Crude Oil Large Speculators Play Catch a Falling Knife

Commodities / Crude Oil Dec 31, 2014 - 12:05 PM GMTBy: Dan_Norcini

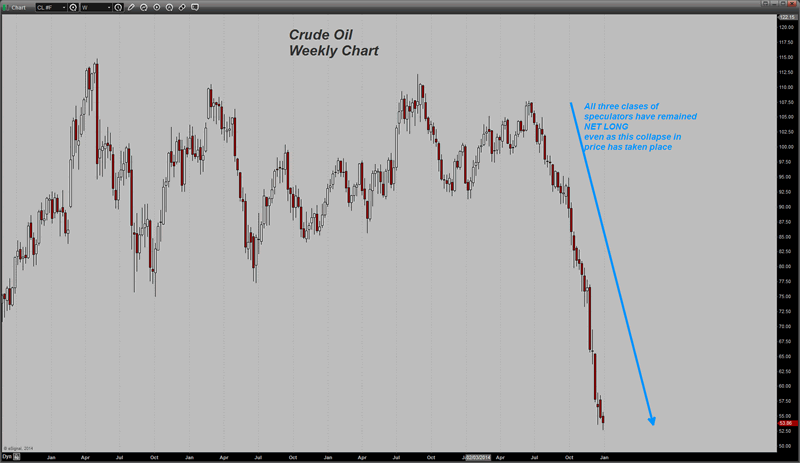

Another week – another CFTC report – more of the same, namely the large speculative category, hedge funds and other reportable traders, continue their love affair with crude oil. This, in spite of the fact that the black goo has lost 50% of its price since June of this year.

Another week – another CFTC report – more of the same, namely the large speculative category, hedge funds and other reportable traders, continue their love affair with crude oil. This, in spite of the fact that the black goo has lost 50% of its price since June of this year.

I have said now for the last few weeks and will say it once more, I am completely mystified and baffled as to how the supposedly smartest and most informed traders on the planet could have gotten this market so wrong. Not only that, but that they continue to stay wrong!

Maybe they all know something that the rest of us smaller traders do not. Speaking of smaller traders, the general public, dumped a considerable amount of their existing long positions this past week ( FINALLY – for a change!). That being said, they also covered some of the smaller position they have on the short side. The result was a 6700 reduction in the total net long position. They remain net long but they are finally moving out it would seem.

The hedge funds did actually finally manage to convince themselves to part with some of their dearly beloved long positions ( almost 14,000) but they still are large net longs in this market by a more than 5:1 ratio! Astonishing!

The other large reportables decided that they would rather cover some short positions than add to that side while only getting rid of a mere 2200 longs. The result is that they actually increased their NET LONG position by over 11,500 contracts! Again, I have no explanation whatsoever for this.

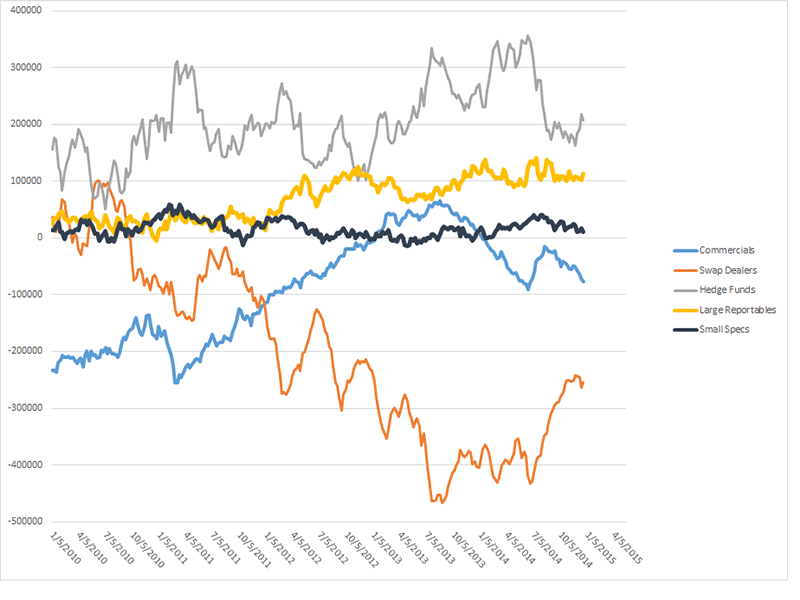

In looking at the COT chart, you can see that the speculative world has been incorrectly positioned in crude oil since June of this year with the majority in all three camps missing the entirety of one of the most powerful and abrupt downtrends that this market has experienced since 2008. One gets the distinct impression that they were caught flatfooted and still cannot believe what happened to them. This is quite peculiar especially when one considers that as a general rule, hedge fund computerized trading programs are designed specifically to work with TRENDING MARKETS. it is sideways markets that tear this group to shreds.

So here we have a powerful bear trend in place and they are wrong by a 5:1 margin!

It is difficult for me to therefore see this market bottoming out anytime soon – not as long as you have so many “hangers on” hanging on the long side.

What makes this move even more strange is that normally, when markets are experiencing sharp moves lower and speculative forces are on the long side and are liquidating, one sees commercial interests covering shorts and thus reducing a net short position that they put in place as the market rallied prior to the liquidation break.

We are getting exact opposite in this WTI market – we see the market falling but commercials are selling- not buying – while speculators remain net long. As I said – I am trying to recall seeing this sort of setup and having difficult doing so. Even in this market, back at its height before the credit crisis of 2008 undid it, Commercials had built a massive net short position against a massive net long position among the speculators. As the market broke – along with everything else back then – commercials were busy buying back existing short positions into the selling of the speculators who were long and getting obliterated.

This time around the market is falling but the specs have been buying while the commercials have been selling. Maybe that is going to change soon but for now, it does not seem to be the general case.

In other words, we have seen nothing that would even slightly resemble any sort of capitulation at all in the crude oil market amongst the speculative class. Could be some of them are buying against what they think will be a floor near or just above the $50 level but that is based on just hunches and nothing concrete that I can see for now.

Maybe they are simply ignoring their systems and doing some sort of discretionary trading and actually going against the trend with that sort of price floor in mind. I honestly do not know – but the fact that this stubborn bullishness remains in place after a market has lost 50% of its value is certainly an extremely rare occurrence.

Tomorrow we have the EIA numbers for Crude and its products. It seems that the majority of analysts are looking for a drawdown in crude stocks ( 600,000). The thinking is that gasoline demand is high during the week of Christmas as people journey around to see family. Same goes for jet fuel use, etc.

The thing is, that was also expected to be the case with this afternoon’s API (American Petroleum Institute) number. It too was expected to reveal a draw in crude oil stocks. Guess what? It DID NOT! Instead of an expected barrel drawdown, API gave us a BUILD ( Increase) of 760,000 barrels. WHOOPS! What is even more troubling is that the stocks at Cushing – the delivery point for the Nymex crude oil contract – rose by a whopping 1.8 MILLION Barrels.

We are getting some reports of rigs being idled, which is a positive for the overall industry as we look forward but there is still a massive amount of oil supply coming into this market. OPEC has still shown no signs of cutting production whatsoever. According to reports from Bloomberg, the oil cartel pumped 30.56 million barrels per day in November. That exceeded their own collective target of 30 million per day for the SIXTH MONTH IN A ROW! Venezuela is screaming bloody murder but the rest of their cartel members could care less!

I still feel that it is going to be at least Q2 2015 before we are going to see any serious denting of the supply overhang in this market. We’ll see what kind of year-end idiocy we get in the price action tomorrow but keep in mind that many traders are already gone for the holiday this afternoon – they packed up and left today… that means pit populations and screen readers are going to be even fewer than there were today – and today was a case of how thin trading conditions can result in some very bizarre price swings.

I for one am going to be very glad to see the full contingent of pit denizens returning for business next Monday.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2014 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.