Challenging the Mainstream Propaganda

Commodities / Propaganda Jan 07, 2015 - 05:50 PM GMTBy: Nick_Barisheff

Paul Joseph Goebbels was the Minister of Propaganda in Nazi Germany from 1933 to 1945. He once said that if you tell a big enough lie and keep repeating it, people eventually come to believe it.

Paul Joseph Goebbels was the Minister of Propaganda in Nazi Germany from 1933 to 1945. He once said that if you tell a big enough lie and keep repeating it, people eventually come to believe it.

Today’s governments together with the mainstream media seems to have taken Goebbels’ comment to heart. They omit facts and distort the truth to suit their agenda, while a completely different point of view is presented by highly qualified, intelligent analysts through blogs, websites and Internet articles. This article by Raul Ilargi Meijer gives an excellent overview of the propaganda disseminated by the press today.

For investors, it is up to each individual to carefully examine the arguments from both sides and come to his or her own conclusion about what is reality and what is propaganda. This knowledge will allow them to make the right decisions and prosper, and avoid painful mistakes in the coming years.

In the area of economics and finance, the manipulation, distortion and outright lies should be obvious to anyone who cares to do even the slightest amount of research outside of the normal channels. At the root of the coming economic disaster is Keynesian economic philosophy of increasing debt implemented by Western central banks. The experiment that started in 1933, and peaked in 1971 with the abandonment of gold convertibility, has gone into the hyperbolic stage, with Japan being the poster child of an economic system gone mad.

Once the world’s second-largest economy, with land in Tokyo selling by the square inch and the Nikkei Index peaking at 38,957 in December 1989, today Japan has the world’s highest debt-to-GDP of about 230%, and the Nikkei is still down about 55% after 25 years. David Stockman, former Assistant Treasury Secretary, does an excellent job of summarizing Japan’s gruesome statistics in this article: ‘The Keynesian End Game Crystalizes In Japan’s Monetary Madness’.

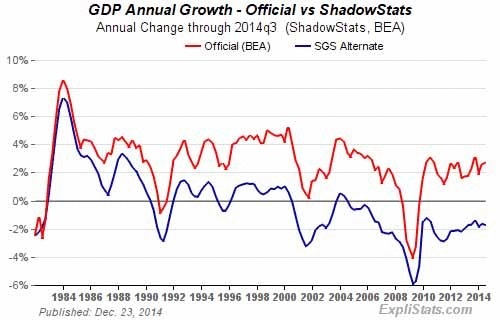

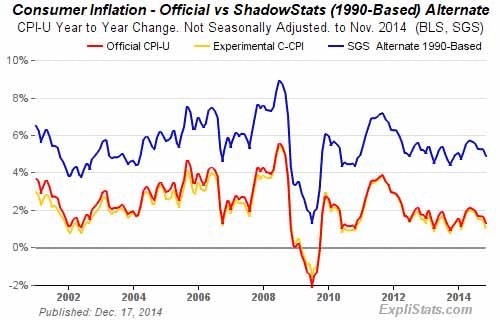

Japan is the canary in the coalmine, and should be closely monitored by investors all over the world, because the same thing is already happening in South America, Europe and Asia. Even though the US appears to be in recovery following the near collapse of the financial system in 2008, a closer examination of the facts leads to a considerably different conclusion. Wall Street was euphoric at the reported “5% growth in third quarter US GDP,” and the DOW surpassed 18,000 on this news. John Williams, however, presents a different, more accurate view, on his website.

|

|||

|

|||

|

|||

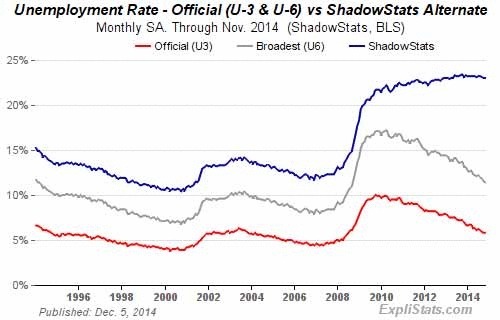

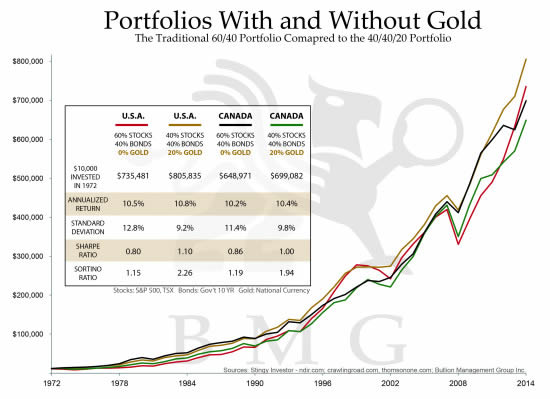

Mike Shedlock has written an article on how GDP is distorted by the Bureau of Economic Analysis Peter Schiff also covers the manipulation. Apart from examining statistics, a simple look at some of the obvious realities brings the official numbers into question. When one considers that, while the official unemployment rate is supposedly 5%, when you use the methodology established in the late 1980s the real unemployment rate is approximately 23%. This is confirmed by the declining labour participation rate of 63%, the lowest in thirty seven years. Real wages have seen no improvement, and are at the lowest level in thirty six years. Food stamp usage is at a record high, with nearly half the US population dependent on some form of government handout. This reality means that recovery is an illusion (at best), or a lie (at worst). Aldous Huxley, the writer and philosopher, said, “Facts do not cease to exist because they are ignored.” Jim Quinn quotes Huxley in his article “Should You Believe What They Tell You or What You See?”, which provides an excellent explanation of the many distortions and lies the mainstream media is asking us to believe. Nowhere is the propaganda and distortion of economic reality more pervasive than in the negative media barrage against gold. The biased commentary, rife with misrepresentations and purposeful omissions, is spun by the media almost on a daily basis. No other asset class or investment category is subject to this level of bias and misrepresentation. Anyone who cares to look outside of the mainstream media propaganda will conclude that the drop in gold prices was clearly an orchestrated event, first in 2011 with a one day drop of 7.2%, and then in April 2013 for an 8.5% drop. In the early morning hours of January 6th, 2014, 12,000 gold contracts representing $1.5 billion of naked short selling was forced onto the paper gold COMEX market. Without speculating about who did it or why, it should be obvious that no trader would sell that much gold into the market at one time, effectively minimizing their sales proceeds. Dr. Paul Craig Roberts provides a detailed overview in “Rigged Gold Price Distorts Perception of Economic Reality”. What most observers miss is the connection between the paper COMEX markets and the exchange-traded fund, GLD. Unless you have read the original 2005 Prospectus and the Authorized Participant Agreement, it is impossible to understand how GLD, and in fact all ETFs, work. ETFs are not like open-end mutual funds with low management fees. They are designed as tracking vehicles that use assets borrowed by Authorized Participants in exchange for ETF shares that are sold to the public, while the Authorized Participants keep all the proceeds of sale. It is not about earning management fees. This article by David Ranson details some of the concerns with GLD. When the gold price declines due to orchestrated naked shorting on the COMEX, redemption requests increase at the GLD. The Authorized Participants, likely the same entities that naked shorted gold on the COMEX exchange, redeem ETF shares for the borrowed physical gold. Either the gold is returned to the central banks from which it was borrowed, or it is sold to China via their sovereign wealth fund after being refined in Switzerland. When China eventually announces that it now holds 5,000 to 6,000 tonnes of gold, the quants among us will have to figure out where that gold came from, because mainstream supply/demand statistics have already accounted for all the gold. What mainstream statistics do not account for is leased gold that, by some estimates, has averaged over 1,500 tonnes per year, when mine supply has averaged 2,800 tonnes per year. In addition, the US Geological Survey shows annual exports of about 700 tonnes over mine supply. This amount of gold can only come from aboveground central bank holdings. When China makes their announcement it will seriously undermine the credibility of Western central banks, and bring into question how much gold, and how many gold IOUs, they hold. In 2002 Frank Veneroso estimated that central banks only held about 16,000 tonnes vs the 32,000 tonnes they claimed. Recently Don Popescu provided a detailed analysis in “How Much Gold is on Loan Worldwide?”. While many think that this manipulation of the gold price makes any investment in gold a losing proposition, the reality is that when the manipulation can no longer be sustained, gold will skyrocket as the public loses confidence in fiat currencies. Paul de Sousa discusses this in a video presentation, “Why the Manipulation of Gold is the Greatest Investment Opportunity of this Century”. What should investors do – believe the government statistics and mainstream propaganda? Do they have the strength to challenge the propaganda and change their mindset, or will they simply follow the herd over the cliff at the next financial crisis? Today, being without gold in a portfolio is like not having flood insurance when the hurricane is bearing down on you. There are a host of events that could topple the world economy’s delicate balance: Geopolitical concerns; a bubble in the DOW, the strength of which is based solely on Federal Reserve policy, unsustainable stock buybacks and financial engineering; derivatives at the major banks that have grown by about 54% from $450 trillion in 2007 to $691 trillion by the second quarter of 2014. Of course, corporate debt around the world may be the trigger for the next financial crisis. In “The Biggest Economic Story Going into 2015 is Not Oil,” Raul Ilargi Meijer discusses the corporate debt around the world, and the vulnerabilities it causes. With all of these vulnerabilities it goes without saying that, in order to reduce risk and improve returns, a diversified, balanced portfolio is the best way to preserve capital. Yet most portfolios are neither balanced nor diversified, and contain only three of the six asset classes of cash, stocks, bonds, real estate, commodities and precious metals. Precious metals have the least correlation to financial assets such as stocks and bonds, and provide the greatest protection for the least amount of allocation. Standard Deviation, the Sharpe Ratio and the Sortino Ratio are improved, and adding gold reduces the number of years with losses, and average loss. A traditional US portfolio of 60% stocks and 40% bonds would have yielded 10.5% over the last 43 years, with volatility of 12.8%. A portfolio that included a 20% allocation to gold would have yielded 10.8% return, with a significantly reduced volatility of 9.2%. In Canada, a traditional portfolio would have yielded 10.2% return, with 11.4% volatility, while one with 20% gold would have yielded 10.4% again a significantly lower volatility of 9.8%. |

|

|||

I publish a free weekly newsletter, the BullionBuzz, which summarizes some of the best articles available on the Internet, to help people understand economics and the underlying fundamentals for precious metals. For those interested in a more comprehensive understanding of gold, my book, $10,000 Gold – Why Gold’s Inevitable Rise Is the Investors Safe Haven, is available. |

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2014 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.