Crude Oil, US National Debt, and Silver

Commodities / Gold and Silver 2014 Dec 23, 2014 - 05:52 PM GMTBy: DeviantInvestor

Examine the following chart of monthly crude oil prices. In the past 26 years crude oil prices have crashed 65%, 59%, 54%, and 76%. The current crash is about 51% so far.

Examine the following chart of monthly crude oil prices. In the past 26 years crude oil prices have crashed 65%, 59%, 54%, and 76%. The current crash is about 51% so far.

Crude Oil - Monthly Prices

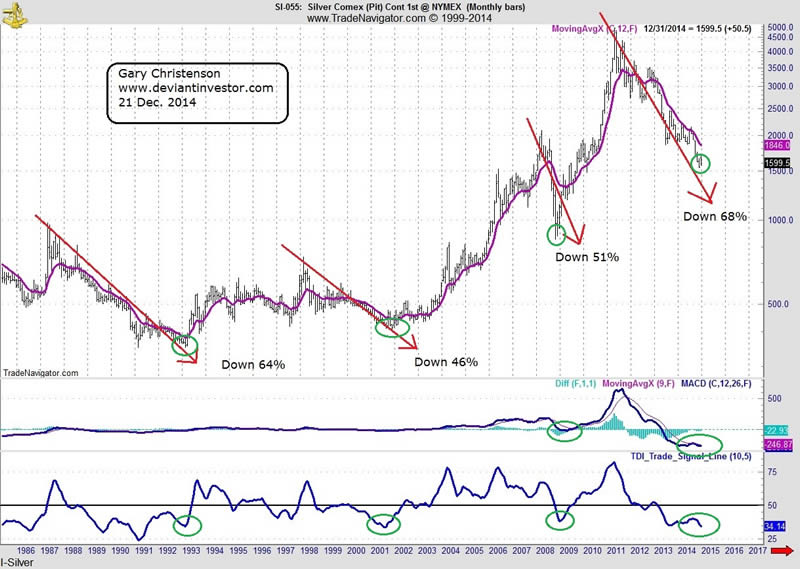

Examine the following chart of monthly silver prices. You can see similar crashes of 64%, 46%, 51%, and 68% since 1986. Prices rallied after these crashes and went considerably higher. Sometimes it took years, but like the national debt, silver prices have substantially increased since 1913.

Silver - Monthly Prices

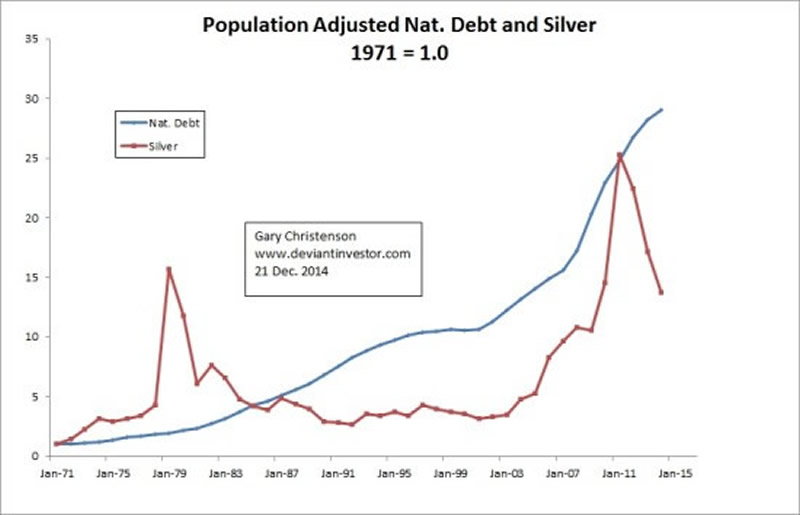

Examine the US national debt, which is currently over $18 Trillion = $18,000,000,000,000. Unfunded liabilities, which might be ten times larger, are not even considered in the following graphs. Adjust the national debt for population increases so we see only the per capita national debt. As expected, it is climbing exponentially higher, and accelerating since 9-11.

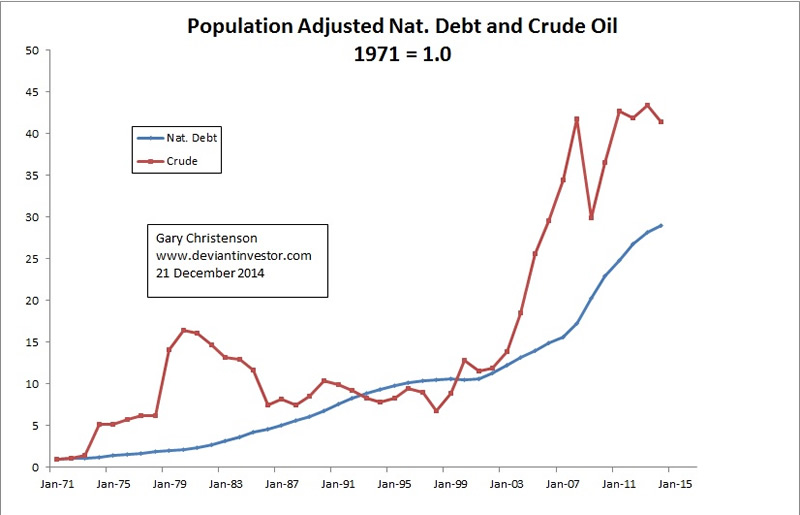

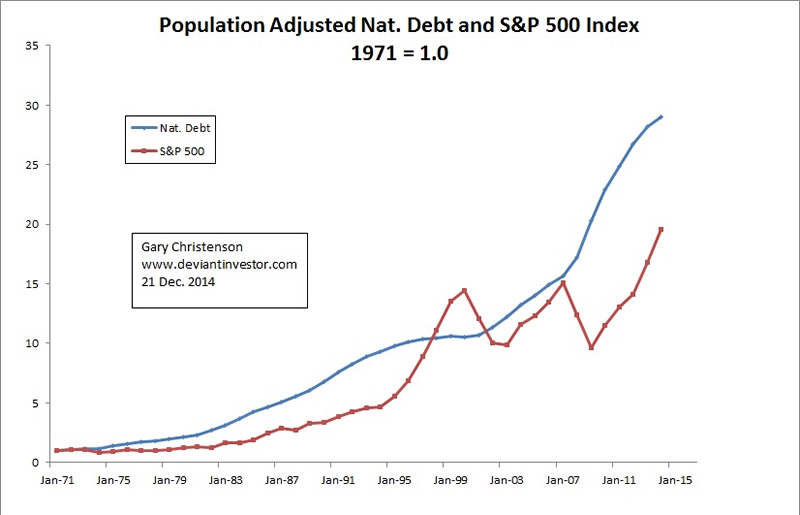

Following the increase in national debt is an increase in the currency in circulation and the prices for most commodities and consumer goods. Examine the graphs for population adjusted national debt, crude oil, silver, and the S&P 500 Index, all of which show annual averages of weekly prices. Note that all prices have been indexed to 1971 = 1.0 for comparison purposes.

Population Adjusted Nat. Debt and Crude Oil

Note that the recent crash in crude oil prices is not yet reflected in the annual average of weekly prices.

Population Adjusted Nat. Debt and Silver

Population Adjusted Nat. Debt and the S&P

Conclusion:

Crude oil and silver prices have crashed before, and they will again. But the one constant in our financial universe that seems inevitable, for the foreseeable future, is increasing debt. Crude oil and silver prices will follow increasing debt.

Expect the S&P to correct downwards (eventually), expect silver and crude to resume their upward trajectory (eventually, probably soon), and, like the inevitability of death and taxes, expect debt to inevitably accelerate higher.

WHEN the corrections will occur seems more and more under the control of the High Frequency Traders, the politicians, and the banking cartel. Sadly our global economic problems, which have been exacerbated by the crude oil crash, will not cured with more debt, which seems to be the preferred “solution.”

Gold and silver are real money, and they are insurance against the craziness and volatility of debt based fiat currency that is increasingly vulnerable to currency crashes like we have seen in Argentina, Venezuela, Ukraine, Russia and elsewhere.

A currency crash can also occur in Japan, Europe, and the United States. Those dollars, euros, and yen have counter-party risk while gold and silver do not.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.