Conclusion from Swelling Stocks/Yields Ratio

Stock-Markets / Stock Markets 2015 Jan 13, 2015 - 03:24 PM GMTBy: Ashraf_Laidi

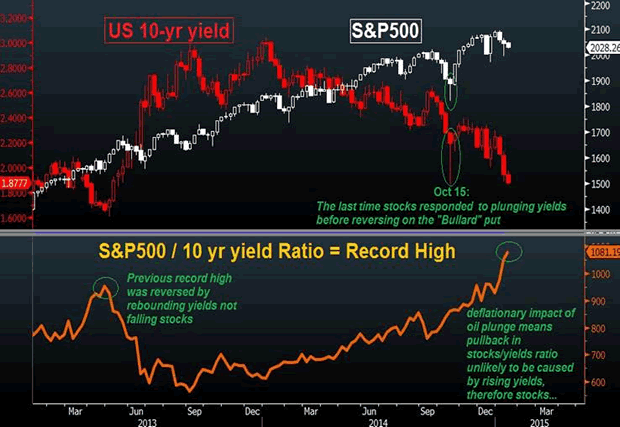

As stocks hit a fresh record high relative to bond yields -- measured by the S&P500/US 10-yr yield ratio at 1081--the contrast between these two markets becomes palpable and the remaining conclusion for a stabilization in the ratio may not appeal to equity bulls. This is not the first time we see a new a high in the stocks/yields ratio, but plunging oil prices are certainly making this phenomenon less of an aberration and more of the new normal... until when?

Surging equity prices are normally a sign of improved investor confidence, while falling bond yields, accompanied by tumbling commodities suggest the contrary - disinflationary (or deflationary) pressures and slowing economic growth. If stocks were correct, then demand is supposed to be soaring and bond yields are rising or at least keeping steady--not falling across the board from 2-year to 30-year yields; and from Australia to Canada to the US.

The chart below shows the last time the SPX/10-YR ratio peaked out was in April 2013, when yields rebounded to the extent of lifting the ratio.

Today, a pullback in the SPX/10-YR ratio is unlikely to be brought about by a rise in yields due to the disinflationary of falling oil (15-yr lows in UK CPI, 5-yr lows in Ezone and US CPI), not to mention the deflationary impact from China as seen through the 6th monthly decline in Chinese imports over the last 10 months, which partly reflects waning Chinese demand and partly its weakening currency.

Since any real rise in bond yields is unlikely to be the catalyst to stabilizing the surging SPX/10-YR ratio, then a pullback in stocks is the more inevitable. And with emerging markets already struggling from costly USD-denominated debt financing, falling demand from China is the last thing they need.

Best

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.