Currencies that are Certificates of Wealth Confiscation- The Crack Up Boom, Part I

Stock-Markets / Money Supply May 29, 2008 - 02:12 PM GMTBy: Ty_Andros

Last summer, Tedbits did a series outlining the unfolding “Crack Up Boom” written about by Ludvig Von Mises. It was well received, to say the least. Now we return to it as the “Crack Up Boom” is front and center to analyzing unfolding economic and political events. The collapse of income and living standards in the G7 (trough misstated inflation) is combining with the “something for nothing” broad social trend to push the “Crack Up Boom” into a higher gear. Malinvestments are collapsing at an increasing rate and public servants and central banks are reacting predictably. They are printing the money as they always have and always will, accelerating the arrival of the global CRACK UP BOOM. They are explicitly saying they will print the money.

Last summer, Tedbits did a series outlining the unfolding “Crack Up Boom” written about by Ludvig Von Mises. It was well received, to say the least. Now we return to it as the “Crack Up Boom” is front and center to analyzing unfolding economic and political events. The collapse of income and living standards in the G7 (trough misstated inflation) is combining with the “something for nothing” broad social trend to push the “Crack Up Boom” into a higher gear. Malinvestments are collapsing at an increasing rate and public servants and central banks are reacting predictably. They are printing the money as they always have and always will, accelerating the arrival of the global CRACK UP BOOM. They are explicitly saying they will print the money.

Note to readers regarding Tedbits availability: Starting in June, Tedbits publications will be available to registered subscribers 2-3 days earlier than to the general public. If you are not a registered subscriber, sign up now.

See Tedbits live on web T.V. Weekly interviews with Ty Andros are back on Yorba TV. Catch the live interviews on Wednesdays at 3:30 U.S. Central Time at www.Yorba.tv .

For decades public servants and socialists in the G7 have quietly been socializing the economies in which they reside, destroying the wealth creation of the formerly capitalist economies in which MIDDLE CLASSES were healthy and growing and their wealth was accumulating and savings were growing . They are transferring the wealth production of the private sector into public sector hands through one means or another. To name a few these means are high and rising taxes -- directly through taxes and fees and indirectly through the confiscation of wealth from FIAT money and credit creation (stealing the purchasing power of your savings and wages while it sits in your bank accounts).

Ever increasing mandates destroy innovation from rising businesses so established corporations can SQUASH the benefits of capitalism. They do so by BUYING the entrenched public servants by funding their reelections through campaign donations. Then the public servants create rules and regulations to “protect you” from innovations from rising new entrepreneurs and businesses, depriving the formerly CAPITALIST economies in which they reside of NEW innovations which provide everyman “more of everything for less”. Capitalist economies have a natural type of disinflation which is ESSENTIAL to creating a more stable fiat currency system.

Creative destruction is where new entrepreneurs and businesses create products and services superior to existing ones at a lower price. Consumers act in a rational manner and choose them over established businesses to MAXIMIZE the wages they are paid and benefits to their families by allowing them to consume more for less.

In its place they substitute CORPORATISM, a system of entrenched corporations in which OWE their ability to stay on top of their industries and sectors to the public servants, which are dependant on them for funds required for reelection. Name me one entrenched business that does not give to ALL public servants for reelection. Both RIGHT and LEFT are funded equally and to the maximum allowable limits.

So corporatism substitutes regulation, which MANDATES their way of doing things and the ever growing government bureaucracies necessary to STAMP out the emerging competitors through endlessly growing regulations and the bureaucracies to ENFORCE them. In Europe this process is almost complete. New businesses and entrepreneurs have NO CHANCE of maneuvering the STRAIGHTJACKET of regulations and taxes required to build a new and innovative business. The result of this is “less of everything for more”. Look no further than the agricultural, alternative energy and medical sectors of the G7 economies to see this in action. They are the epitome of government mandates and subsidies, forever distorted from the price mechanisms of capitalism. Energy, food and medical prices are SOARING and the new solution to today's problems NEVER ARRIVE. The US is rapidly following down this path.

To have a successful new business or personal success you must “produce more than you consume” and the cost of regulations and taxes guarantees that you cannot do so on the first day of business. Savings become IMPOSSIBLE as they are eaten by the public sector. In the G7 whole societies have now lived for GENERATIONS consuming more than they produce and do not know this IMMUTABLE law of nature -- survival of the fittest. They stand on an altar of hubris on which they will be sacrificed. Public servants tell their “something for nothing” constituents that they are the richest country on earth when in reality they may be the poorest based upon the amount of indebtedness. These societies save nothing and spend far more than they produce -- a recipe for bankruptcy.

Savings combine with innovation and the factory room floor to create the virtuous circle that creates vibrant and growing middle classes -- the ability to create wealth as defined by Austrian Economics and Von Mises. As this has become almost “impossible to do” in the G7, the middle classes are slipping away, ground into the dirt by the constant debasement of their living standards as capitalism is substituted with the policies of socialized economies, corporatism, inflation and the benefits of incumbency. NO POLITICIAN in the G7 plans for the futures of their children. There is now only one overriding priority for a G7 public servant and that is the next election.

It is so much easier for public servants to substitute easy money (monetary policy and inflation) and asset inflation for the fiscal policies of growth (less taxes and innovation stifling regulations and mandates). It pays them more as industries are forced into the arms of government as they fail from its policies or FLEE to economies in which they can PRESERVE their competitiveness. Once on the subsidy bandwagon permanent political constituencies are the result! This is why they G7 have been steadily de -industrializing for over four decades. They must move outside the grasp of G7 public servants to stay in business. It is self preservation on a corporate level.

Money printing drives more and more people into government dependence. It is a silent tax. Less taxes, regulations and mandates drive constituents to freedom. Which do you think government wishes to do? Asset backed economies rely on financial and fixed assets growing faster than the stated rate of inflation, creating the illusion of growth and rising incomes. It is the way public servants PUSH their constituents into the arms of government solutions which when implemented serve the government's elite constituents and ever-growing legion of government bureaucrats at the expense of the broad public which have placed their trust and votes in them. All solutions lead to more of the government and less in the private sectors. So it's less for you, me and our families and more for them.

Impoverishment of the middle classes drives them into populism as they try and preserve their standard of living from the HIGH cost government mandated products and services and the debasement of what they hold their wealth in: currency, stocks & bonds. As this debasement occurs middle class families are forced to find second incomes or suffer declining living standards and even then their lifestyles are always declining. As their futures slip away on this slippery slope the “something for nothing” social trend is born.

Creating broad swaths of voting populous mobs looking to rob the remaining wealth creating sectors and transfer it to themselves. The Public servants never do so, as their promises sell HOPE, and CHANGE to the hopeful. Cannibalism of the worst sort. Too uneducated to understand that they will never advance economically by destroying the companies they work for. This social trend has ALWAYS led to the demise of the empires in which it has emerged. There is no such thing as a free lunch and those that believe there is are headed to bankruptcy, both moral and fiscal. This is the broad social consensus in the G7 today.

ALL GOVERNMENT SOLUTIONS ARE “less of everything for more money.” Understand that they hold NO value in the practical world, only in the politically correct one. Politically correct means practically incorrect as they accrue to their campaign and special interest supporters rather than create benefits and practical solutions which reach the public.

As this destruction has unfolded wealth creation became a function of ASSET inflation and asset backed economies which are now deeply woven into the fabric of the entire G7. Inflation has become the policy of governments throughout the G7. This inflation has been accomplished through decades and decades of money and credit creation in excess of economic growth. In the early 1970's, Bretton Woods II altered forever the definition of money in a subtle but very economically destructive manner.

None other than John Maynard Keynes once said:

"By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens...There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose." -- John Maynard Keynes

Money has several functions they must provide and they are:

- A medium of exchange

- A measure of value

- A standard of value

- A store of value

“As a common medium of exchange and measure of value, money transfers value through space. Money as a standard of value transfers value through time. Money as a store of value transfers value over time. These are all important functions of money ” -- Doug Gnazzo

Money has this definition if it can buy next year something of equal value to that it was used to purchase today. For instance, if 100 dollars was used to purchase a barrel of oil today, than the same 100 dollars should purchase a barrel of crude oil a year from now. Gold fits this definition for the most part. A barrel of crude roughly cost the same amount of gold as it did in the 1930's. A dollar, Euro, British pound, Swiss Franc, Chinese Yuan, Russian ruble DO NOT DO SO. As I have said for years (since I met my good friend Clyde Harrison who pointed out the flaw in how I think) “currencies do not float, they just sink at different rates”. The assumption that you can store purchasing power or wealth in a currency or bond is FALSE.

This debasement in the G7 is DIFFERENT than the debasement in the EMERGING world which I will cover in another part of this “Crack Up Boom” series. In the G7, it is public servants masking their footprints of deficit spending through debt creation, confiscation of wealth through stealth taxation by printing press and poor policies. While in the emerging world, it is a self-defense mechanism from enormous FIAT CURRENCY monetary exports.

In today's monetary and financial systems money FAILS to accomplish most of the definitions outlined above. It still functions as a medium exchange but can be expected to increasingly lose this function in the future.

Wealth creation and incomes are collapsing in the G7. Living standards, corporate profits, income growth, rising debt levels and collapsing savings rates all point to the unfolding calamity, a slow motion train wreck which will unfold over the next decade . In a heavily indebted, income-short economy there are only two solutions that can be considered— inflating the obligations away or creating the policies of government which encourage capitalism, savings and Austrian economics to work their magic of wealth creation.

In the emerging world, the public servants have chosen the latter and in the developed world of the G7 they have chosen the former. It is a wonderful turn of events for the emerging world as three billion people emerge to more modern lifestyles and create new and vibrant middle classes. In the developed world it is a recipe for “misery spread in ever widening circles” as the economic pie and economies are always shrinking in REAL terms masked by growth in NOMINAL terms.

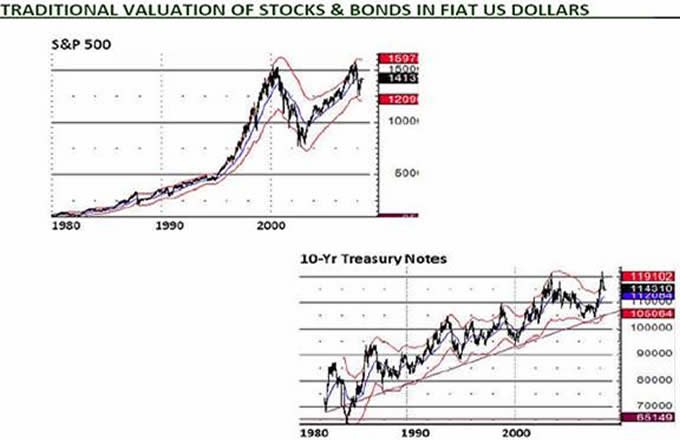

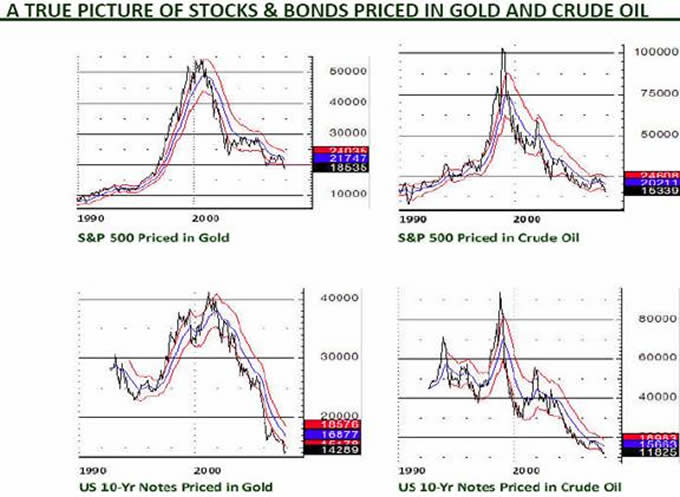

To see how monetary debasement and inflation is robbing you of the purchasing power and value of your holdings look at these two charts of US 10 year notes and the S&P 500 denominated in constantly debasing US dollars and then gold and oil to illustrate the confiscation described by John Maynard Keynes:

These are the pictures of wealth destruction. You have lost almost 75% of the purchasing power and REAL value of your stocks and bonds. When I explain this to people they look at me blankly. Even at the highest levels of the investment world this is not understood, as Keynes said: “not one in a million” and he was not kidding. If you think this is limited to the US dollar, think again. Here is the FIAT money and credit creation of most of the worlds leading economies:

| GLOBAL MONEY SUPPLY | |

| as of 10/04/07 Country, very accurate even today | YOY % |

| Russian Fed. M2 | 43.71 |

| India M3 | 20.15 |

| China M2 | 17.06 |

| Australia M3 | 16.64 |

| Denmark M3 | 14.53 |

| UK M4 | 13.06 |

| Mexico M4 | 12.69 |

| Brazil M2 | 12.37 |

| Korea M3 | 9.97 |

| OECD Total M3 | 8.22 |

| Canada M3 | 8.15 |

| United States, M3 reconstructed | 17.00 |

| Germany M3 | 6.16 |

| Japan M4 | 4.22 |

| France M3 | 2.72 |

| Spain M2 | 1.98 |

| Switzerland M3 | 0.95 |

Wow. Using the rule of 72 we can see what's transpiring in the G7/20 and that the emerging world is forced into huge money supply growth to “sterilize” the massive influx of G7/20 money exports:

Russia , 72 divided by 43.7 equals money supply doubling every 1.64 years

India , 72 divided by 20.15 equals money supply doubling every 3.57 years

China , 72 divided by 17.06 equals money supply doubling every 4.22 years

Australia , 72 divided by 16.64 equals money supply doubling every 4.32 years

United States , 72 divided by 17. equals money supply doubling every 4.23 years

Denmark , 72 divided by 14.53 equals money supply doubling every 4.95 years

UK , 72 divided by 13.06 equals money supply doubling every 5.51 years

Mexico , 72 divided by 12.69 equals money supply doubling every 5.67 years

Euro zone, 72 divided by 12 equals money supply doubling every 6 years

Brazil , 72 divided by 12.37 equals money supply doubling every 5.82 years

Korea , 72 divided by 9.97 equals money supply doubling every 7.22 years

OECD, 72 divided by 8.22 equals money supply doubling every 8.75 years

Canada , 72 divided by 8.15 equals money supply doubling every 8.83 years

Germany , 72 divided by 6.16 equals money supply doubling every 11.68 years

I could continue, but the point has been made. These are economies that CONTEND that inflation is contained and running below 4% in the developed world and less than 6% in the emerging world. “Inflation is a policy of Government” and constitute a crack up boom in its infancy . Those headline numbers are used to fool the dumbest among them and they keep the man on the street as their fool and victim. This is the face of public servants and government PREYING upon their constituents.

A ten-year bond or currency from these countries is a certificate of confiscation. You are GUARANTEED to lose half the purchasing power or more.

The BIGGEST money in the world is operating under the false assumption that you can store wealth in global currencies, stocks and bonds . The definition of this was irreparably changed during Bretton Woods II in the early 1970's. Now we see why commodities and natural resources are in BULL markets against ALL currencies . Almost 40 years of debasement compounded annually is finally catching up with the central bank fraudsters and their public servant masters.

Because of current and previous money printing there are now TRILLIONS upon TRILLIONS of the aforementioned currencies sitting in bank accounts and bonds around the world. They are constantly being debased and inflated away by the respective governments, public servants and central banks. The compounding of this debasement over many years is now really coming home to roost. It's now getting to the point that a few people are WAKING up to the facts. As people realize this more and more money moves off the sidelines and seeks shelter from the coming maelstrom by seeking the indirect exchange which marks every “Crack Up boom” as outlined by Ludvig Von Mises:

The course of a progressing inflation is this: At the beginning the inflow of additional money makes the prices of some commodities and services rise; other prices rise later. The price rise affects the various commodities and services, as has been shown, at different dates and to a different extent.

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German Mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last.

When Von Mises wrote this, Crack Up Booms were typically limited to one country or another. This is the biggest Crack Up Boom in history as the whole world is aboard rather than one irresponsible government . Mass insanity at the highest levels of leadership in the world as well as the broad publics. The world is operating under the illusion that money has the definitions outlined previously, and this IS NOT true. In this case, I believe this process will take a decade or more and when done the FACE of the world will be quite a different place financially and economically.

Crack Up Booms also are accompanied by the conditions I outlined above of creeping socialism, collapsing production and de-industrializing countries. When wealth creation ceases or is diminishing, the debasement of the currency takes on an accelerated phase as the ability to meet the obligations of the debasing currency is constantly shrinking. People that hold them are always getting back less for them so they increasingly hold less of them. Think of the former Soviet Union , Argentina , and Zimbabwe , Argentina (again) and Venezuela TODAY. NOW it is the G7 where wealth creation is declining rapidly and is accompanied by rapid monetary debasement.

In the BRIC's ( Brazil , Russia , India and China , emerging world and the natural resource economies) growing wealth-creating economies, the expectation of recovering the value of the goods or services that you exchanged for the currency is greater as they create wealth and have savings, so they naturally will rise against the declining economies' currencies. So you can expect the BRIC's and emerging world currencies to constantly be rising against declining G7 script.

Next week we will begin with the individual issues which you must deal with to create OPPORTUNITIES from these realities and recognize the PITFALLS which you must avoid.

In conclusion:

The misconceptions of investors around the world are opportunities for informed investors. Now you know why I say bonds are BOMBS, as is anything which can be printed, such as G7 currencies. Emerging market, BRIC and natural resource currencies, the dirham in Dubai and other currencies hold relative advantage over G7 script. But is it relative? They just sink slower as those economies that are CREATING wealth, building savings, investing in infrastructure, plants and equipment, and growing. Their ability to pay is rising while the G7s is shrinking.

Rather than shrinking in real terms like the G7 (where savings are falling, wealth creation a shadow of what it was, taxes rising and debt skyrocketing) where infrastructure is neglected, sensible cost-effective energy is outlawed, plants and equipment investments are marginalized through micro-regulation and potentially unprofitable so they are transacted OFF SHORE. Capital is misallocated to subsidize politically correct industries (consume more than they produce at radically higher price of their products) rather than economically VIABLE industries (produce more than they consume and deliver solutions at a small fraction of the price of the politically correct and connected ones).

The solvency crisis in the G7 banking and financial industries is a supercharger to the arrival of the ultimate demise of the G7 EMPIRES and the unfolding Crack Up Boom! Many think the US is empire. No, it is the whole group of developed countries that is known as the developed world and are parties to the financial systems known as the G7. Their handmaidens in the global financial industry are the supposed NGO's such as the IMF, IEA, and World Bank. They are called non-governmental organizations (NGO's) to create the illusions of non-partiality. In actuality, they are proxy government organizations of the G7. They are in order: the taxman in disguise, exporters of the internally crippling poor policies of the G7, socialists, and most importantly, the purveyor of the fiat currencies and credit regimes, confiscating their ‘citizens' and your wealth through confiscation by debasement.

I look at traditional safe haven investments such as T-Bills, government treasuries, bonds and plain old cash, safe is the anti thesis of what they truly are. Main stream Money center and Investment banks do not have any products which can withstand the wealth destruction of what has and is transpiring and unfolding at this time. Short circuiting the printing press and turning it to your benefit can be done and you must do so now. Look no further than the current gang of 545 in Washington to see how they are may OUTLAW commodity index investing which is an absolute method of short circuiting the printing press. They are outlawing the method your pension funds using to protect your retirement funds. Can you say absolutely immoral? If they outlaw commodity index investing it will move off shore and be outlawed for US citizens to benefit from this self preservation from debasement.

These are huge opportunities to create wealth for yourself, figure out how to do so or find someone who does to assist you. Take these fraudsters to the bank.

The Fall of Rome took decades, if not a century, and we are far along in this process. New empires are emerging and global economic power is rotating. New capital markets are being built worldwide in the Middle East , and Asia . These new financial centers will gradually build to the point that they can handle the capital management duties of the emerging world at which time New York and eventually London will be severely diminished. Don't mss the next edition of Tedbits and the Crack-up Boom Series Part II

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.