U.S. Gold Production Declined 7% During First 9 Months of 2014

Commodities / Gold and Silver 2014 Dec 18, 2014 - 11:06 AM GMTBy: Jason_Hamlin

I have long argued that gold would bottom around the all-in cost of production and this would provide price support. This is because as the price drops below the cost to produce, miners will be forced to shut down or suspend operations. This reduces supply and lower supply is supportive of prices, assuming demand remains relatively stable. We are finally starting to see signs that gold supplies are declining.

I have long argued that gold would bottom around the all-in cost of production and this would provide price support. This is because as the price drops below the cost to produce, miners will be forced to shut down or suspend operations. This reduces supply and lower supply is supportive of prices, assuming demand remains relatively stable. We are finally starting to see signs that gold supplies are declining.

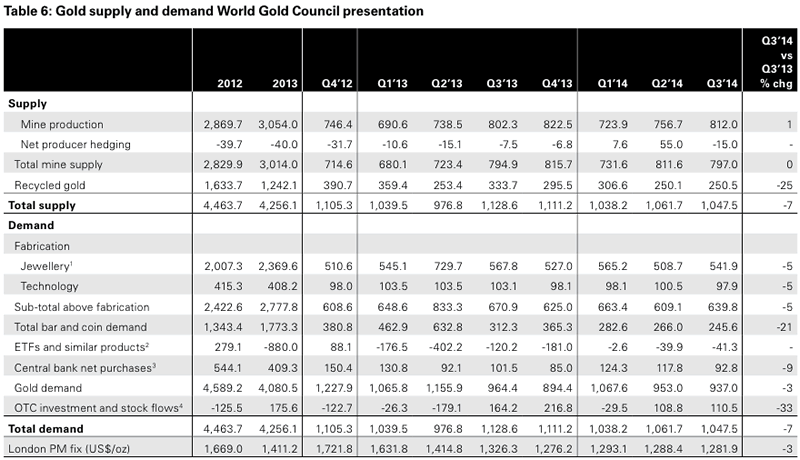

The U.S. Geological Survey has reported that U.S. gold mine production declined 7% in the first nine months of this year. This is in line with the Gold Council reporting that Q3 gold supply dropped by 7%. Gold supplies also dropped 4.6% in 2013, but the trend appears to be accelerating. Lower production from some of the largest gold miners such as Barick Gold and Newmont Mining were drivers of this decline. Lower grades and decreased mill throughput were some of the reasons cited.

A lack of new production from emerging gold mining companies is also a contributing factor. After all, with the price dropping toward the all-in cost of production for many miners, there is little or no profit margin remaining. Mines that would have come online this year were postponed and some miners that might have ramped up production more aggressively, decided there was no rush at current prices. The lack of profitability in the industry also serves to tighten up capital markets and make it more difficult for miners to fund new projects or expand existing projects.

When gold prices were pushing towards $2,000, there was a surge in recycling. Everyone was taking advantage of the record high nominal prices by turning in their jewelry, sterling utensils, old coins and anything else that could sell at their local “cash for gold” coin shop. This activity has slowed considerably over the past few years, both because people have very little left to sell and because prices are no longer as attractive. This is another reason for the declining supply in 2014.

The volume of recycled gold supplied to the market year-to-date – 807.2t – is the lowest since 2007 and 35% below the average of 1,250.6t during the peak years 2009-2012. Gold waste and scrap trade in the first 9 months of 2014 was 83% and 79% lower for trade and exports, respectively, compared with that in the first 9 months of 2013.

Unfortunately, the lower supply of gold may not immediately translate into higher prices as demand has also dropped. The World Gold Council has reported that gold demand is down 5.6% over the first 9 months of 2014, the same period for which supplies are down 7%. Although this trend may be changing, as Q3 demand was down just 2% versus the same period in 2013.

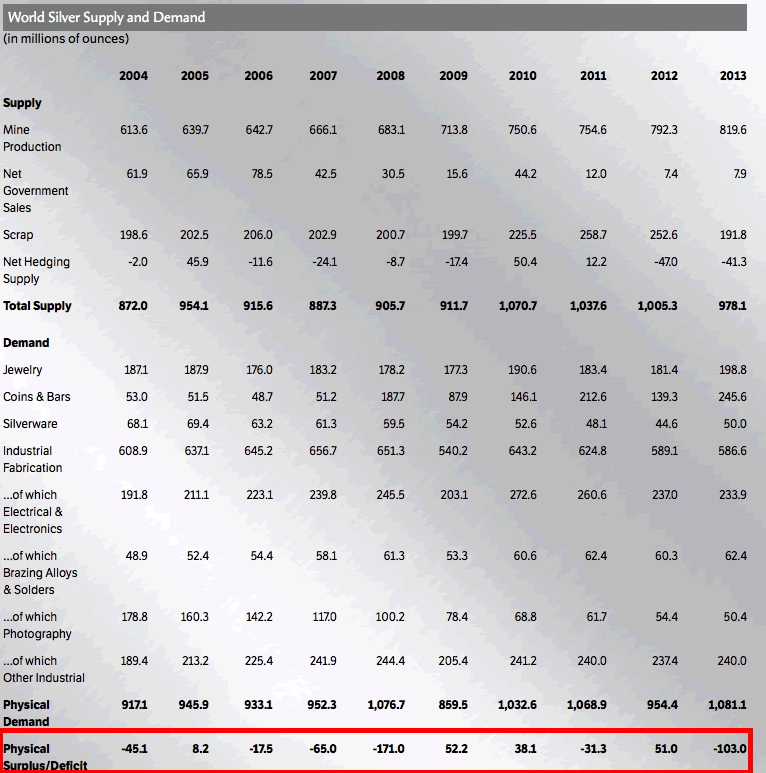

The supply and demand fundamentals for silver appear to be a bit more bullish. While supplies have dropped in the past few years, demand has actually increased according to the Silver Institute. This is consistent with the latest data from the U.S. Mint showing that Silver Eagles hit an all-time sales record during 2014. Canadian Silver Maple Leafs have also seen robust demand in 2014. In the first nine months of the year, Silver Maple Leaf sales reached a record 20.8 million compared to 20.7 million during the same period last year. Going back a few years we can see that combined sales of Silver Eagles and Silver Maple Leafs in 2014 is roughly 5 times the numbers reported in 2007.

The Silver Institute reported that in 2013 world demand was 1081 million ounces, yet supply was 978 million ounces. The supply/demand deficit of 103 million ounces was the largest since 2007 and second largest going back a decade towards the start of the silver bull market. I expect this trend will continue in 2014.

Despite the stronger supply/demand fundamentals, silver has actually lost value versus gold over the past few years. The gold/silver ratio has more than doubled since 2011 from around 35 ounces of silver to one ounce of gold to the current ratio of 72 ounces of silver to buy once ounce of gold. Silver is undervalued not only in fiat dollar terms, but also relative to gold.

The bottom line is that production is likely to continue dropping off if prices remain at or below the all-in cost of production. A large number of miners will not be able to turn a profit and will be forced to shut down or suspend operations. Lower supply is supportive of higher prices going forward, so long as demand remains strong. This increases the likelihood that we are at or near a bottom for precious metals. I like holding a mix of gold and silver, but silver is clearly the better buy at this juncture and will likely appreciate versus gold in the years ahead. This is a buying opportunity in my view and one that doesn’t come along too often.

If you would like to see which silver stocks we currently hold in the Gold Stock Bull Portfolio and get updates whenever we are buying or selling, sign up for the premium membership by clicking here.

A 3-month trial subscription is just $95 and we offer a 100% satisfaction guarantee. In addition to the portfolio and trade alerts, you will also get our monthly contrarian newsletter with fundamental and technical analysis across not only precious metals, but the energy, agriculture and technology sectors as well.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.