Weak CNY + Low Wages + Ultra Low Interest Rates = Deflationary Pressures 2015

Economics / Deflation Jan 05, 2015 - 01:48 PM GMTBy: Ashraf_Laidi

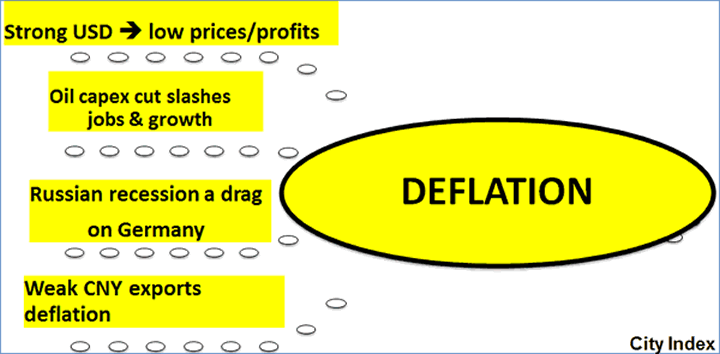

Deflation will be the dominating theme of 2015. Deflation occurs when prices of production factors (wages and interest rates) fall to the extent of limiting labour and capital from drawing higher prices. The culprit to these conditions is typically an excess supply of labour and capital to the extent that wages and interest rates weaken substantially until they draw sufficient demand to the point of stabilising their price.

Deflation will be the dominating theme of 2015. Deflation occurs when prices of production factors (wages and interest rates) fall to the extent of limiting labour and capital from drawing higher prices. The culprit to these conditions is typically an excess supply of labour and capital to the extent that wages and interest rates weaken substantially until they draw sufficient demand to the point of stabilising their price.

But as demand for labour and capital fails to fill the supply of workers and available liquidity, the spiral of excess supply takes over wages and interest rates remain weak, and even negative. Deflation hurts borrowers relative to lenders. Countries whose central banks combat deflation, or conduct reflationary policies, should see their currencies depreciate. As low inflation extends to disinflation and creeps into deflation territory in Europe and China, the US runs the risk of importing deflation via the strengthening dollar. If this occurs, the Fed will be forced to postpone its first rate hike, now expected by bond traders to occur as early as Q2 2015.

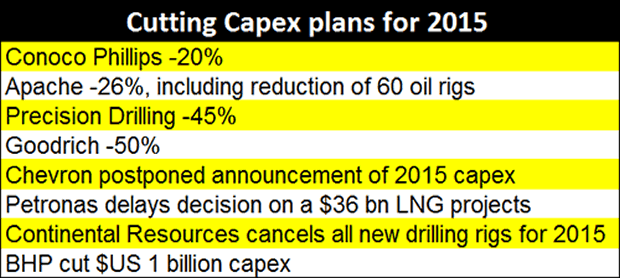

Oil price impact: Capex cuts by big oil to windfall to consumers

If oil prices remain near the mid-$50s, or fall even further, capital expenditure by US companies could fall by as much as 20%, as low revenues no longer justify project finance. Why is capex a big issue? Since 2007, energy sector rose from 28% of the S&P 500 total to almost 40%, being the only component of the S&P 500 where capex has recovered since the crisis. Is it a surprise that capex in all other sectors remains below the 2008-highs when companies are busy investing in their shareholders by buying back stocks and paying dividends?

The non-residential component of US fixed investment contributed by an average of 0.7 percentage points to GDP growth over the last four years. This compares to personal consumption's contribution of an average of 1.5 percentage points, which is double the amount of non-residential investment. A 20% decline in capital expenditure risks offsetting the usual 1-2% increase in personal consumption, especially as the domino effect of capex cuts extends to job layoffs and precautionary spending.

Globally, as much as $150 billion in energy capex could be cut off next year as 800 oil and gas projects worth $500 are considered for financing decision, according to data from consultancy Rystad Energy.

The bonds of existing energy projects could also send a negative transmission mechanism to creditors and investors. With over $400 bn of energy-related high yield held by the public, the yield on these bonds is nearly 900 basis points over comparable treasuries. This compares to only 100 basis points three years ago. Any company seeing the yield on its bond rise to 900 basis points over safer treasuries, "junk" would be an understatement and the repercussions to its stock price will be severe.

The magic of stock buybacks

The two most powerful components of the stock market rally in the US have been stock buybacks and dividend payments. Shareholder distributions remain the quickest and most common attribute of increasing share prices, but not necessarily value in the business. This has happened to the extent that companies have been accused of prioritising the stock price over capital expenditures to acquire or upgrade property and equipment.

As of Nov 2014, stock buybacks amounted to $45bn according to S&P and Dow Jones, with about 25% of S&P500 companies doing buybacks up from 20% of companies in Q1. In Q3 2014, $238 bn was spent on dividends and buybacks, with the latter making up two-thirds of total shareholder distributions.

Stock buybacks alone jumped 308% to US$108-billion from US$26.5-billion, while dividends grew 70% to US$77.5-billion from US$45.7-billion. Buybacks are easier and less controversial to curtail or eliminate than dividends. Buybacks in energy and gas sector surged to $35.4 bn in 2014, leading all sectors.

Two questions for 2015:

-

If energy companies are discouraged by falling oil to invest in capex, will they make up the difference via buybacks?

-

Up to what point would companies' stock prices react to the buyback effect and when does it(what?) start to reflect eroding equipment and cancelled pipeline?

Stocks-yields divergence

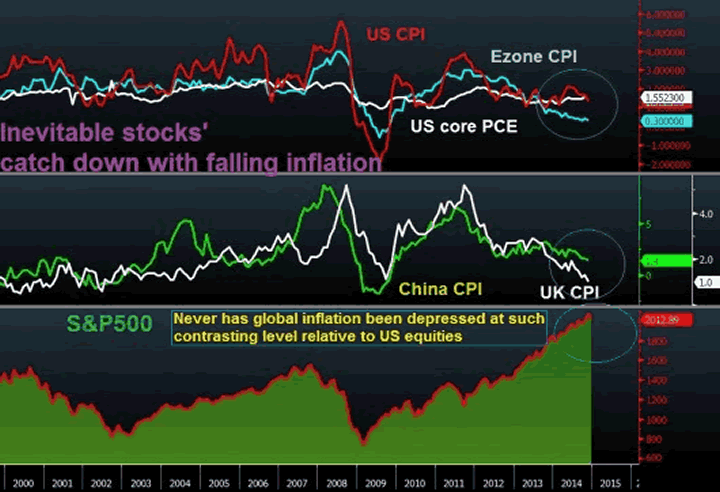

The persistent divergence between soaring stock markets (especially in the US) and tumbling bond yields around the world (including the US) highlights the view that bond traders increasingly expect low inflation to remain the overwhelming force in global macro. Surging bond purchases by the Bank of Japan, anticipated asset purchases by the European Central Bank and persistent talking down of bond yields from the Federal Reserve and Bank of England are the main causes.

The above chart highlights the dangerous revelation that inflation rates in the US, Eurozone, China and the UK are all trending lower in unison, while the S&P500 surges to record highs. The extent of the contrast between global inflation rates and equities is unprecedented. Such a divergence plays a large role in explaining disparate paths of stocks and yields.

In the "old normal", bull markets in equities were typically accompanied by steady or rising sovereign bond yields as improved corporate valuations reflected robust economic growth. Such an assessment would ultimately force central banks to raise interest rates in order to rein inflation. This year, however, bond yields and equity prices have gone in their separate directions, as central banks print, bond traders expect low growth and low or zero inflation, while companies buy back their stock and pay dividends to boost their stock prices. Such divergence could only go so far until stocks give in to fresh bouts of volatility - as was seen in October and early December.

Best

For tradable ideas on FX, gold, silver, oil & equity indices get your free 1-week trial to our Premium Intermarket Insights here

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2014 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.