Surprise!

Hmm. What happened to the theory that consumers would take gas money and spend it on everything else? At best, they drank some of it.

I have a strong suspicion the recovery is finally over and that 2015 will mightily surprise economists to the downside. If so, it's fitting the party would end on the recent upward GDP revisions.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2014 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.