Suddenly, Not A Bad Environment For Gold Mining Stocks

Commodities / Gold and Silver Stocks 2015 Jan 13, 2015 - 04:29 PM GMTBy: John_Rubino

A few years ago (when the world was very different) veteran mining analyst Jay Taylor told me something that seemed counterintuitive: Deflation can actually be a good thing for the gold and silver mining business — if the prices of mining inputs like oil fall faster than the price of precious metals.

A few years ago (when the world was very different) veteran mining analyst Jay Taylor told me something that seemed counterintuitive: Deflation can actually be a good thing for the gold and silver mining business — if the prices of mining inputs like oil fall faster than the price of precious metals.

In other words, it’s not inflation or deflation per se that matter, but the distribution of price trends. “With quantitative easing,” said Taylor, “the liquidity being pumped into the system has caused energy and labor costs to rise, which has more than offset higher precious metals prices. Historically, the miners have actually done better in a deflationary environment in which gold and silver are seen as monetary metals and the cost of getting them out of the ground declines due to lower energy and labor.”

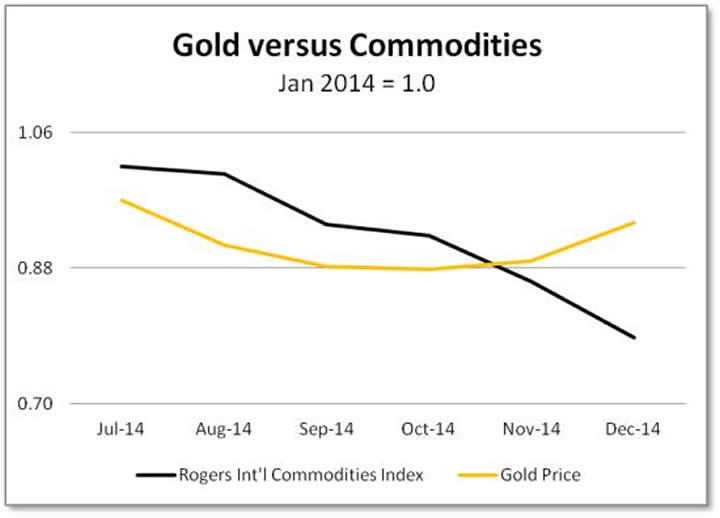

So the relationship of gold to the rest of the commodities complex is a good indicator of the mining environment. Gold might be down, but if it’s relatively strong, the mining equation is favorable. How is it today? Improving:

This implies that the cost of mining gold is falling while the price received for each ounce of gold is rising slightly. So margins, which have been squeezed to the point of evaporation for even high-quality miners, might be less horrendous than the markets now expect and (assuming current trends continue) earnings in the second quarter and beyond might exceed expectations. With mining stocks beaten down to historically-low levels, even stable earnings might be enough for a nice rally.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.