Twitter, the Only Social Media Stock Play I'm Recommending Right Now

Companies / Tech Stocks Dec 23, 2014 - 05:16 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: I recently talked about the secret I wish everybody knew when it comes to market timing and discussed one of the most valuable Total Wealth tools of all – the Put/Call Ratio.

Keith Fitz-Gerald writes: I recently talked about the secret I wish everybody knew when it comes to market timing and discussed one of the most valuable Total Wealth tools of all – the Put/Call Ratio.

I also promised you a look at one great trade in particular involving a current social media darling. Today I'd like to keep that promise.

If you've been with me for a while, you already know I don't like social media stocks. They're not hooked into our unstoppable trends (nope, not even Technology). Their products are "nice to have" instead of "need to have." And most of them have no real way to make money.

But that's the thing about tactics.

If you have the right trading tactics, you can squeeze profit out of any stock. Even ones you don't like.

In this case, I think betting on one stock's failure may be far more profitable than betting on its success.

I know that this may seem un-American or somehow unethical, but shorting a stock – that is, betting on its decline – is a killer tactic and can be a fabulously profitable tactic used to build your wealth.

That's a tactic we've talked about, but if you're not familiar with shorting, don't worry. I've got you covered with a special sidebar in a few minutes. So let's get back to the meat and potatoes.

Here's the thinking and here's why #ShortingTwitter is the only social media play I like right now…

As I noted in last Thursday's column, the Put/Call Ratio has warned of the potential for a pullback or reversal for weeks.

For more conservative investors, it's a sign that you should be tightening up your protective stops to harvest gains and control risk.

For more aggressive investors or traders, it's a sign that you want to hunt down the weakest companies you can find. That's because they'll be the first to hit the skids when the trash gets taken out.I first named Twitter Inc. (NYSE: TWTR) in my Money Map Report 2014 Outlook last January as ripe for a fall under similar circumstances. So far that trade has returned 44.64% and counting.

For more aggressive investors or traders, it's a sign that you want to hunt down the weakest companies you can find. That's because they'll be the first to hit the skids when the trash gets taken out.I first named Twitter Inc. (NYSE: TWTR) in my Money Map Report 2014 Outlook last January as ripe for a fall under similar circumstances. So far that trade has returned 44.64% and counting.

Then, a few weeks ago when the Put/Call Ratio reached another extreme, I reiterated the trade for my Strike Force subscribers. So far the returns are 16.13% and 148.06% for those who shorted the stock and those who purchased put options as directed, respectively.

For the social media cognoscenti, what I am suggesting is akin to heresy, but sometimes the most profitable opportunities are.

Here's my thinking…

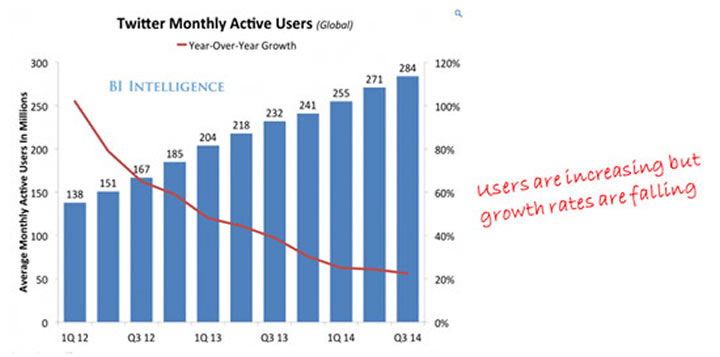

Reason No. 1 – Sagging User Growth

It's no secret I don't like social media stocks.

There's a clear difference between products that consumers use because they pay for them and those they don't. Further, there's a huge disconnect between trillion-dollar trends producing real earnings for real companies like those WE prefer and profitless companies that come to market based solely on their plans to make profits that hype-driven speculators prefer.

Even so, it surprised a lot of people on Jan. 6, 2014, when I said it was time to short Twitter. At the time, the stock was up 86% in the prior month, fresh off its November 2013 IPO.

My reasoning was very simple. The company's user base growth was increasing but at a radically slower rate. That suggested to me that the numbers were going in the wrong direction.

Now, nearly a year later, you can see the trend even more clearly than you could then.

Never forget, real businesses with real growth show numbers going in the same direction – up.

Reason No. 2 – Twitter Can't Make Money off the Users It Has

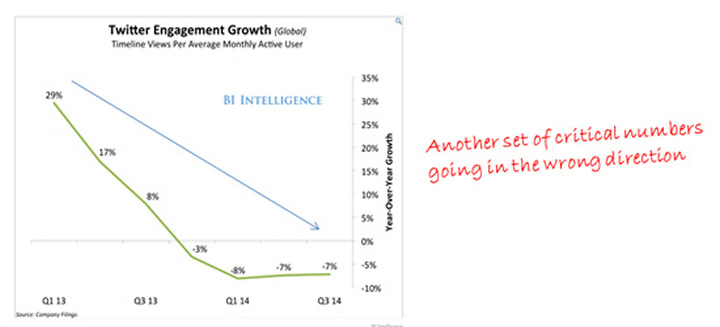

Social media investing Rule 101 says that the number of eyeballs is directly correlated to higher advertising revenue. But in Twitter's case, that's simply not happening.

It's not for a lack of trying, though. The company has been on a tear buying anything and everything geared towards "monetizing" users.

For example, Twitter acquired MoPub, a mobile-focused ad exchange, hoping to boost the sale and purchase of ad space on its platform. The purchase cost $350 million – a serious expenditure for a company that had yet to turn out any sort of profit on its own.

This was followed by a $230 million mobile ad deal with Omnicom, in which it integrated Omnicon's programmatic ad-buying unit called Accuen with Twitter's newly acquired MoPub. Supposedly, the ad deal would give Twitter a much more secure foothold in the world of mobile advertising.

Good luck. No matter what fancy Silicon Valley terminology you want to put on it, the company is like a gigantic used car lot in that they've got to convert tire kickers into buyers or they go out of business.

That's not happening, either. In fact, Twitter's "engagement" growth is declining, too.

Real businesses have increasing engagement numbers because customers find the products on offer worth paying for.

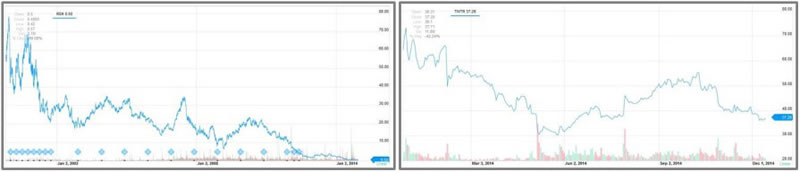

To that end, Twitter reminds me of RadioShack Corp. (NYSE: RSH).

That may surprise you because RadioShack is not a social media company. But, that's precisely my point.

During the 1980s the company was the pinnacle of what "could be" and had a large customer following based on potential it squandered. Forced to flail wildly for an identity, the company spent money like water while moving from one set of unmet objectives to the next – none of which worked and all of which alienated consumers who didn't care and who ultimately found better alternatives.

RadioShack, incidentally, trades at $0.50 today and is a shadow of itself at the $76.63 per share peak it hit in November 1999. The trajectories sure are similar (RadioShack pictured left, Twitter on the right).

Reason No. 3 – Twitter Management Is Cashing Out

Normally, a growing company not only has legions of rabid fans, but management that is totally on board, too.

But Chief Executive Officer Dick Costolo sold half his family trust's TWTR holdings in early November for a quick $11.6 million score. Ordinarily, this wouldn't concern me too much because corporate officers can have liquidity events just like anybody else can – selling a house, paying for college, funding a divorce, caring for a sick parent, and more.

In this case, though, Costolo sold after Twitter stock had already slumped following the dismal Q3 2014 earnings report in late October. That's not the move of a confident CEO who would be buying because he saw value in depressed prices.

So how far can Twitter fall?

Nobody knows for sure. I believe the company is worth $11.19 a share based on calculations including current revenue and borrowing Google's price to sales figure of 5.25 instead of the ridiculous 16.67 Twitter currently enjoys as a comp – just to be generous.

And that means shorting Twitter or buying put options that bet on a price decline may be far more profitable than betting on a recovery.

Just make sure you've got your upside covered and risk management under control. And I'll be back to talk about both of those things in an upcoming column as we head into 2015 together.

I think it's going to be a great year.

Source : http://moneymorning.com/2014/12/18/the-only-social-media-play-im-recommending-right-now/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.