US Economy Stuck in the Purple Haze of Stagflation

Economics / US Economy May 31, 2008 - 02:54 AM GMTBy: Joseph_Brusuelas

With the economy caught somewhere in the purple haze between recession and anemic growth, many market prognosticators have been making the case that the worst is behind us.

With the economy caught somewhere in the purple haze between recession and anemic growth, many market prognosticators have been making the case that the worst is behind us.

With respect to the credit crisis, I do think that with the exception of a few nerve-rattling write-offs still to come, that is true. Credit spreads have begun to narrow, volatility measures seem to have settled down in recent weeks and the very unorthodox liquidity measures taken by the Fed appear to have calmed the nerves of market actors and appears to be in the process of pushing the market back towards something approximating normalcy.

However, we do not think that the overall economic picture is as sanguine as many have implied over the past few weeks. We can sit and debate weather the economy actually dipped into recession (we do) or has bounced along at a sub-trend rate until the cows come home. What is much more important at this time is to recognize that the strong headwinds facing the US consumer have actually picked up steam over the past several weeks. Once the stimulus from the fiscal package fades near the end of Q3 there is the very real danger that the economy will, run out of steam and the consumer will finally capitulate after an impressive quarter of a century long run. We do urge our clients to recall that the reaction function of consumers to an increase in energy and food prices will occur with a lag and we do not expect to see an observable decline in the data to this objective fact until later this year. Unless an increase in the real incomes of consumers somehow materializes between now and the end of the year, there will be little to stimulate personal expenditures once the impact of the fiscal stimulus wanes.

We expect that premature declarations of the victory against the current deleterious economic conditions that provide a clear and present danger to overall growth will face a realty check in the coming weeks. Most noticeably, the upcoming May non-farm payrolls report where we see the economy shedding -65k jobs and the unemployment rate rising to 5.1% should provide a not so gentle reminder of the real trouble ahead. If it were true that the economy has experienced little more than a mid-cycle correction then we should not be observing the steady climb in the continuing claims series, that now stands in excess of 3.1mln. The combination of that rise in unemployment and inflation simultaneously has begun to unnerve players in the fixed income market will drive yield and interest rates higher to ward off the inflation coming down the pike. What is lurking deep in that purple haze that the economy seems to be stuck, is not recovery but something better described as stagflation.

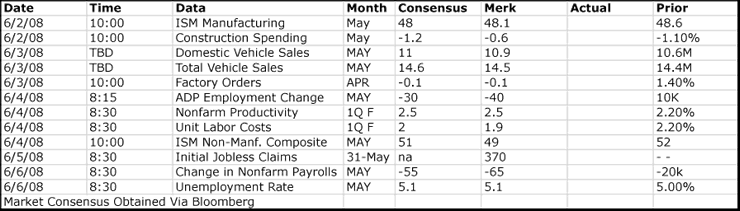

Week Ahead In US Financial Markets

Monday 10:00 AM ISM Manufacturing (May)

The manufacturing sector still looks to be struggling under the combined pressure of weak aggregate demand in on the domestic side of the equation and the surging costs of basic inputs which look to provide an outsized risk going forward to global economic stability. Our forecast implies that the headline-manufacturing index would arrive in territory signaling economic contraction for the fourth consecutive month and the fifth time in the past six surveys. Our forecast of 48.1 carries significant downside risk specifically in both the prices paid and new orders categories that look to bearing the brunt of the current down cycle in the domestic economy. At this juncture the only positive in the entire series over the past few months has been the external sector and that looks to be cooling after several robust months due to the same pricing concerns that have become paramount in the United States.

Monday TBD Total Vehicle Sales (May)

For quite some time the major problem in the US auto industry was soft demand for the lackluster product put to market by Detroit. However, as the jump in the cost of gasoline and food have eaten away at the real incomes of US consumers, the domestic auto industry is faced with a growing problem that will require far more than gimmicky ad campaigns and the return of invoice pricing. We do not see significant consumer demand for new autos until the domestic price situation begins to stabilize. Many in the auto industry and the broader retail sector had placed significant hope on the potential firepower of the rebate checks that consumers have begun to receive as a means to a temporary bounce in consumer demand. The rise of $4.00 gasoline and $5.00 diesel are in the process of taking whatever wind is left in the sails of the domestic consumer. We are forecasting a monthly sales tally of 10.9mln in domestic auto purchases and a total of 14.5 in overall sales for the May sampling period.

Tuesday 10:00 Factory Orders (April)

A weak month of non-defense aircraft orders and third straight decline in new orders for vehicles and parts should facilitate a -0.1% decline in the April factory orders report. The risk for the month, however, is to the upside with robust external demand driving new orders for electrical equipment by 27.8% in April. The combination of a weak dollar and strong external demand is keeping the economy afloat and offsetting lackluster domestic demand during what is a very painful period of adjustment for the US economy.

Wednesday 8:15 ADP Employment (May)

Although, the ADP model over the past few months is clearly caught on the downside of the current adjustment in the labor market, it still is the best overall survey of the payroll landscape and does retain the power to move the market upon its release. Our forecast of a -40K print is based on the continuing outsized retrenchment in manufacturing, construction and goods producing jobs that is well underway in the economy. We anticipate that the ADP survey will continue to undershoot the first cut payroll number released by the BLS, but will make statistical adjustments along the way that will put it very close the longer term real data and position it for calling a turn in the labor market once the economy works of the inventory in the housing sector, works through the credit crisis and adequately deals with the inflation problem in the pipeline.

Wednesday 8:30 Non Farm Productivity (Q1'08)

The major narrative inside the non-farm productivity report for the first quarter of 2008 is the fact that unit labor costs have come to a full stop. With the rise in headline costs begging provide a deleterious impact on core costs, the last line of defense in the Fed's assumption that costs will remain contained is that unit labor costs will remain fairly muted concomitant with a decelerating economy and sagging labor prospects. We expect that productivity will increase 2.5% and unit labor costs will advance a modest 1.9% for the final estimate of Q1'08.

Wednesday 10:00 ISM Non-Manufacturing (May)

For all those market players who have taken positions regarding the efficacy of the Federal Government's fiscal stimulus program, we will get an advance preview in the guise of the demand for services for the month of May. In our estimation the real bite that the jump in gasoline and food prices is begging to take a toll on consumer discretionary spending. After a lackluster increase in retail sales for the month of April and several months of declining demand for US autos, we think that the very difficult month of May that consumers have faced will trigger a move below the critical threshold of 50 signaling contraction in the service sector for the fourth time in the past five months. We anticipate that the headline will fall to 49.0 vs. the 50.9 recorded in April.

Thursday 8:30 Initial Jobless Claims (Week Ending 31 May)

We expect that jobless claims will moderate slightly to 370K after the 372 posting for the week ending 24 May. With the headline and the four-week moving average looking to converge, the weekly labor series does look to be stabilizing in the 370-400K range. With the settlement of the American Axel strike, we do expect the headline to trend towards the bottom of the range. Our real concern is in the continuing claims series that has now moved to 3.1mln and looks to be poised to rise higher as the economy continues to tread water.

Friday 8:30 Non-Farm Payroll Report (May)

During the May sampling period the labor market moved sideways with leading indicators signaling no real improvement without significant deterioration in the data occurring either. We expect that the majority of the losses for the month of May will be directly attributed to the ongoing culling of the workforce in the manufacturing sector. Our forecast implies that the cuts in the goods producing sector look to be flattening out and the increase in non-residential construction appears to be providing an outlet for those workers displaced by the sharp decline in the housing sector. However, we do expect that damage in the household survey will continue to reflect the move above 3.0mln in the continuing claims series during the sampling period and the rate of unemployment should move to 5.1% for the month.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.