Silver Eagle Coin Sales Very Robust - Record High For Second Consecutive Year

Commodities / Gold and Silver 2014 Dec 15, 2014 - 12:06 PM GMTBy: GoldCore

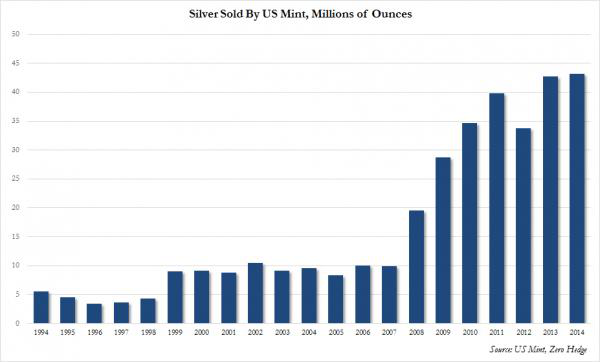

Silver bullion demand remains very robust as silver stackers continue to stack. 2014 has been another record-breaking year at the U.S. Mint which has sold 43.3 million silver eagle coins – up from 42.7 million coins last year.

Silver bullion demand remains very robust as silver stackers continue to stack. 2014 has been another record-breaking year at the U.S. Mint which has sold 43.3 million silver eagle coins – up from 42.7 million coins last year.

Record demand in 2014 was seen despite the U.S. Mint running out of Silver Eagles early last month due to very high demand throughout October. As a consequence of this lack of supply, November sales of the coins were down 40.8% according to Reuters.

Silver prices fell 36% last year and, despite obvious shortages in the supply of physical silver, they have declined a further 12.5% this year. This demonstrates the degree to which naked shorting of the market - the selling of paper contracts for gold which the seller is not actually in possession of - is determining price of the physical metal.

Silver in USD - 5 Years (Thomson Reuters)

Why is it that demand is so high for an investment whose price is falling? For one, silver is a poor man’s gold. Working people with little disposable cash who are nervous about the condition of the global economy can hedge against instability, systemic risk and currency debasement by acquiring a small allocation of silver.

One ounce of silver is currently valued at $16.87. Whereas smaller gold bullion coins such as sovereigns are currently valued at around $283. This makes silver a more attractive and realistic option for a section of people in the western world who have seen their standards of living decimated in recent years.

Clearly, record demand for silver eagles shows a high level of anxiety and indeed fear regarding their financial well-being and that of their families.

Guide to Silver Eagles here

MARKET UPDATE

Today’s AM fix was USD 1,210.75, EUR 974.53 and GBP 772.41 per ounce.

Friday’s AM fix was USD 1,223.50, EUR 984.31 and GBP 779.15 per ounce.

Spot gold fell $3.00 or 0.25% to $1,222.10 per ounce Friday and silver slipped $0.04 or 0.24% to $17.01 per ounce. Gold climbed and silver soared last week - up 2.6% and 4.4% respectively.

Silver in USD - 1 Year (Thomson Reuters)

Gold fell 0.8% today on further speculation the U.S. Federal Reserve is moving closer to raising U.S. interest rates despite a mixed economic outlook. The Fed’s meeting starts tomorrow and is from December 16-17th.

Silver for immediate delivery declined 1% to $16.8605 an ounce in London, after rising in the past two weeks. Platinum slipped 0.8% to $1,220.44 an ounce. Palladium retreated 0.4% to $812.25 an ounce.

Gold futures and options for net long positions rose for a fourth week in the period to December 9, the longest stretch of increases since July, data showed.

Gold’s 2.5% gains last week were the most in two months and came as the dollar declined and global stocks tumbled amid a drop in energy prices.

Holdings in gold-backed exchange-traded products fell 1.5 metric tons to 1,611.3 tons as of Dec. 12, data from Bloomberg shows. They reached the lowest since 2009 on December 8th.

Asian shares were lower except for shares in China which bucked the trend. The Stoxx Europe 600 Index gained 0.5% this morning, for its first gain in six days. It slumped 5.8% last week on concerns about economic growth.

Greece’s ASE Index (ASE) climbed 2% and a rally in energy shares sent European stocks higher after their biggest weekly slump in three years. Standard & Poor’s 500 Index index futures climbed 0.8% before data that may highlight U.S. industrial production rose in November. The benchmark S&P lost 3.5% last week for biggest slump since May 2012.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.