Stock Market SPX Trendline About to be Broken

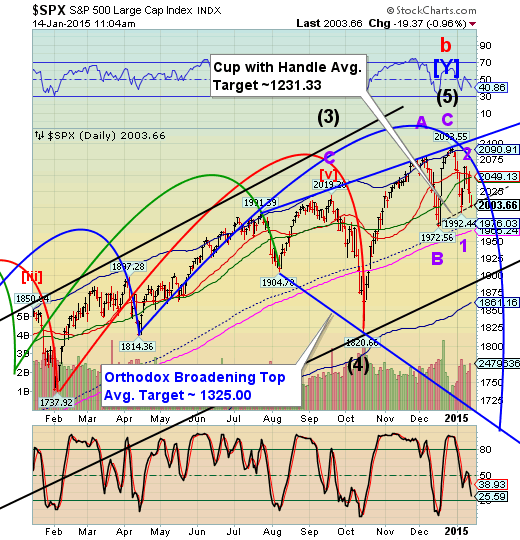

Stock-Markets / Stock Markets 2015 Jan 14, 2015 - 06:15 PM GMT SPX did gap down but not beneath the Lip of its Cup with Handle formation. It challenged the Lip but bounced back above. It may be gathering strength for another attempt below the trendline, since it has also stubbornly closed beneath the 50-day Moving Average three days in a row. The algos cannot keep it elevated enough…ultimately, the breakdown could be severe.

SPX did gap down but not beneath the Lip of its Cup with Handle formation. It challenged the Lip but bounced back above. It may be gathering strength for another attempt below the trendline, since it has also stubbornly closed beneath the 50-day Moving Average three days in a row. The algos cannot keep it elevated enough…ultimately, the breakdown could be severe.

My basic premise of this decline is that it must go beneath the October low at 1820.56. The problem is that now we are headed into dangerous ground…options expiration. It appears that the Primary Dealers are attempting to delay the decline until after options expiration. However, accidents can happen and once the line is broken, the decline could quickly go out of control. In addition, The Master Cycle low is overdue. Its normal due date would have been last Friday, January 9, but it inverted, instead. So now we are left with a minimum of 4.3 days from yesterday’s high to make the Flash Crash happen.

ZeroHedge claims, “The Dow is now down almost 600 points from yesterday's highs At 2.39%, 30Y Yields have never been lower...ever! “

The Hi-Lo Index opened on a confirmed sell signal. The Hi-Lo is a sensitive indicator, but I have not seen it so jumpy after giving a sell signal.

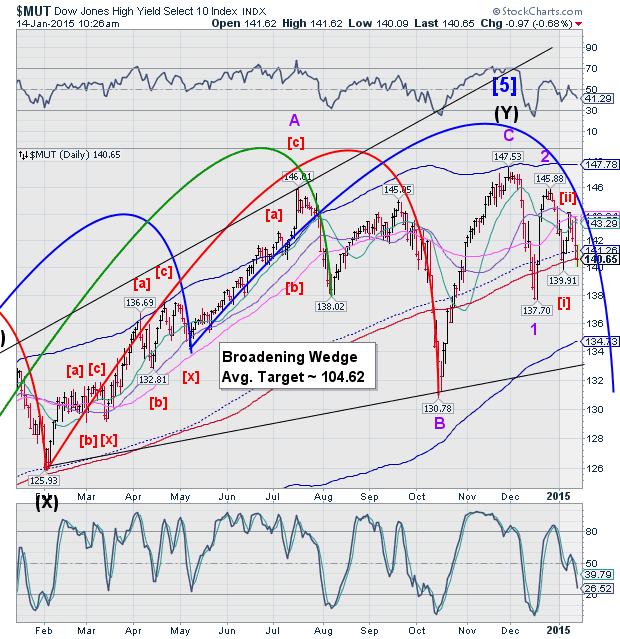

MUT is crossing its 200-day Moving Average, suggesting there is much more weakness to come in the credit markets.

ZeroHedge reports, “Of course, it's different this time... credit is "just weaker because of energy names... which is transitory" except that's the same bullshit (but about LBOs) that was used last time... 'higher leverage is great for stocks... at the expense of credit' until it reaches a tipping point.

Worried about rising interest rates? Well they are already here for corporates...!”

In the meantime, crude crumbles this morning on an unexpectedly large inventory build.

So the conditions deteriorate while damage control is in high gear.

Things can happen quickly, so stay on the alert!

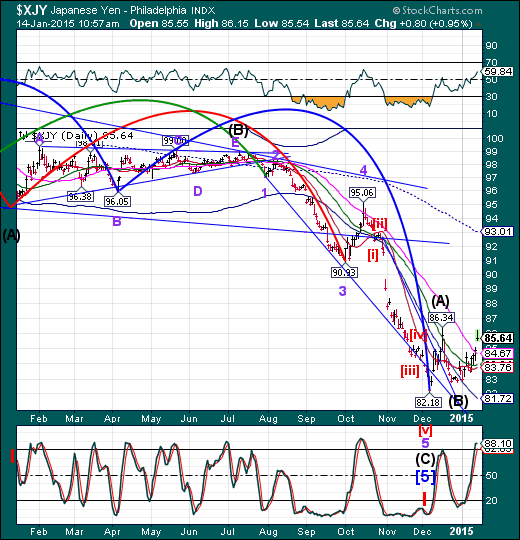

Finally, XJY vaulted above its Model resistance cluster and is ready to move considerably higher. A further breakout above its prior high at 86.34 is likely to gain recognition by traders that the yen carry trade is suspended for a while. This is where margin calls may also begin, as the collateral for the carry trade shrinks.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.