Germany Caves On Greek Debt; Italy Takes Note

Politics / Eurozone Debt Crisis Jan 08, 2015 - 11:25 AM GMTBy: John_Rubino

Global financial markets breathed a sigh of relief today on news that Germany might cut Greece some slack after the latter elects an anti-austerity government:

Global financial markets breathed a sigh of relief today on news that Germany might cut Greece some slack after the latter elects an anti-austerity government:

Greek Debt-Relief Talks Possible After Vote, Germans Say

Germany is leaving the door open to discussing debt relief with Greece’s next government, lawmakers in Chancellor Angela Merkel’s coalition said, signaling a more flexible stance than her administration has taken publicly.While writing off Greek debt isn’t on the table, talks on easing the repayment terms on aid that Greece received from European governments are possible after the country’s parliamentary elections on Jan. 25, the lawmakers from Germany’s two biggest governing parties said. The condition is that Greece sticks to its austerity commitments, they said.

The potential opening reflects scenarios under discussion in Merkel’s coalition for how to respond if Greek voters oust Prime Minister Antonis Samaras, a Merkel ally who has enforced German-led demands for austerity, and elect anti-austerity leader Alexis Tsipras’s Syriza party.

“There should be talks with any government that emerges from the election,” Ingrid Arndt-Brauer, a Social Democrat who chairs the lower house’s finance committee, said in an interview. “You can talk about extending maturities and easing the interest rate on loans with a left-wing government, too.”…

….Where German policy makers draw the line is at a writedown on nominal Greek debt held by European governments and the European Central Bank, a demand made by Tsipras as recently as Jan. 3 in a Syriza convention speech.

That’s “out of the question,” CDU lawmaker Norbert Barthle, the party’s budget spokesman in parliament, said in an interview. “A haircut would mean that financial markets lose faith in Greek bonds and that a return to financial markets would be blocked for a long time.”

This, of course, it just the first in a series of reluctant concessions that Germany will make as it approaches its Big Decision: either let Greece leave the eurozone or make Greece’s debt part of the German balance sheet.

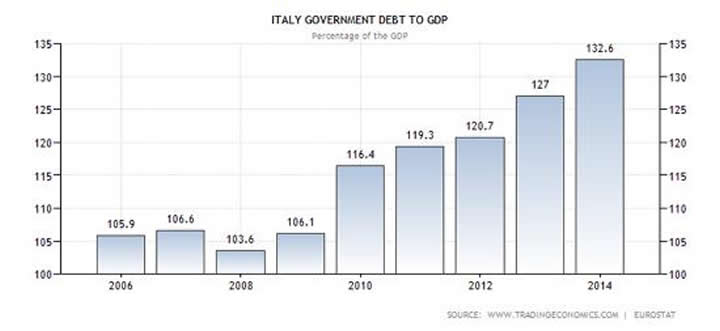

In any event, Greece is just an appetizer. Italy is the main course, and you can bet it notices what Greece is getting in return for threatening to elect an anti-euro party. Greece owes a lot of money, but Italy puts it to shame. The third biggest eurozone economy after Germany and France, its government debt totalled about 100% of GDP before the last financial crisis and now exceeds 130%. It is, in short, on a (now very short) road to deflation, depression and default.

Its anti-euro party is torn by internal dissention at the moment (see Falling Star) but could be revived in a heartbeat by the prospect that a strong electoral showing would pull concessions out of the Germans.

The Germans of course know this, which is in part why they’ve been making noises about letting Greece go. This would lead to a certain amount of chaos. But it might, from a German perspective, be better than having to guarantee or write down or otherwise finance Italy’s mountain of debt.

Soon, Germany will reach its crossroad and have to choose one branch or the other. Then the real fun begins.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.