The Energy Sector Takes 2015 by Storm

Commodities / Energy Resources Jan 03, 2015 - 03:59 PM GMTBy: DailyWealth

Rachel Gearhart writes: Stocks are booming, the economy is growing, the job market is strengthening and it’s looking like the prosperity will continue into 2015.

With the bombardment of doom-and-gloom business news, that may feel more like wishful thinking than reality. So let’s allow the numbers to tell the tale.

In 2014, American-based mergers and acquisitions rung in at $1.52 trillion, up from $998 billion in 2013.

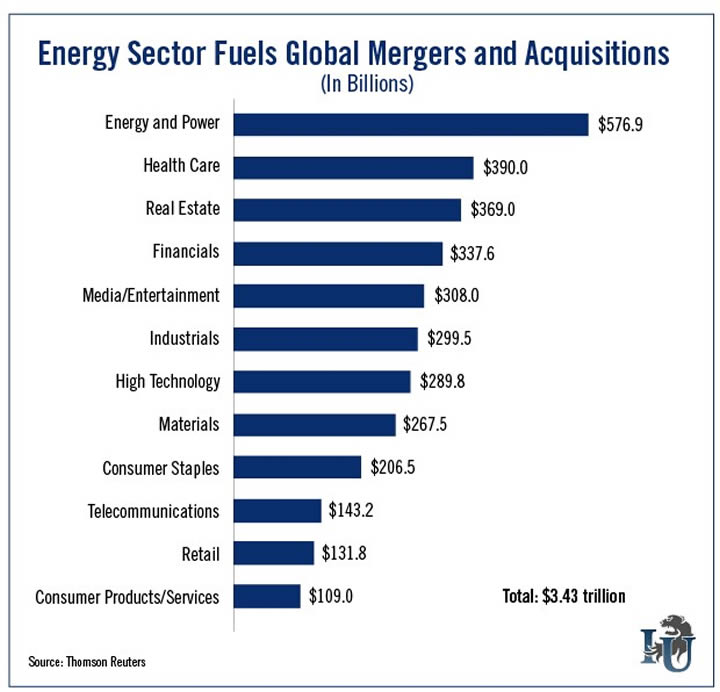

U.S. deals comprised 45% of the total $3.43 trillion worth of global merger and acquisition activity - up from 43% in the prior year.

This week’s chart looks at the value of those deals per sector.

One sector stood out with 3,000 global deals worth nearly $577 billion: the energy and power sector. In total, the energy sector comprised 16.8% of total deals (worth $408 billion), which was up 67% from 2013.

With many analysts pointing to the drop in oil prices for the boom in global deals, there’s a strong chance we’ll see even more activity in the year ahead. In fact, many analysts say more buying and merging will be imperative in 2015.

Earlier this week, The Oxford Club's Energy and Infrastructure Strategist David Fessler showed us one way to play the energy sector. He’s confident that as the dust settles, the panic stops and companies rush to make deals, 2015 could be an especially profitable year for energy investors.

Editorial Note: Dave Fessler and Resource Strategist Sean Brodrick both see big things on the horizon for the oil and gas industry in 2015. In fact, they’ve found a company that is doing the impossible: creating gasoline without oil. To hear more about the company and what it could mean for energy and gas investing, click here.

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.