Trading Markets - 3 Ways to Identify Support and Resistance - 5 Chart Examples

InvestorEducation / Learn to Trade Jan 08, 2015 - 11:19 AM GMTBy: EWI

Today's lesson considers three ways to identify price support and resistance in the markets you trade.

Today's lesson considers three ways to identify price support and resistance in the markets you trade.

- Previous highs and lows

- Trendline support

- Fibonacci Ratios

These examples are adapted from Jeffrey Kennedy's Trader's Classroom service.

1) Uptrends terminate at resistance while downtrends terminate at support. Previous highs and lows often act as resistance and support.

In ALCOA Inc (AA), the September 2012 selloff found support near the previous July 2012 low.

The February 2013 peak occurred following a test of resistance at the January peak at $9.33.

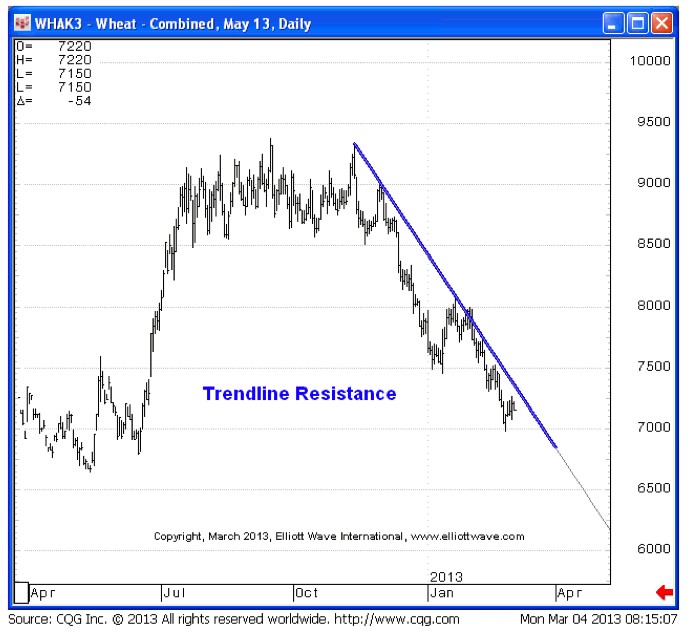

2) Trendlines offer resistance and support for prices.

The 2008 advance in Gold found support numerous times near the trendline that connected the lows of the move, as you can see below:

Conversely, the trendline connecting the highs of Wheat's 2012-2013 decline provided resistance for countertrend price action.

3) Fibonacci ratios also identify resistance and support. As Elliotticians, we often look at retracements, the most common being .382, .500 and .618. In Akamai Tech, Fibonacci support ignited the July and November 2012 rallies:

In the same chart you can also notice how Fibonacci resistance in AKAM halted the July 2012 and February advances.

For more free trading lessons on trendlines, download Jeffrey Kennedy's free 14-page eBook, Trading the Line -- 5 Ways You Can Use Trendlines to Improve Your Trading Decisions. It explains the power of simple trendlines, how to draw them, and how to determine when the trend has actually changed. Download your free eBook.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.