One of the Best 'Hard Assets' to Own in 2015

Commodities / Timber Jan 07, 2015 - 03:38 PM GMTBy: DailyWealth

Dr. David Eifrig writes: To most everyone's surprise, the U.S. dollar continues to surge...

Dr. David Eifrig writes: To most everyone's surprise, the U.S. dollar continues to surge...

The U.S. Dollar Index has gained nearly 15% in the last six months... an astounding move for a major currency.

While this is great news for the purchasing power of U.S. consumers, it has crushed the value of almost all "hard assets" such as oil and precious metals – which are priced in U.S. dollars.

However, one overlooked commodity has continued to provide my Income Intelligence subscribers with growth AND yield over the past few months... even with a surging dollar.

I'm talking about timber...

Timber is a great portfolio holding because it's a "soft hard asset."

By that, we mean it's a real and valuable commodity. A lot of value investors have an affinity for commodities you can touch... So-called "hard assets," like precious metals, oil and gas, farmland, and other commodities, are perceived as having an intrinsic value no matter what's going on in the business cycle.

Timber is similar. We're always going to use lumber for building, but we have a limited amount of land. However, timber grows...

It's not a strictly limited commodity like gold or oil. Once you "prove" a barrel of oil in the ground, all you have is one barrel of oil. It doesn't grow or multiply. Same with gold. But when you own timberland, it continues to regenerate its value. Compare that with a gold mine, which decreases in value as every ounce of ore is pulled from the ground.

That makes timber both a viable growth business and a hard asset.

As a business, timber has a great cost structure. It has low fixed costs relative to other hard assets.

Once an investor has bought timberland, the upkeep is cheap. If timber prices are low, like they were during the recession, you simply don't cut any wood.

By sitting and waiting for a better market, the reduced supply raises prices. Timber owners don't have a lot of costs they need to pay while they wait. Better still; the timberland grows more valuable as trees grow.

Compare that with a gold mine, which has a massive capital investment in machinery and employees that need to be kept up even if prices are low. It's expensive to shut down a gold mine.

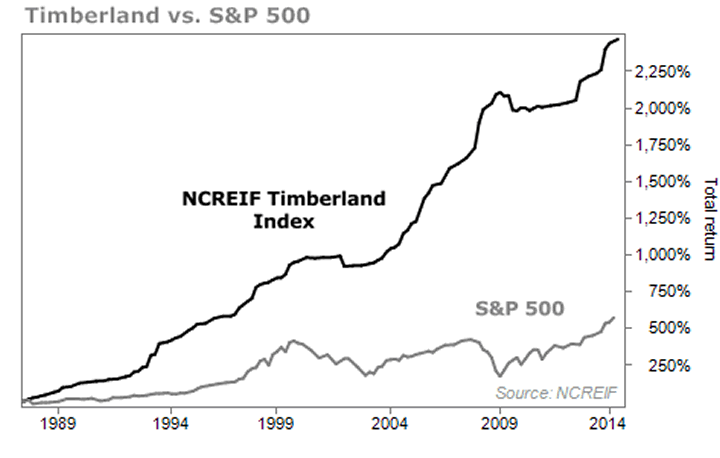

Timberland grows on its own. It's cheap to run. It'll always have demand. The continuous harvesting carves out regular income. It's an ideal investment. That's why timberland values have handily trounced the stock market.

The chart below compares the value of a pool of individual timber properties measured by the National Council of Real Estate Investment Fiduciaries (NCREIF) Timberland Index with the S&P 500 stock index:

And you can benefit not only from rising timberland values, but also from the yearly income.

For example, timber stocks Rayonier, Plum Creek Timber, Potlatch, and Weyerhaeuser all own huge areas of timberland. And since they are structured as real estate investment trusts, they enjoy tax breaks that allow them to pay shareholders high yields. All of them pay dividend yields of more than 3%.

If you're looking to collect income while investing in "hard assets," consider investing in timber today.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig Jr.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.