Stock Market Confirmed Sell Signal

Stock-Markets / Stock Markets 2015 Jan 05, 2015 - 05:07 PM GMT SPX gapped down nearly 4 points, which was less than the decline at 9:00 am. So, despite the algos attempting to spike the open, SPX still opened down and is now beneath the 50-day Moving Average at 2039.84.

SPX gapped down nearly 4 points, which was less than the decline at 9:00 am. So, despite the algos attempting to spike the open, SPX still opened down and is now beneath the 50-day Moving Average at 2039.84.

Notice how abrupt and definite the decline is compared to prior declines. SPX is apparently in a much more impulsive mindset. There may be an attempt to rally at this point, but should close much lower at the end of the day. The last bastion for a bounce may be either the mid-cycle support at 1970.10 or the 200-day Moving Average at 1959.47. I cannot say how soon either of these two supports are reached, but once tested and proven inadequate to the occasion, we may see a much more intense decline.

SPX is on a confirmed sell signal.

VIX is now above its daily Cycle To resistance and headed toward the neckline of its Head & Shoulders formation near 31.06. It may not take long to get there. It is now on a confirmed sell signal. Traders should now be 100% short SPX.

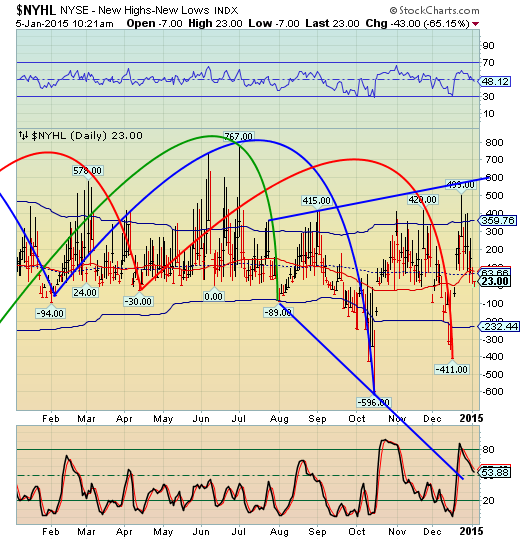

The Hi-Lo Index has opened well below its mid-cycle support at 63.66 and the 50-day Moving Average at 73.28. It is also on a confirmed sell signal. Things may start becoming more intense here.

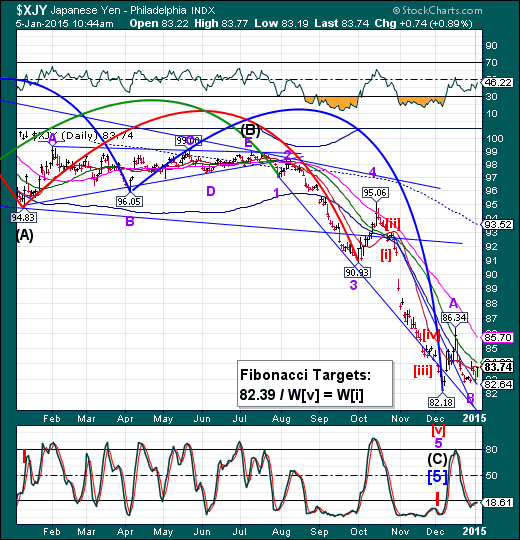

XJY has resumed its rally and is approaching a minor breakout at 84.13. USD/JPY is impulsing lower at 119.44, breaking the 120.00 support.

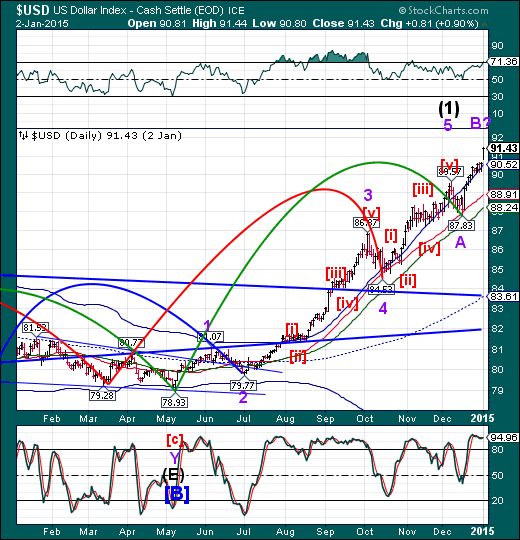

USD peaked this morning at 92.04, going further than one might have expected. However, it has no made a reversal and is currently at 91.77 and declining.

Why is that? On good reason for the USD to decline is that most of the market gains were made with leverage, not savings. A loan repaid extinguishes not only the debt, but the currency in circulation, as well. The primary source of the debt in the past year has been the Yen which, when repaid, does not increase the float in Yen. Instead, it increases the demand for the Yen, which raises the price. At the same time, demand for the dollar may decrease, causing it to decline.

When margin calls are made and debt cannot be repaid, the currency in circulation goes down not only by the amount of debt repaid, but also affects the collateral, which extinguishes even more currency in circulation. Thus, a self-reinforcing cycle is begun, where even more margin calls must be made.

I have tried to simplify a complex relationship. I hope this does the job without getting too confusing.

Respectfully,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.