Gold Beat All Other World Currencies in 2014

Commodities / Gold and Silver 2014 Dec 31, 2014 - 12:22 PM GMTBy: Frank_Holmes

"Gold is money. Everything else is credit."~ J.P. Morgan in 1912

"Gold is money. Everything else is credit."~ J.P. Morgan in 1912

Loyal readers of our Investor Alert and my blog Frank Talk are no doubt aware that the U.S. dollar's rising strength has put pressure on commodities such as oil and gold. I wrote about this as recently as my roundup of the top commodities stories of 2014, which you can read here.

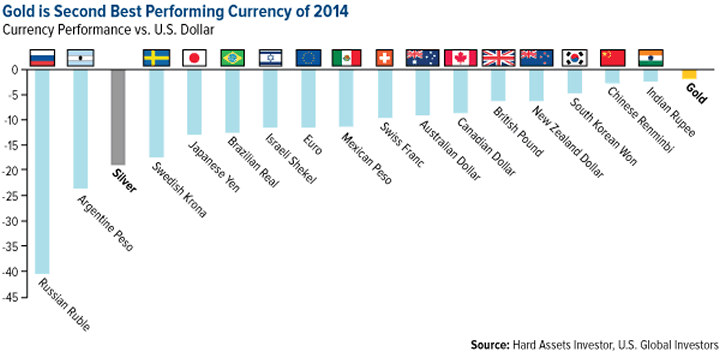

Gold took a blow in the second half of 2014 as a result of the dollar's ascent, and sentiment toward the yellow metal right now is less than ideal. But to keep things in perspective, its performance this year has far outpaced that of 2013, when it fell 28 percent--its worst showing since early into President Reagan's first term.

Even though gold has lost 0.8 percent year-to-date as of this writing, it still leads all major world currencies except for the U.S. dollar.

The Case for Gold as Currency

In his most recent book, former Federal Reserve Chairman Alan Greenspan convincingly makes the case that gold is indeed money:

Yet gold has special properties that no other currency, with the possible exception of silver, can claim. For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close.

Greenspan goes on to make another astute point. If gold is nothing more than a commodity, then why do most developed countries' central banks see the need to hold the stuff? Wouldn't some other commodity suffice? Diamonds perhaps, or soybeans?

During a Congressional monetary policy meeting in 2011, Texas Representative Ron Paul squared off against former Fed Chairman Ben Bernanke over this very topic. When asked why central banks still insist on holding the precious metal in their reserves, Bernanke responded that it was simply tradition.

Tradition, yes, but the reason goes so much deeper than that. Gold has an intrinsic value that transcends its commodity-ness, something that's recognized by nations all over the globe.

For example, we're seeing a trend among European central banks seeking to bring their gold reserves back under their jurisdiction. Although Switzerland recently voted down a referendum that would have done just that, there's talk now that Austria, Belgium and France are interested in shoring up their own gold reserves. The Netherlands and Germany have already brought some of their gold home.

China and India's central banks are in the buying mood. Russia is currently snapping up gold at an astounding rate: 130 tons this year alone, up 73 percent from 2013.

Of course, if you're Russia, buying that much bullion makes perfect sense. When your currency is the worst-performing in the world, you sorely need something in your coffers with greater value, ample liquidity and no credit risk.

Diversify and Rebalance

For the rest of us, gold remains an exceptional instrument to diversify your portfolio with. Despite its decline midway through the year, its price has remained relatively stable, much more so than oil's. What investors--especially the gold bears--need to remember is that bullion has a 12-month standard deviation of ±18 percent, meaning that its price action this year is well within normal behavior.

As always, I advocate a 10-percent weighting in gold: 5 percent in physical metal, 5 percent in equities, then rebalance every year.

Speaking of which, look out for my special New Year's edition of the Investor Alert this Friday. I'll be discussing what steps you can take to maximize your portfolio going into 2015!

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.