Make No Mistake, the Crude Oil Price Slump Is Going to Hurt the US Too

Commodities / Crude Oil Dec 23, 2014 - 05:22 PM GMTBy: Marin_Katusa

If you only paid attention to the mainstream media, you’d be forgiven for thinking that the US is going to get away from the collapse in oil prices scot free. According to popular belief, America is even going to be a net winner from cheaper oil prices, because they will act like a tax cut for US consumers. Or so we are told.

If you only paid attention to the mainstream media, you’d be forgiven for thinking that the US is going to get away from the collapse in oil prices scot free. According to popular belief, America is even going to be a net winner from cheaper oil prices, because they will act like a tax cut for US consumers. Or so we are told.

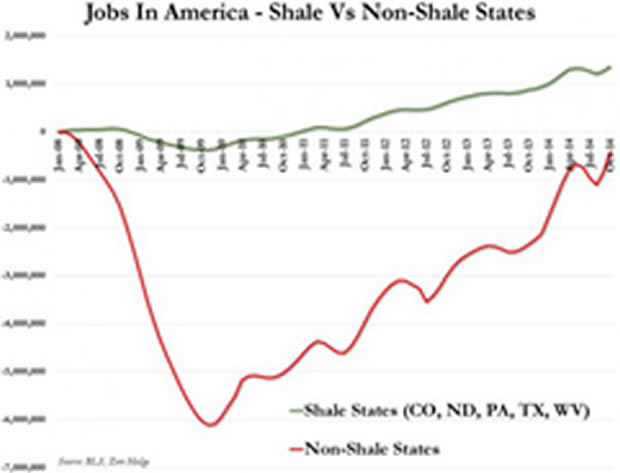

In reality, though, many of the jobs the US energy boom has created in the last few years are now at risk, and their loss could drag the economy into a recession.

The view that cheaper oil automatically boosts US GDP is overly simplistic. It assumes that US consumers will spend the money they save at the pump on US-made goods rather than imports. And it assumes consumers won’t save some of this windfall rather than spending it.

Those are shaky enough. But the story that cheap fuel for our cars is good for us is also based on an even more dangerous assumption: that the price of oil won’t fall far enough to wipe out the US shale sector, or at least seriously impact the volume of US oil production.

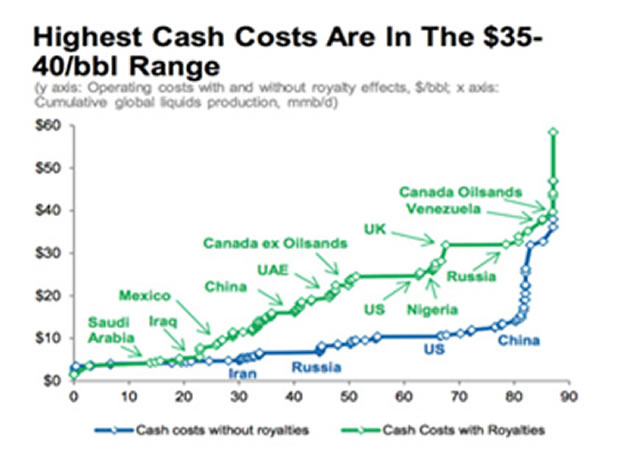

The nightmare for the US oil industry is that the only way that the market mechanism can eliminate the global oil glut—without a formal agreement between OPEC, Russia, and other producers to cut production—is if the price of oil falls below the “cash cost” of production, i.e., it reaches the price at which oil companies lose money on every single barrel they produce.

If oil doesn’t sink below the cash cost of production, then we’ll have more of what we’re seeing now. US shale producers, like oil companies the world over, are only going to continue to add to the global oil glut—now running at 2-4 million barrels per day—by keeping their existing wells going full tilt.

True, oil would have to fall even further if it’s going to rebalance the oil market by bankrupting the world’s most marginal producers. But that’s what’s bound to happen if the oversupply continues. And because North American shale producers have relatively high cash costs (in the $30 range), the Saudis could very well succeed in making a big portion of US and Canadian oil production disappear, if they are determined to.

In this scenario, the US is clearly headed for a recession, because the US owes nearly all the jobs that have been created in the last few years to the shale boom. All those related jobs in equipment, manufacturing, and transportation are also at stake. It’s no accident that all new jobs created since June 2009 have been in the five shale states, with Texas home to 40% of them.

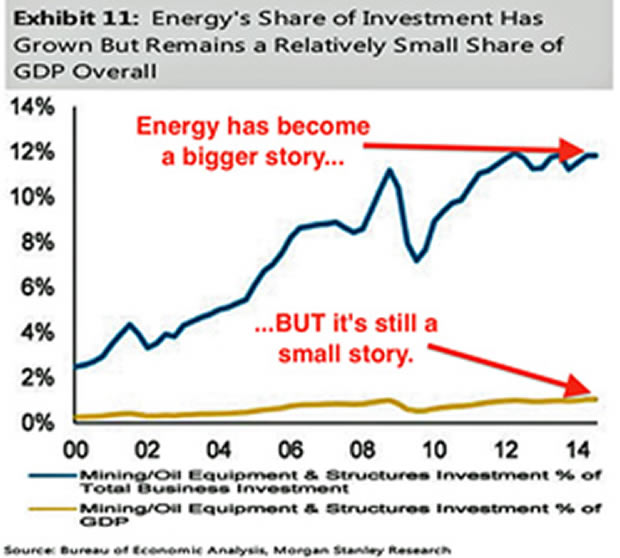

Even if oil were to recover to $70, $1 trillion of global oil-sector capital expenditure—in fields representing up to 7.5 million bbl/d of production—would be at risk, according to Goldman Sachs. And that doesn’t even include the US shale sector!

Unless the price of oil miraculously recovers, tens of billions of dollars worth of oil- and gas-related capital expenditure in the US is going to dry up next year. While US oil and gas capex only represents about 1% of GDP, it still amounts to 10% of total US capex.

We’re not lost quite yet. Producers can hang on for a while, since there has been a lot of forward hedging at higher prices. But eventually hedges run out—and if the price of oil stays down sufficiently long, then the US is facing a massive amount of capital destruction in the energy industry.

There will be spillover into the financial arena, as well. Energy junk bonds may only account for 15% of the US junk bond market, or $200 billion, but the banks are also exposed to $300 billion in leveraged loans to the energy sector. Some of these lenders are local and regional banks, like Oklahoma-based BOK Financial, which has to be nervously eyeing the 19% of its portfolio that’s made up of energy loans.

If oil prices stay at $55 a barrel, a third of companies rated B or CCC may be unable to meet their obligations, according to Deutsche Bank. But that looks like a conservative estimate, considering that many North American shale oil fields don’t make money below $55. And fully 50% are uneconomic at $50.

So if oil falls to $40 a barrel, a cascading 2008-style financial collapse, at least in the junk bond market, is in the cards. No wonder the too-big-to-fail banks slipped a measure into the recently passed budget bill that put the US taxpayer back on the hook to insure any ill-advised derivatives trades!

We know what happened the last time a bubble in financial assets popped in the US. There was a banking crisis, a serious recession, and a big spike in unemployment. It’s hard to see why it should be different this time.

It’s a crying shame. The US has come so close to becoming energy independent. But it’s going to have to get its head around the idea that it could become a big oil importer again. In the end, the US energy boom may add up to nothing more than an illusion dependent upon the artificially cheap debt environment created by the Federal Reserve’s easy money policy.

However, there are a handful of domestic producers with high operating margins that are positioned to profit right through this slump in oil prices. To find out their names, sign up for Marin Katusa’s just-launched advisory, The Colder War Letter.

You’ll also receive monthly updates on the latest geopolitical moves in this struggle to control the world’s oil pricing and the energy sector at large and what it means for your personal wealth. Plus, you’ll get a free hardback copy of Marin’s New York Times bestselling book, The Colder War, just for signing up today. Click here for all the details.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.