Opposing Forces At Play In Gold and Silver Precious Metals Complex

Commodities / Gold and Silver 2015 Dec 17, 2014 - 12:13 PM GMTBy: GoldSilverWorlds

Ronald Stoeferle writes: Precious metals had a hard time in 2014. However, this year proved to be not as catastrophic as last year, as the gold price remained in the trading range which was established last year after the waterfall price declines.

Ronald Stoeferle writes: Precious metals had a hard time in 2014. However, this year proved to be not as catastrophic as last year, as the gold price remained in the trading range which was established last year after the waterfall price declines.

The “good” news for gold bulls is that the bottom of the trading range has been tested a third time, in particular on November 10th 2014. Readers undoubtedly remember how the previous two tests took place in June 2013 and on the very last day of 2013.

So far, the price action looks encouraging when it comes to gold. On the other hand, silver and the miners have broken through major support. It is fair to say there is a mixed picture in the precious metals complex.

Gold Silver Worlds reached out to gold analyst Ronald-Peter Stoeferle, Managing Partner and fund manager at Incrementum AG in Liechtenstein, with a dozen of questions which were submitted by readers.

Precious Metals Market Weakness and Outlook

By far, the most popular question on readers’ minds was the view of Stoeferle on the recent gold price weakness, and, related to that, possible triggers which could reverse the downtrend.

Stoeferle has provided an exhaustive list of reasons for gold’s weakness in his 2013 and 2014 In Gold We Trust reports which we will not repeat in this article. The key driver is gold’s correlation with disinflation, as evidenced by the Incrementum Inflation Signal.

It is not so much the absolute rate of inflation that is relevant for the gold price, but rather the rate of change of inflation. Rising inflation rates generally mean that the environment for the gold price is positive, while falling rates of inflation (= disinflation) indicate the environment is negative. Since autumn of 2011, the trend of the PCE index is clearly declining. And the ongoing collapse in the oil price is certainly strengthening that trend.

History does not repeat itself, but it does rhyme. Interestingly, as time progresses, the similarities between the mid-cycle gold correction of 1974-1976 with the current correction are striking. At the end of the 1976 correction, pessimism towards gold was unanimous. This is an excerpt from the NYJ from 29 August 1976:

“Two years ago gold bugs ran wild as the price of gold rose nearly six times. But since cresting two years ago it has steadily declined, almost by half, putting the gold bugs in flight. The most recent advisory from a leading Wall Street firm suggests that the price will continue to drift downward, and may ultimately settle 40% below current levels… The sharply reduced rates of inflation combined with resurgence of other, more economically productive investments, such as stocks, real estate, and bank savings have combined to eliminate gold’s allure…. Although the American economy has reduced its rate of recovery, it is on a firm expansionary course.”

The gold price has definitely been suffering from the temporary return of confidence, for instance in the euro area. The spread between Italian and Spanish to German government bond yields has been declining significantly for many months and was recently at the lowest level since 2011, as evidenced by the following chart. This signals that tail risks in the euro zone have recently been priced out.

The timing of this article could not have been better. Astute readers have noticed how risk in the euro area, in particular the periphery, has been rising in the last weeks. Unsurprisingly, gold has refused to break down although it traded at $1,135 on November 10th. This really is no coincidence.

Related to disinflation, a strengthening U.S. Dollar has damaged the typical summer and autumn rally of the metals. From a longer-term perspective, the decline in the Dollar’s purchasing power versus gold is subject to long-term cycles. The current devaluation period is actually markedly more moderate than that of the 1970s. The final trend acceleration phase analogous to that of the 1970s, which is highlighted by a dotted circle, has not taken place yet.

From a monetary policy point of view, the monetary experiments currently underway resemble a walk on a knife’s edge. A low rate of inflation can be driven up by brute force through decisive central bank action. Whether the flood of liquidity that is currently put at the banking system’s disposal can really be removed in time is more than questionable. In a worst-case scenario, a loss of confidence in the currency may occur that can no longer be reversed.

So, when taking all these elements into consideration, it becomes clear that there are opposing forces at play in the precious metals complex. U.S. Dollar strength and disinflation, supported by the ongoing oil price collapse, are providing headwinds for the metals; on the other hand, a recent rise in fear in the euro area, combined with continuing loose monetary policies, result in favorable conditions.

Another popular question by our readers was Stoeferle’s short and long term outlook. Stoeferle suggests readers to monitor whether inflationary forces are prevailing over deflation. Central banks definitely want to avoid deflation at all cost. However, disinflationary forces should not be underestimated, as evidenced by the economic situation in Japan and the still undercapitalized southern European banking system. It cannot be ruled out that deflationary effects will intermittently prevail, e.g. due to another banking crisis or a government bankruptcy. However, a temporary deflationary episode similar to that of 2008, on the road to greater inflation, could well be a realistic scenario.

In the very short run, if the collapse of the price of oil continues, it has the potential to drag all commodities lower. It could even trigger a banking crisis in oil focused countries. Nobody has a crystal ball, so it is impossible to make a short term call. Readers should thoroughly monitor the strength and impact of the oil market, as well as central banks actions and announcements.

Market Interventions By Central Planners And Possible Resolutions

Another popular theme among readers is the organized effort by large banks, acting as agents for Western central banks, to suppress the price of gold. In particular, the question is how long this suppression can continue.

Stoeferle points to the fine line between intervention (governmental and political interference) and manipulation (in the negative sense of “exertion of influence”). That central banks intervene heavily in terms of bond yields (Operation Twist, quantitative easing) and currencies (Swiss franc, Japanese yen), is official and legitimized. Free price determination is therefore a thing of the past in many areas.

It is obvious that a rising gold price signals a decline in confidence in the financial and monetary system. Neither central banks nor governments have an interest in that. Consequently, incentives for “price management” clearly exist and are plausible. It would therefore be naïve to rule out that there is intervention in the gold market.

Allegations of manipulation have always been categorized as conspiracy theories. However, quite a bit of sound evidence has emerged in recent years that clearly suggests a suppression of gold and silver prices is being pursued. Rosa Abrantes-Metz, professor at New York University, has presented a study together with Albert Metz, managing director at Moody’s, in which they prove that the banks involved in the London Price Fixing have been manipulating the gold price. The extent of this manipulative behavior was said to be worrisome.

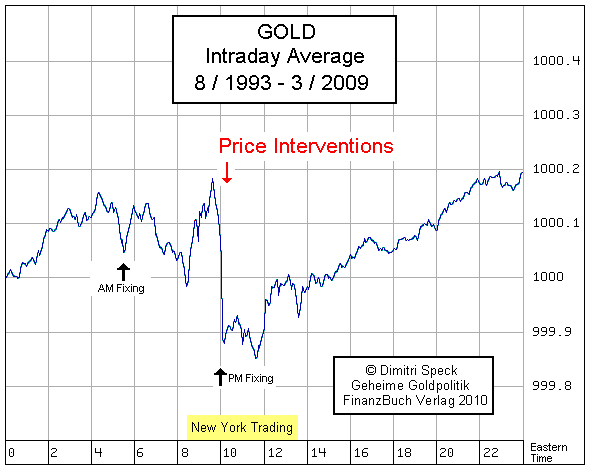

A much more comprehensive study regarding manipulation was published by author and fund manager Dimitri Speck. In his meticulously detailed work, he diagnosed with the aid of statistical methods that a new era began in the gold market on 5 August 1993. On that day, price manipulation is said to have started. The following chart shows the average daily price movement since 1993. One can clearly see that prices decline conspicuously hard and fast at the time of the afternoon fixing.

Answering the question for how long this can go is quite hard. The “powers to be” are able to control markets and situations for much longer than most of us believe. Gold market interventions, directly or indirectly, can go on for a long time, but not indefinitely. Stoeferle believes the final arbiter will be the physical market. In other words, when interventions will result in an exaggerated distortion, a physical shortage is very likely, and it will rebalance the market by driving prices (much) higher. Alternatively, would a collapse in the monetary system occur, gold could be invoked by central planners to rebalance the system.

Asian gold demand is certainly providing strong support in the physical gold market. With scrap gold and global mining production down, and Asian demand skyrocketing (think of Chinese demand combined with the recent alleviation of Indian import rules), the question is where all the physical gold is coming from? Could this trend result in a physical shortage?

It is no secret that the gold price is driven by the futures market. However, gold spot and futures are connected via arbitrage and for that reason cannot, in principle, move diametrically away from each other.

The paper gold market has grown exponentially in recent years. Originally it was created to help miners in hedging and mine developers to finance the development of mines. In the meantime the paper gold market has become one of the most leveraged markets. According to an LBMA study, total trading volume in 2011 amounted to 50 billion ounces. That is 600 times annual production. According to the study, 10.9 billion ounces of gold worth a total of 15,200 billion Dollars were traded in the first quarter of 2011. That equals 125 times annual production, or twice the entire amount of gold ever mined. 240 billion Dollars in trading volume per day amounts to more turnover than in most currency pairs.

Numerous contracts have been recently in backwardation, or close to. Simply put, backwardation means that the price of a futures contract is lower than the spot price. That, in turn, means that one can sell a physical commodity, buy a futures contract concurrently, and make a risk-free profit.

Because gold’s stock-to-flow ratio is far higher than that of wheat, gold should never trade in backwardation. In the case of gold, backwardation signals lack of confidence in future delivery of the physical metal. Since only around 0.3% of all contracts are settled physically, a sudden increase in physical settlements could lead to massive dislocations.

The Monetary System And Gold’s Monetary Role

This brings us the banking world. As one astute reader rightfully observed, the BIS (Bank of International Settlements, also known as the mother of all central banks) is the elephant in the room that not many talk about. All central banks, including Russia and China, bow to the decisions made at the BIS, including IMF’s plans for introducing SDRs. If this would be the plan, how will gold and silver do during this transition?

Before answering that question, some background is required on SDRs (special drawing rights). SDR is a currency unit introduced by the IMF, which isn’t traded on foreign exchange markets (however, rates are on IMF’s website). Currently, the units consist of 41.9% USD, 37.4% euro, 9.4% JPY and 11.3% pound sterling. Aside from the function as a currency unit, the IMF can actually issue SDRs. However, this has not yet happened to any significant extent. What isn’t widely known is that special drawing rights are already used in many places. For instance, they are employed as a unit of account in international guarantee claims, in air transport, shipping, and in the event of oil-related accidents on the high seas.

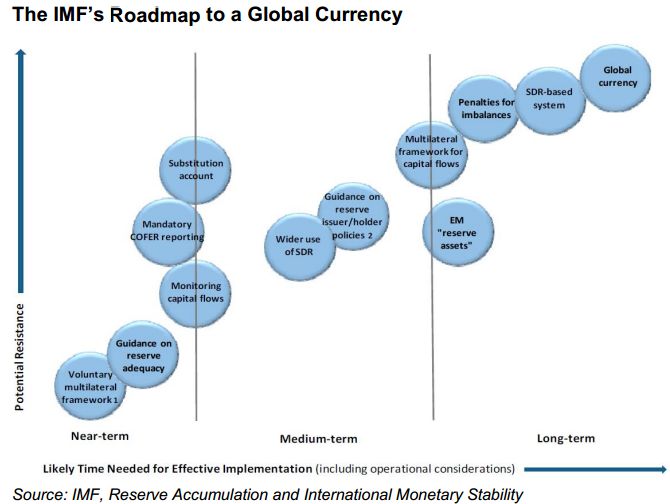

In one of its studies, the IMF makes critical remarks regarding the Dollar’s dominance and stresses the importance of SDRs. The IMF makes no bones about its ambition to replace the Dollar with SDRs. A multi-stage plan was presented in the form of a study, which discusses how to position SDRs as a global reserve currency. The IMF recommends increasing SDR liquidity by means of companies issuing bonds denominated in SDRs. Sovereign wealth funds should buy such bonds for reasons of foreign exchange diversification. The study recommends that the SDR bond market should replicate the US Treasury bond market as precisely as possible. That the establishment of a global currency is an explicit goal of the IMF can be seen in the following chart:

This leads to the conclusion that the next big crisis could lead to a realignment of the global monetary order. However, these proposals concerning the use of special drawing rights appear not very sensible from an “Austrian” perspective, as a global institutionalized fiat money cannot avoid the system-immanent problems of the debt money system as such. Special drawing rights are derivatives of derivatives, insofar it seems doubtful whether such an instrument would generate much confidence. One should nevertheless not underestimate the political will behind such proposals. An expansion of special drawing rights and the transformation of the IMF into a global central bank would not only agree with the mentality of the central economic planners in both East and West, but would from their perspective also have the advantage that governments could continue to finance various projects via a hidden inflation tax.

At the same time, there are clear signs that the Renminbi is heading toward a global trade currency, as international acceptance of the Renminbi is proceeding apace. The number of new bilateral trade and clearing agreements settled in the Renminbi with countries all over the world is being announced at an astonishing rate.

China wants to establish the renminbi as the dominant currency among emerging markets. This goal can however only be reached if its exchange value is strong and confidence in its future purchasing power is high. That is where we see a link with gold which China is clearly taking up as a key pillar in its strategy. It is Stoeferle’s assumption that China’s central bank continues to accumulate gold covertly, and that it is possible that gold-backing of the renminbi is on China’s roadmap. A gold-backed renminbi would increase its international acceptance in one fell swoop. The enormous gold reserves held by the United States were for instance – aside from its military superiority – a major reason why the US Dollar became the global reserve currency.

Another reader asked to look at the digital currencies (think of Bitcoin and the likes) and what may happen if gold and silver would have to compete with digital currencies in the globalized marketplace.

Nobel Laureate Friedreich Hayek’s book “Currency competition” has provided excellent insights in the usage of competing private currencies in the world economy. Hayek explains in his book how a competitive private market for money would function and what the benefits are compared to an arbitrary government monopoly.

The issue with the current government based monopoly in ruling “money” is that governments have abused their monopolies. In ancient times, the governing standards for weights and measures grew out of the competitive private marketplace of ideas in every culture, while the government’s function was to validate what came out of it. As time passed, governments increasingly intervened. Think of the transition of pure gold and silver coins to the mix up of base metals, which really is a primitive form of inflation. This, over time, became more intelligent as money issuance became more complex … and so did the tactics to intervene in the monetary system. The effect always remained the same: the issuers of currency transferred wealth from creditors to favor debtors, who could pay back their debts in depreciated currency.

Peter Ferrara nicely summarizes Hayek’s view: “In competitive private markets, private currency issuers would compete to maintain the value of their currencies. Those who were less reliable or effectively stole from their customers would be driven out of the market.”

According to Lietaer and Dunne, there are currently already some 4,000 unofficial, private currencies operational in the world. Think for instance of frequent flyer miles or time-backed currency. These currencies are not competing to replace the official currency, but to complement it where it is leaving available resources unused.

Such private complementary currencies have arisen to serve local economies around the globe on a regional basis. Germany and Austria are now spearheading regional currencies, generically called regios, which complement the euro. Participating local businesses, from shops to restaurants, accept the regional currency for their goods and services.

Here it becomes interesting. As Peter Ferrara writes, “the granddaddy of all private currencies is potentially the Terra. This would be a global currency explicitly backed by a basket of a dozen or so precious commodities, such as gold, silver, oil, etc. Each Terra can be turned in for the specified share of the basket of commodities, which would be held as 100% backing of the currency, under contract with producers of those commodities who are partners in the financial institution issuing the Terras. The producers would be paid in Terras for their contribution, which they could use to pay their suppliers and creditors, and their workers. Each unit of Terra currency would be charged each year a transaction fee of 3.5% to 4%, assessed against the face value of the currency, depreciating its backing by that amount. That would finance the costs of issuing and maintaining the Terra, including the costs of the storage of the reserve commodities backing the currency.”

The point is that alternative currencies, whether it is a Terra or Bitcoin or anything else, would be an inflation proof, international, global currency. No government permission is required to issue and trade in such a currency, except to the extent that someone tried to pay their taxes in the currency. Whether to accept such payments would be up to each government to decide, just like any other party transacting in the currency.

Those currencies could potentially be a major boost to global economic growth and prosperity, empowering the world economy to trade in currency not subject to inflation, devaluations, and variation in real market value. And gold could serve as an objective asset backing those up, just like it used to do in the last 3,000 years.

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.