Stocks on a Confirmed Sell

Stock-Markets / Stock Markets 2015 Jan 09, 2015 - 06:23 PM GMT SPX is on confirmed sell signal, since it has declined beneath the 50-day at 2042.43 it will be on a confirmed sell signal through the end of the decline.

SPX is on confirmed sell signal, since it has declined beneath the 50-day at 2042.43 it will be on a confirmed sell signal through the end of the decline.

As expected, the Hi-Lo Index opened beneath both the 50-day and daily mid-cycle support at 63.55, but surged above it, leaving it back on an aggressive sell signal. Unless the SPX starts into free-fall, the Hi-Lo may remain above those supports for the rest of the day. I will report back on any change in status.

The VIX remained above the 50-day Moving Average at 15.43 and stayed on the confirmed sell signal. It took a poke at hourly mid-Cycle resistance at 18.06 and has exceeded it again,. There is no further resistance until it reaches its Cycle Top at 23.08. It is likely that the cycle top will not hold the rally. This rally should also take it above the December 17 high and is aiming for the October 17 high at 31.06.

NDX is now below its 50-day Moving Average at 4223.83 and is set to challenge its prior low at 4090.33 next. It is not expected to hold.

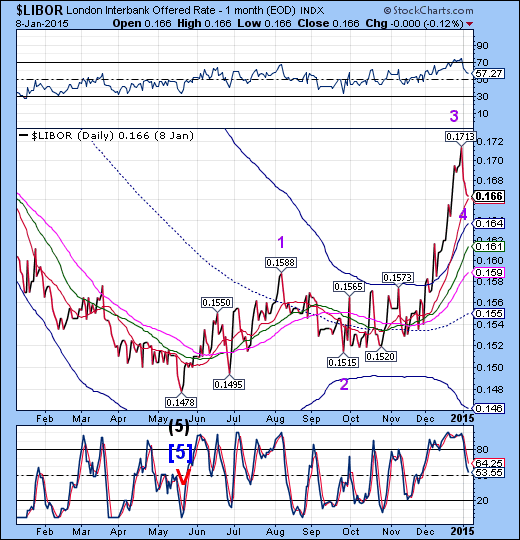

LIBOR may have completed its Minor wave 4 during the overnight session. Wave 5 is starting and, if the Wave relationship remains, may see a rise to .525. It indicates that trust is quickly eroding among the banks in their overnight market. Some large bank is in trouble. I suggest we watch what happens to Citi.

BKX rose clear to the top of its Orthodox Broadening top formation on December 29, but fell beneath its mid-Cycle support at 70.94 to the lower trendline of yet another Orthodox Broadening Top. It has fallen back beneath the mid-cycle support at appears ready to break the lower trendline in its decline to point 8.

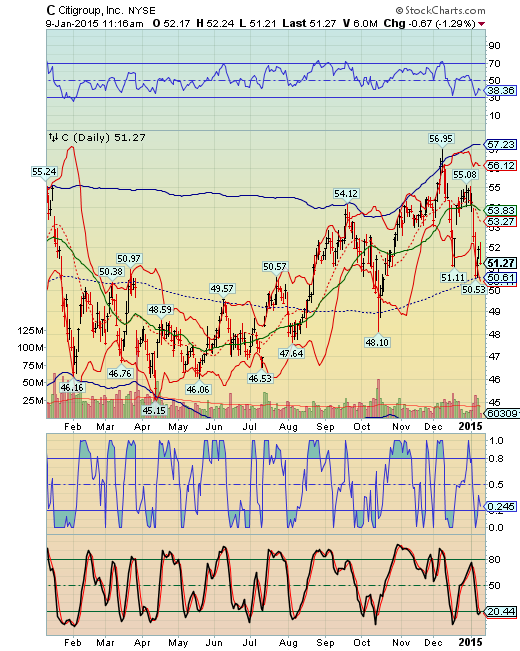

Although Citigroup hasn’t yet broken its mid-Cycle resistance, it had a major failure to make a new high on December 29. ZeroHedge writes, “Earlier today, when we were conducting a routine check with the Office of the Currency Comptroller's on the total notional amount of derivatives held at the Big 4 banks in the context of the "JPMorgan break up" story, we found something stunning: using the latest, just released Q3 OCC data, JPMorgan is no longer America's undisputed derivatives king. Well, it still is at the HoldCo level, where it is number one in terms of notional derivatives with $65.5 trillion, but when one steps a level lower, namely the FDIC-insured commercial bank (the National Association or N.A.) level, something quite disturbing emerges.“

Citi’s Cycle Bottom is at 43.99, a good 14% lower, but also a full 23% from its high in late November. If Citi is found choking on its derivative holdings, it may be left to its own devices by the other banks and force the Fed’s hand on yet another bailout.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.