Are Central Banks Dumping Euros?

Currencies / Euro Jan 06, 2015 - 12:41 PM GMTBy: Ashraf_Laidi

The euro began the first full trading week of 2015 by breaking below the $1.20 level for the first time in four years to end up hitting a nine-year low of $1.1864. The latest reasons of the renewed slump are rising probability that the Greek anti-bailout left alliance will win the Jan 25 elections, a combination of apparent tolerance from German Chancellor Merkel over the possibility of a Greek exit and emerging consensus that even if outright QE of euro sovereign bonds were agreed upon by the European Central Bank, the plan would fail to ridding the Eurozone from deflation.

The euro began the first full trading week of 2015 by breaking below the $1.20 level for the first time in four years to end up hitting a nine-year low of $1.1864. The latest reasons of the renewed slump are rising probability that the Greek anti-bailout left alliance will win the Jan 25 elections, a combination of apparent tolerance from German Chancellor Merkel over the possibility of a Greek exit and emerging consensus that even if outright QE of euro sovereign bonds were agreed upon by the European Central Bank, the plan would fail to ridding the Eurozone from deflation.

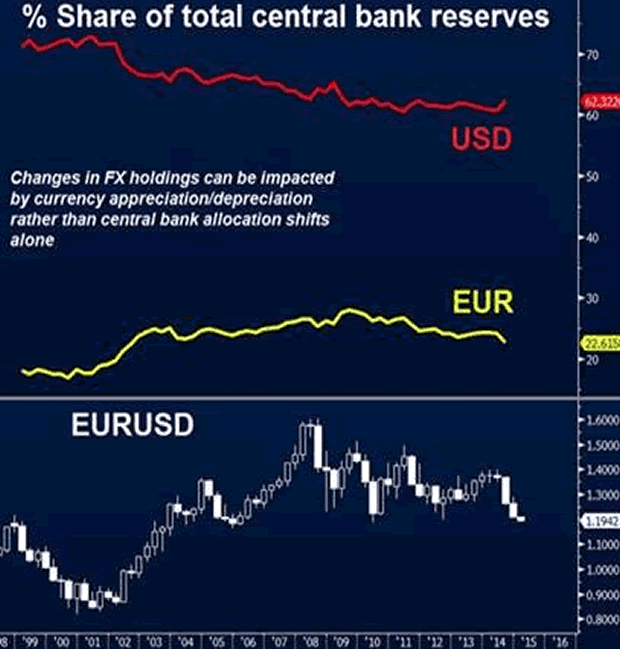

Further propagating the euro's decline was the latest data from the International Monetary Fund, showing central banks' euro-denominated foreign exchange holdings fell to 22.6% in Q3 2014, reaching the lowest level in 12 years. The proportion of euro holdings fell over the last three consecutive quarters on record. In contrast, the proportion of central banks' USD-denominated currency holdings rose to 62.3%, the highest level since Q1 2011.

One potential problem with interpreting these figures is that the percentages reflect the change of value, suggesting that the change in proportion could be a result of the change in value of the currency impacting the value of holdings, rather it being a reflection of actual central bank dumping or adding currencies. This is highlighted by the positive correlation between the EURUSD chart and the percentage of EUR holdings.

These doubts further highlighted by the doubling of central bank holdings of Japanese yen between Q1 2009 and Q3 2012 from 2.78% to 4.27% of total reserves. Certainly the rise was a result of the yen's 20% appreciation during the same period, rather central banks being drawn to the yen's non-existent yield.

Whether the depreciation of a currency feeds into actual central bank selling of the currency is a valid question, the more important dynamic is the direction of the currency, especially when moving in tandem with central bank holdings. Another factor is the reallocation into other such as the Aussie and Canadian dollar, whose share of central bank holdings increased to about 2.0% over the last two years.

Currency weakness is key priority

The resurging threat of a Greek exit coupled with the fear that Eurozone inflation may drop and remain stuck at or near zero% has accelerated the euro's falling momentum after the ECB's implementation of its fourth operation of long-term financing and purchase of covered bonds and asset-backed securities failed to make a difference in the data. The ECB has little choice but to begin purchasing Eurozone sovereign bonds at its January 22nd meeting.

And in the likely event that Draghi fails to secure majority among the Governing Council in favour of QE this month, we expect a resolution to this to materialise later in Q1 or Q2 2015. But not before the deflationary situation deteriorates further. For currency traders, the situation is becoming more straightforward.

Regardless of whether QE takes place or not, Draghi has assured the ECB's balance sheet will return to 2012 levels, which means it will increase by at least €700 bn over the next two years. And regardless of the policy mix pursued, euro weakness will be part and parcel of it. Having broken below its 200-month moving average for the first time in 12 years, EURUSD will fail from staging any real recovery above 1.25 until a break of 1.16 is shown this quarter at least in one occasion.

Best

For tradable ideas on FX, gold, silver, oil & equity indices get your free 1-week trial to our Premium Intermarket Insights here

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.