Is Now the Time to Buy Small Cap Stocks?

Stock-Markets / Investing 2015 Dec 30, 2014 - 04:16 PM GMTBy: Investment_U

Matthew Carr writes: There are a number of misconceptions that are perpetually parroted as truth.

Matthew Carr writes: There are a number of misconceptions that are perpetually parroted as truth.

For example...

Albert Einstein did not fail mathematics... In fact, he mastered higher forms of calculus (which most of us don’t see until college) before he was 15.

You can’t see the Great Wall of China from space... It is barely visible from low Earth orbit. Even then, you need binoculars.

Twinkies, in fact, do go bad... The shelf life of a Twinkie is 45 days.

There’s also a popular belief that January is the best month of the year for small cap stocks... That’s not even remotely close to the truth.

But as we close out the year, this will be thrown out again and again as fact.

After struggling for the last several months, the Russell 2000 closes out 2014 setting all-time highs. And so the question becomes: Is now the time to buy small cap stocks?

Fact Versus Fiction

History shows us December is the best month for small cap stocks, with the rally really taking shape mid-month. Much like we saw this year.

The Russell 2000 is up over 4% in December. It’s up 6.98% since the close on December 16. And this run-up accounts for the small cap index’s gains for the year.

But this is far from unusual for the Russell 2000.

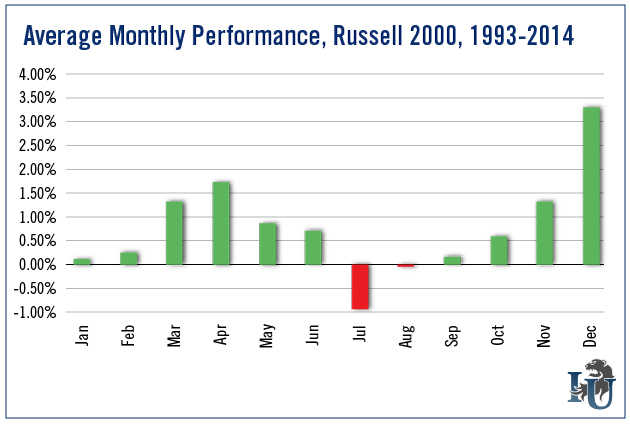

Let’s take a look at the average monthly performance of the small cap index from 1993 to today...

We see some points that stand out.

First, over the last 22 years, January is the third worst month of the year for small caps. The only months that are worse are July and August, part of the summer slump.

And since 2008, small caps have performed particularly poorly in January, scoring just two gains - 2012 and 2013.

Second, when looking at the chart, we see how big that final month of the year is.

December, year in and year out, has been prime time for the Russell 2000. In fact, December’s average gain is nearly twice that of the second-best month for small caps, April.

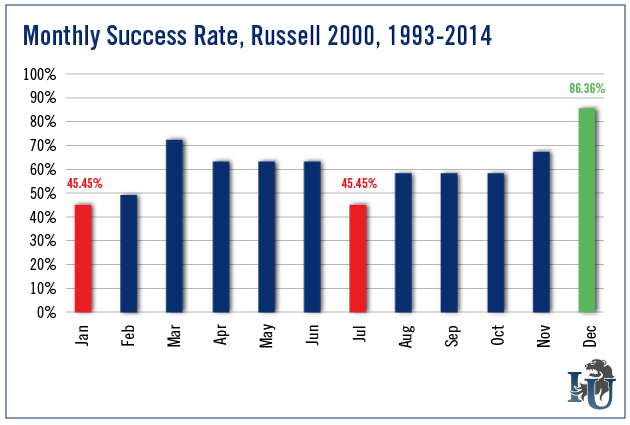

But, what’s more, when we look at the success rate of each month over the past 22 years we also notice something interesting...

The Russell 2000 has notched a success rate of only 45.45% in January. That means it’s ended the month positive only 10 times out of the last 22 years. That’s the same success rate as the worst month of the year, July.

But when we look over at December, small caps have ended the month in the red just three times since 1993. These losses happened in 2002, 2005 and 2007.

Either case doesn’t point to a strong performance by small caps to kick off the year in January. For a little more than two decades, December is the best month for small cap stocks.

Small Caps vs. Large Caps to Kick Off the New Year

Now, do small caps outperform large cap stocks in January?

That’s another “fact” that will be trotted out this time of the year. Part of the January Effect for stocks.

So, how true is it?

The Dow Jones Industrial Average has ended January in the red nine times since 1993. That’s a 59% success rate, better than the Russell’s 45% success rate for the month.

And January, since 1993, has ranked as the fourth worst month of the year for the blue chips on the Dow - behind June, August and September.

But while the average gain of the Russell 2000 in January over the past 22 years is 0.08%, the average gain of the Dow is 0.03% during the month.

So, not really a home-run, breakaway performance.

On a strictly comparative basis, the Russell 2000 has outperformed the Dow 10 times during the month of January over the past 22 years... 45% of the time.

And in none of those years was the Dow negative and the Russell positive for the month. If the Dow was strong, the Russell had a chance to perform stronger. Or if the Dow was weak, the Russell had a chance to be not as weak.

Now, since 2000, small caps have outperformed the Dow nine times in January... But again, it’s largely just as I mentioned above.

Despite all the praise and promise for January and the January Effect, it’s not really there in the actual data. The month has ranked as one of the worst months for both large cap and small cap stocks for the past 20 years.

At one time it was viable. There are plenty of studies that have shown it.

But the January Effect for small caps is not new, and that’s the problem. It was born by Sidney Wachtel in his 1942 paper, “Certain Observations on Seasonal Movements in Stock Prices.” And was based on data from 1925 to 1941.

And like all trends, the potency starts to wear off over time. Trends shift and move.

January is often a rough month for both small and large cap stocks. We’re also entering the new year with new all-time highs on the S&P 500, the Dow and the Russell 2000. So, stay vigilant in the face of any volatility we might see and look for opportunities before the next earnings season gets underway.

Good investing,

Matthew

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.