State of the Stock Market

Stock-Markets / Stock Markets 2014 Dec 11, 2014 - 03:05 PM GMTBy: David_Banister

We are seeing normal corrective declines in the broader indexes of late. December has been volatile from day one. Tax selling is obvious to me, and we are seeing extreme oversold set ups in Energy stocks. Insiders have been loading up the last few weeks yet those same stocks are still declining, and we think Hedge funds are taking on heavy losses, and selling is begetting selling.

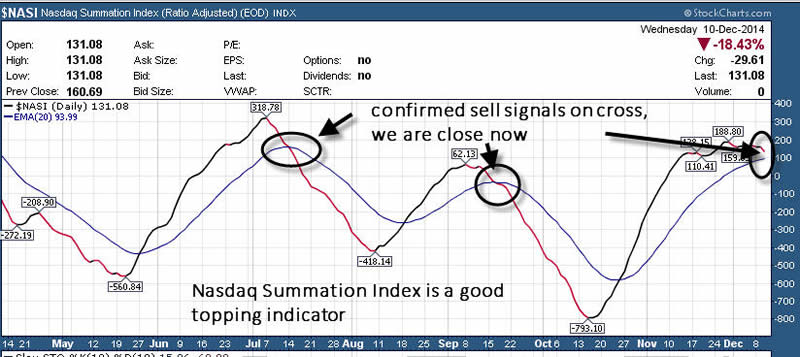

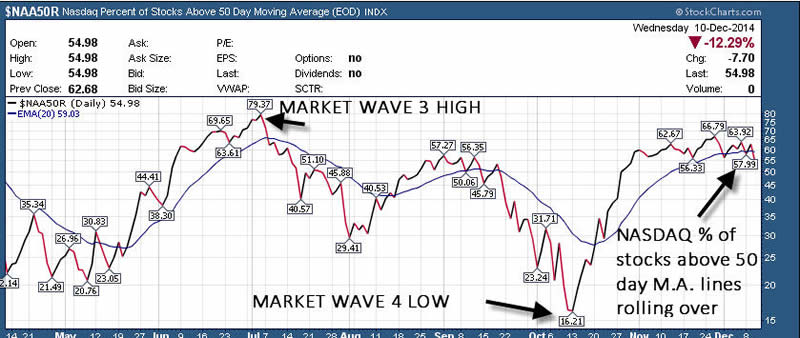

Also, the percentage of stocks above their 50 day moving averages hit the mid 60’s recently which is pretty high. Currently at 53% still and likely to fall further into year end? We also look at the NASI Summation index, and that is topping and rolling over… another topping signal. So the likelihood is we are in early stages of a wave 2 correction from 2070 SP 500 highs after a 250 point rally. Initial support is at the 1994-2000 area for starters, so let’s see if that area holds.

The DOW we want to see 17000 support, and its not just a number I made up its a key support line. NASDAQ look for initial key support at 4617 and 4457 below that.

Biotech stocks are very inflated here, though I like them and have profited. They seem like the end of season rotation to save some Portfolios and window dressing.

Looking for Energy stocks to be the January rebound winner candidates.

Need to see GOLD over 1241 on Closing basis before I start getting bullish.

Consider joining us for free weekly reports at www.markettrendforecast.com or sign up for a 33% discount on a one year subscription today

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2013 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.