Japan Is Writing History As A Prime Boom And Bust Economic Case

Economics / Japan Economy Dec 30, 2014 - 02:50 PM GMTBy: GoldSilverWorlds

Recently, we wrote a paper about the dynamics behind the boom and bust cycles, based on the view of the Austrian School (the Austrian Business Cycle Theory, or ABCT). The key takeaway was that central banks don’t help in smoothing the amplitude of the cycles, but rather are the cause of cycles.

Recently, we wrote a paper about the dynamics behind the boom and bust cycles, based on the view of the Austrian School (the Austrian Business Cycle Theory, or ABCT). The key takeaway was that central banks don’t help in smoothing the amplitude of the cycles, but rather are the cause of cycles.

Business cycles are a direct result of excessive credit flow into the market, facilitated by an intentionally low interest rate set by the government.

The problem with ongoing monetary policies is that the excessive money supply sends the wrong signals to the market, which ultimately leads to misallocation of investments or ‘malinvestments’.

On the one hand, entrepreneurs invest more and increase the depth of the production process. On the other hand, consumers spend more as saving becomes unattractive. When the excess products created through the cheap money-induced investments reach the market, consumers are unable to buy them due to the lack of prior savings. At this point the bust occurs.

It is key to understand that by manipulating interest rates (particularly by lowering them), central banks create bubbles that end in busts.

Japan is an excellent case study depicting the scenario discussed by the Austrian Business Cycle Theory (ABCT). In this article, we will examine the course of the economic and monetary situation in Japan from the ABCT’s point of view.

The latest quarterly GDP release in Japan was a real disaster. Economists had forecast a GDP growth between 2.2% and 2.5% but the result was a contraction of 1.6% on an annualized basis (i.e., -0.5% on a quarterly basis). That comes after a quarter in which GDP had already fallen 7.3% on an annualized basis (i.e., -1.9% on a quarterly basis).

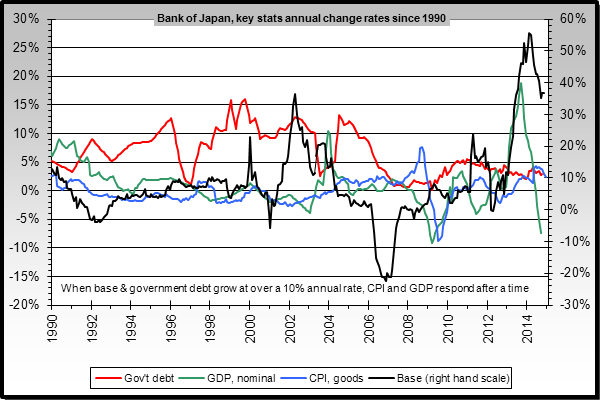

The money printing frenzy has taken gigantic proportions, and the (lack of) effectiveness of the excessive money creation is visible in the charts. The first chart below shows the annual monetary base expansion (the black line) since 1990. The GDP year-on-year growth is shown in the green line. Notice how the monetary base had exploded in 2013 but the steepness of the rise was slightly reduced in 2014. Even with this slight pull back in monetary growth, the GDP growth is truly collapsing. Chart courtesy: Nowandfutures.

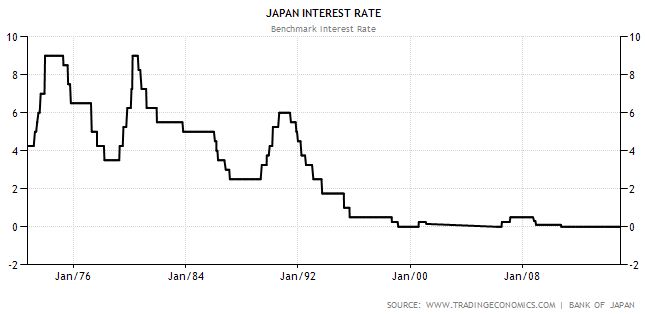

The Japanese interest rate over the last 4 decades reflects the frenzy of the monetary policy. Japan has had 0% interest rates since the start of the new millennium; that is over a decade! In 2012, Prime Minister Shinzō Abe applied his aggressive economic reform program also known as

‘Abenomics’. It has three core elements: fiscal stimulus, structural reforms and monetary easing. Needless to say, monetary easing plays a big role and Japan has gone all the way hoping to see a 2% annual inflation rate including negative interest rates and quantitative easing. Chart courtesy: TradingEconomics.

As we said in the introduction, the manipulation of interest rates does not come without consequences. A bust is inevitable; the timing of the bust, however, is the wildcard.

Japanese policymakers are fighting tooth and tail to direct the mindset of consumers and businesses in their favor. Their rationale goes as follows: by emanating greater inflation expectations, consumers and businesses should accelerate their desired consumption and investments, gradually boosting economic activity. All these measures have come at a high price with Japanese public debt now exceeding 200% of GDP.

Accordingly, economic growth is intended to be partly based on increased inflation, which they aim to achieve by a rise in consumption.

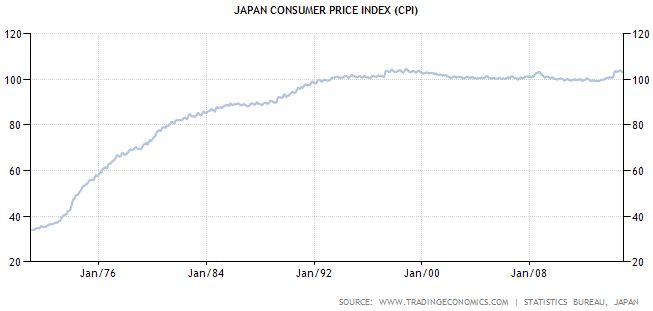

The next chart clearly shows that this higher inflation target has yet not materialized in the Japanese experiment, and it may take a few years for it to reach the 2% target.

Unfortunately, a real economic recovery cannot follow a period dominated by “fear” and “skepticism” as consumers were afraid to overspend and entrepreneurs were afraid to invest. That is such a simple truth that apparently escapes the intelligence of central planners.

There is more evidence of that on a macro economic level by breaking down the GDP components. The next chart makes that point; it is based on IMF research. The stimulus effect of Abenomics on households, businesses and exports had a very short life span, and, bottom line, no real effect. The only real effect on the economy is in the segment of public spending.

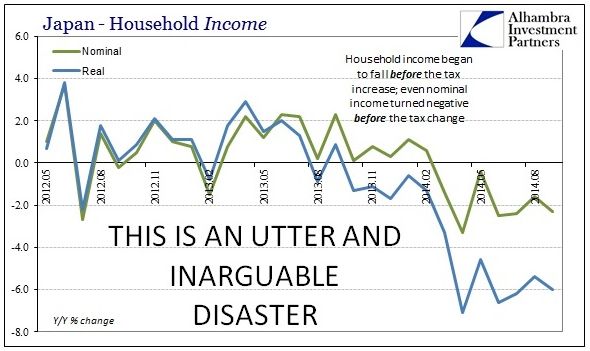

Moreover, in line with the previous data, net purchasing power of households has been going down, see next chart (courtesy of Alhambra Partners). The graph shows that the gap between nominal and real wages is widening. That is probably one of the most worrisome trends: hard working people are the victims of government stimulus. Chart courtesy: Alhambrapartners.

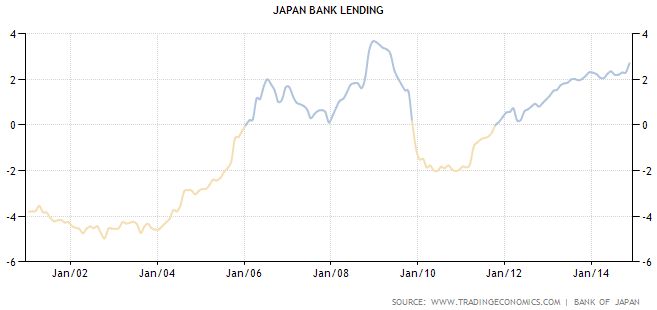

As a result, bank lending, a key driver for economic growth, has been rising very slowly in the last few years. Unsurprisingly, in 2014 there was no growth in Japan.

Given the absence of real GDP growth (first and third chart above) and inflation (second chart above), total GDP growth remains subdued. The gigantic monetary expansion has no constructive power. Given the extent of the monetary efforts and the consequent lack of creating an impact on the real economy, it is clear that monetary policy is only delaying and aggravating the inevitable bust.

To make things worse, the Japanese government imposed a sales tax in April of this year. The Q2 GDP figures, which were released thereafter, were a true disaster! A tax increase in a healthy economy does not have the potential to torpedo economic growth the way it did in Japan in Q2 and Q3.

Take the automobile industry in Japan, for example. Chairman of the Japan Automobile Manufacturers Association (JAMA), Fumihiko Ike, recently confessed that Abenomics, which was designed to end years of deflation, had failed to encourage spending on big-ticket items like cars. He said that “Abenomics is not having clear traction across the country and even though as an industry we benefit from the weaker yen, we feel a sense of crisis about the fact that cars are actually not selling”.

Were Japan to live in some sort of hypothetical vacuum, their actions could have been slightly more effective. But in a globally interconnected world, complexity and dependency have grown tremendously. However, no academic model has been able to capture and quantify those dimensions. In the context of Japan, as an example, the currency devaluation of the Yen is indeed having a positive effect on the exports but, simultaneously, it is having a destructive effect on imports, as a weaker Yen makes imported products and services more expensive. It should not come as a surprise that policy makers are not taking these effects into consideration as their models seem to be archaic.

As Austrian economist Ludwig von Mises indicated a long time ago, “there is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

It is fair to say that the dynamics in the Austrian Business Cycle Theory are at play in Japan. There are striking similarities with the case analyzed in the micro-documentary released by Global Gold earlier this year which illustrated the Great Depression, the recession of 1990, the Dot Com crash, and the financial crash of 2008.

Given the data points discussed in this article, it is fair to say that Japan is on track for a devastating bust at some point in the future. The unknown factor is timing. When the inevitable will take place is anyone’s guess. What we know from history is that frenzies can go on for much longer than most of us believe. Also, inevitable does not equal imminent.

The fate of countries like Japan is really in the hands of central bankers. However, central planners are not able to manipulate markets infinitely. At a certain point, something has to give. That is when the markets will give up and disbelief will replace trust.

Readers should remember that in such a bust scenario, people flee down the Golden Pyramid of asset classes to their safe haven, being gold (source: John Exter). When the bust does occur, holding physical gold and storing it outside the banking system is the ideal counter-balance to other asset classes. Gold is a scarce asset that has absolutely no counterparty risk and instead offers the optimal “hedge” against a crisis! Gold presents its holders with the safety net when the monetary and financial systems break down.

It is our fundamental belief that it is better to be prepared 3 years too early than 3 days too late.

To read more about holding physical gold outside the banking system and the available solutions offered by Global Gold, please visit http://welcome.globalgold.ch/physicalgold and request an investor kit for free.

Source - http://goldsilverworlds.com/economy/japan-is-writing-history-as-a-prime-boom-and-bust-case/

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.