Fed Signaling Future US Interest Rate Cuts - Gold to benefit

Interest-Rates / US Interest Rates Mar 09, 2007 - 12:22 AM GMTBy: Jim_Willie_CB

In a series of public messages, the US Federal Reserve has issued some statements recently which telegraph an increasingly likely official interest rate cut. These guys will cut rates, but only when kicking and screaming, since they have displayed extreme reluctance at every opportunity.

They know the damage to the US Dollar certain to follow. They speak through their usual mouthpieces, but this time with the added impact of Sir Alan Greenspan, serial bubble engineer extraordinaire. One must connect the dots, a task now routine among my methods, putting to practice the motto “think like a thief” in order to properly gauge the enemy. Why? Because the integrity of the US financial system, economic management, and leadership is as low as a snake's belly slithering in the grass.

The US Fed will not suddenly reverse course and cut rates. They do so slowly, deliberately, and usually very late in the game. They lay the groundwork for a change in monetary direction, as in hiking or cutting rates. They have yet to change their position bias, having in recent months moved to neutral, with constant banter on an inflation threat. In my opinion, their stated inflation threat is a disguised US Dollar threat. They wish not to shock the financial markets. Their stodgy and consistent poor judgment earns them the accusation and charge of incompetence. They are chronically slow in recognizing the best time to take action, to avoid economic and banking system damage, to properly manage the economy. They are the Western world Politburo, only their board members are wet behind the ears with inexperience, instead of geriatric fuddy duddy ideologue clowns. Don't get me wrong, these guys of ours are ideological clowns of a different order, that dogma being of the debt based system, the floating currency system, the financial securities supermarket wholly dependent upon a raft of falsified statistics. Increasingly the system of governance and aggregate management has been blurred with the likes of giant corporations. They have become so engrained into the management, that neither integrity nor fair market can even remotely be used to describe that system.

BERNANKE

In a speech at Stanford University on March 2nd, US Fed Chairman Ben Bernanke made a couple interesting yet telling comments. First, he assessed the globalization impact. He claimed the effects of cheaper manufactured products from Asia are offset by higher energy & commodity prices. When considered together, he sees little basis for any conclusion that globalization has reduced price inflation inside the US Economy. Agreed fully here. He went on to make a silly claim that global factors have not “materially affected the ability” of the US Fed to influence financial conditions. How absurd a notion!! Every time Asian or Mid East nations threaten to sell UST Bonds, or actually sell UST Bonds, minor shock waves hit high level financial markets, notably the currency and bond markets. Global factors obviously are more pronounced nowadays. If not for the recycle of Asian trade surpluses, the US Fed would not have to deal with an inverted Treasury yield curve. That inversion is the bane to lending institutions, and a hindrance to monetary policy. Dumb statement, Ben, earning a “C” grade at Princeton University.

It was his second comment which caught my attention, as he believes USGovt data overstates price inflation. Try not to laugh. “I still think that there is still some overstatement, and Federal Reserve estimates are, depending on the indicator, somewhere between half a percent and percentage point of overstatement on the inflation rate.” He made another citation to the substitution concept, that consumers will purchase different goods when prices rise. This concept as well as quality improvements are the cornerstones to fraudulent CPI statistics dating back to their origins during the Clinton Administration. Perhaps we are to be treated to a new CPI revision in its formula calculation? Hey Ben, check out the employment cost index cited with 4Q2006 productivity. The ECI rose by 6.6% in Q4 to ring alarm bells. The real CPI is closer to 8% than 4% in my book.

The importance of his price inflation comment should not be lost. When the Bank of Japan assisted in the revision to their CPI last summer, the 0.5% reduction in stated CPI provided the BOJ with the necessary political interference (from fraud cloud cover) to hold back on an interest rate increase. In the United States, one might conclude that Bernanke is attempting to lay the groundwork for an interest rate cut this year. He might be alarmed by the housing market as a drag on consumers, and shocked by the mortgage finance industry as a cancer on the banking sector. Last month during a Senate testimony, his only words of caution were directed at the mortgage industry, which were worth watching closely, according to his view. Gold investors should pay heed to Ben's words on price inflation being exaggerated. Of course, the CPI is 4% to 5% lower than the real world in which we live.

But Ben is stating publicly a claim that the real CPI is lower, which means the risks are removed from an official US Fed rate cut!! Gold would love such a rate cut, since it will weaken the US Dollar. The buck has been held aloft by positive bond yield differentials.

EUROPEANS HIKE INTEREST RATES

Today, the Euro Central Bank hiked rates by 25 basis points to 3.75% which is still 1.5% below the official US Fed Funds rate. Those speculators who capitalize on that yield differential have less to leverage upon, with possible unwind coming (US$ selling, euro buybacks). Another two ECB rate hikes are in the offing, according to the best & brightest oracles on the continent. Jean Claude Trichet made comments at a briefing in Frankfurt today after the ECB hike, after the bank also raised its growth and inflation forecasts for 2008. “Given the favorable economic environment, our monetary policy continues to be on the accommodative side, with the key ECB interest rates moderate.” The ECB has indicated its intention to curb inflation in the 13-nation euro region by removing “monetary accommodation” in a lift of borrowing rates to a level that no longer stimulative. The Euro zone region posted the fastest economic growth in six years in 2006, raising the perceived risk that inflation will accelerate as companies increase prices and unions demand higher wages. They think much like the Americans, who have taught them incorrectly that growth causes price inflation. In fact, excessive money growth does.

Market professionals regard Trichet is signaling they still have further to go in raising rates. The implied rate on the three-month Euribor futures contract for September rose to 4.07% from 4.03% in today's trading. That would mean another 25 basis point hike to come. Just like in the US, watchers pick apart words in language analysis. Trichet was very clear with his precise words, “I said interest rates are moderate, moderate does not mean appropriate.” The ECB has used the term “appropriate” in the past to signal that interest rates are unlikely to change any time soon.

With each ECB rate hike to come, the US Dollar. foundation of bond support will erode further. Gold will find wings. We live in a bond driven world, not fundamental driven. If currencies traded according to the trade deficits and current account deficits, then the US Dollar. never would have stabilized above DX=80 in the last two years. A run would never have been prevented by the euro currency toward 140. The yen currency never would have plunged toward 82 at the end of 2005 and the early months of 2007.

GREENSPAN

Preface any quoted comments by Sir Alan with a reminder that he urged homeowners to migrate into adjustable rate mortgages in 2003 and 2004, even mocking those who did not. This man is hailed as a genius, yet he succumbed to political and Wall Street pressure to provide ongoing endless easy money in the late 1990 decade, enough to earn a stock bubble and bust episode. He actively served as a cheerleader to create the housing bubble, arguing openly for the bond market to rally on the long maturities, enough to provide impetus and force for the housing bubble itself. He wanted to escape blame for the 2000 stock bust. His crowning errant deed was the urge into ARM mortgages in order to cut monthly costs, which transferred risk from bankers to individuals. This was blatantly aristocratic.

The current mess of mortgage defaults and foreclosures testifies to Alan's counsel being highly destructive. Alan must be shuddering as he observes the debacle in mortgage finance, his indirect creation. He must be cringing at the extreme damage to banking balance sheets. He benefits from the absent pressure to see the biased view for pubic consumption, and the absent boot licking by Congressional members too dopey to form a majority in opposition. The sad reality in the mortgage industry right now is that subprime mortgage bonds have dried up to such an extent that CIGA Rusty Bayonet is quoted to say regarding the last week of February, “I know for a fact that there was not a single buyer of subprime mortgages last week. I have a buddy who trades them and said he could not find a bidder down to 93... Essentially the subprime industry ceased to exist last week.” This is the stuff of bank crises, from liquidity seizures, which to date have been minimized and fully denied. The next phase will center on negative amortization mortgages.

After 2-1/2 years without a national bank failure, a small Pennsylvania bank went bust and collapsed in February. Little Metropolitan Savings Bank of Pittsburgh went kaput. Coast Bank of Florida is desperately trying to stave off its own bank failure.

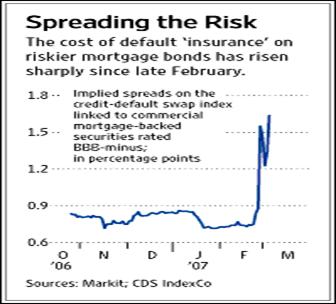

Bank failures, bank losses, and general bank distress will become a major motive for the next US Fed rate cut in a grand maneuver to assist banks reeling from the housing bear market downturn. That rate cut, and subsequent series of rate cuts, will assist gold in a major way! The current mortgage lender crisis is only beginning, as the meltdown continues and the contagion spreads. The cost of mortgage portfolio insurance is the best measure of the crisis under a magnifying glass. When the cost of default insurance stabilizes, get back to me. No way will that happen in this year, and probably next in 2008. When the cost of insurance is greater than the loss from mortgage portfolio sales, banks will sell what they can, and that means mortgage bonds !!! What the financial markets and economic analysts are missing is the severe tightening of lending practices, which will become tighter. In a land which depends upon credit like a human requires food and oxygen, this is important and should never be minimized, like it is routinely.

Now Greenspasm talks about a strong likelihood of a US Economic recession. Could it stem from credit tightness by banks under duress from mortgages? Could it stem from lender tightness inflicted upon consumers who need evermore new credit to maintain their debt burdens, elevated standard of living, and mini Ponzi schemes? Methinks yes and yes.

Sir Alan assesses a 33% chance of a US Economic recession in 2007. He pointed out the aging US Economy.“We are in the sixth year of a recovery. Imbalances can emerge as a result.” He urged tighter controls of Fannie Mae and Freddie Mac, the primary GSE centrifuges of uncontrolled debt growth. He risks a conflict with the US Fed holding its court still. His comments are at odds with those of Fed Chairman Bernanke, and highlight the internal bias. Ben does share one of Alan's concerns, that GSE portfolios “represent a potentially significant source of systemic risk” and should really focus entirely on low-cost housing.

Why do market and industry watchers care what a sitting Fed Chairman says, when the bias is obvious? Greenspan no longer is employed at the US Fed, and can speak more freely and without pressure to paint a rosy picture. His comments roiled stock markets globally in the wake of the Chinese sell off, triggered by broader measures taken against credit abuse.

FED GOVERNORS

One cannot comment on communications without touching upon abuses of official records and disclosure. Why just last week the Board of Governors at the Federal Reserve System voted to reduce disclosure requirements in what are known as Call Reports for major shareholders and officers for member banks. Scratch your head now! They clearly desire more darkness to conceal backroom activity. My firm steadfast belief is that very broad shady dealing has been perpetrated on a regular routine rogue fashion. Are some of them enjoying sweet deals or kickbacks to assist in mortgage bond laundering? Are officers receiving secret illicit loans? Are they not required perhaps to pay them back? Will they borrow from banks in the throes of failure currently? Who knows?

Goldman Sachs has engaged in insider trading off USGovt policy, insider trading off managed index funds, and direct laundering of mortgage bonds. The proof is not here to share, but suspected. That is ok, since it is for the greater good (of GSax shareholders). Just how much did GSax profit from reducing the GSCI commodity index gasoline weighting by 6% last summer? Did they load up in short gasoline futures contracts beforehand? Would a shareholder investor lawsuit even make it into a courtroom? Methinks huge profits with certainty with front running, and no chance at all for grievances and losses redressed. The lines are horribly blurred between governance & policy makers and enforcers & regulators!

Strange practices are coming to light, which testify to pure fraud. Word came by email to me that the friend of a subscriber has worked at several home loan refinance firms, including subprimes. It is apparently a standard practice to forge documents on behalf of borrowers, without the knowledge of those borrowers. Underwriters receive a better looking application. Officers receive fatter fees. Management is very often fully aware. If forgeries are sloppy, or if officers simply are caught fat fingered, they are sacked. If not, then are rewarded. Behind every bubble is deep fraud. Such is the high price of a corrupt currency, the USDollar kept afloat by a printing press.

The people have begun to rebel. The avenue of lawsuits, especially regarding mortgages, has grown to become an avalanche. Misrepresentation by lenders to homeowners on applications, misrepresentation of packaged mortgages as collateral for bonds by lenders, retaliation for refusal to accept faulty loan packages from brokers back to lenders, these are the elements of the flood. Class action lawsuits have been filed against Novastar Financial and New Century Financial, the first of many. Isn't America still the land of lawyers and lawsuits? Yup. Where are the class action lawsuits against Goldman Sachs for manipulation and profiteering in financial markets? Nowhere! Those who file such claims might receive IRS audits.

CONCLUSION

The bank sector powers that be appear to be creating the groundwork for a cut in interest rates by the US Federal Reserve. Greenspan kibitzes with warnings of a possible recession. Bernanke claims inflation is overstated. Ben has had the mortgage finance fiasco on his radar. The USFed is setting the stage for a rate cut, and in order to justify such a reversal, they must paint a picture with some credibility. They cannot say what they really think, nor comment on what they really see. Why? Because they are leaders.

The futures market has changed its course once more. In early weeks of 2007, they totally wiped out all thoughts of a USFed rate cut. Then the bank distress emerged, then worsened, then spread enough to warrant the name CONTAGION. This crisis is unfolding much as was forecasted here, certainly not to my pleasure, but definitely to my expectation. Flagging factory orders and housing sales point to a weakening tangible economy. The Fed Funds futures contract indicates a likely rate cut by August, and another by December. GOLD WILL FIND WINGS IF & WHEN IT OCCURS ACCORDING TO THIS CHART. To make the gains greater, a rising euro currency (as they continue to hike twice more) will do serious harm to the USDollar. One should always keep in mind, the buck & gold are like a cat & dog, a termite & ant, deadly adversaries.

Last Friday David Rosenberg of Merrill Lynch reiterated his forecast for a 125 basis point cut by the end of 2007 and a 25 bpt cut in 2008. Yesterday, Goldman Sachs jumped on the same bandwagon and announced that they were forecasting the USFed to cut interest rates by 75 bpt between now and the end of the year. Gold was ambushed when it encroached upon the $700 mark. Gold will easily surpass that $700 mark when the USFed rate cuts are made clear, especially when the Euro Central Bank continues with its rate hikes.

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Copyright ©2007 Jim Willie CB

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

The golden jackass is designed to inform and instruct in the complex ways of gold, currencies, bonds, interest rates, stocks, commodities, futures, derivatives, and the world economy, with no respect shown for inept bankers and economists, whose policies and practices contribute toward the slow motion degradation, if not destruction, of the financial world ~ Jim Willie CB, aka "The Golden Jackass" www.GoldenJackass.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.