Seasonal Sweet Spot for Small Stocks?

Stock-Markets / Seasonal Trends Jan 03, 2015 - 01:08 PM GMTBy: Sy_Harding

Studies show that one of the most persistent patterns investors follow is

‘chasing performance’. It’s most prevalent at this time of year. Investors shop for next year’s winners from the lists of the best performing stocks or mutual funds of the previous year. They switch from the successful investment strategy they have been following to one that out-performed it over the previous period.The Investment Company Institute says 88% of mutual fund buyers cite a fund’s performance over the last one to three years as the primary reason they choose one fund over another. They want the stocks and funds that were up the most in the previous period.

Obviously, the pattern is opposite to the basic investing goal of buying low and selling high.

John Rekenthaler, fund-tracker Morningstar Inc. vice-president of research, says, “Investors piling into the hottest funds of the previous period will usually be sorry, since the lower-ranked funds tend to be the winners over the next period.”

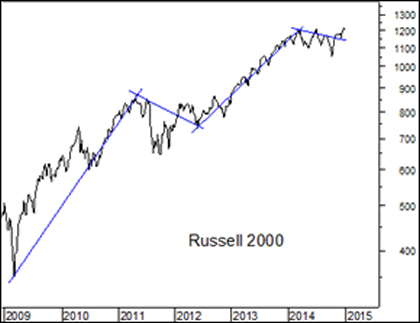

With that in mind, we know that while the Dow, S&P 500, and Nasdaq experienced double-digit gains in 2014, the small-stock Russell 2000 index significantly underperformed for the year. In fact, it was down 2.0% year-to-date in mid-December, before rallying 5% over the subsequent two weeks.

Since the bull market began in 2009, it followed the pattern of a couple of years of over-performance, perhaps enticing ‘chasing performance’ investors in just in time for a year of under-performance.

As we enter the new year, there are reasons to believe that small stocks are poised to outperform the rest of the market for a while..

They not only have that potential from the history of the previous year’s losers often being the following year’s winners.

We are also now entering what has historically been the seasonal sweet spot for small stocks. They have historically out-performed the S&P 500 index from mid-December to late February. According to EquityClock data, over the last 25 years, the Russell 2000 index has outperformed the S&P 500 19 times, or 76% of the time, and by an average over-performance of 3.2% for the period. The Stock Traders Almanac reports that over the last 35 years, the Russell 2000 gained 4.7% between December 15 and January 31 on average, compared to the 2.7% average gain of the large-cap Russell 1000.

Small cap stocks may have an additional advantage for a while this year. They tend to be the stocks of U.S. companies doing most of their business in the U.S., while large cap stocks and funds tend to be those of companies with considerable exposure in global economies, this at a time when investors are more bullish on the U.S. economy.

Rather than attempting to cherry-pick among individual small cap stocks, investors intrigued by the history and other potential positives, might consider a diversified small-cap etf. The largest and best known is the iShares Russell 2000 etf, symbol IWM.

(In the interest of full disclosure, my subscribers and I have had a position in IWM since December 18).

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.