Are We In Another 1990’s-Style Super Stocks Bull Market?

Stock-Markets / Stock Markets 2014 Dec 05, 2014 - 07:05 PM GMTBy: Sy_Harding

Bull markets normally last an average of 4.5 years. By that time, stocks are usually over-valued, the market is over-extended, the Fed is making plans to cool off the enthusiasm, and the bull market/ bear market cycle begins to sequence into the next bear market.

Bull markets normally last an average of 4.5 years. By that time, stocks are usually over-valued, the market is over-extended, the Fed is making plans to cool off the enthusiasm, and the bull market/ bear market cycle begins to sequence into the next bear market.

Super bull markets, those that go beyond the norm, have been once in a lifetime anomalies, driven by unusual, life-changing technological transformations. There have been two in the last 100 years.

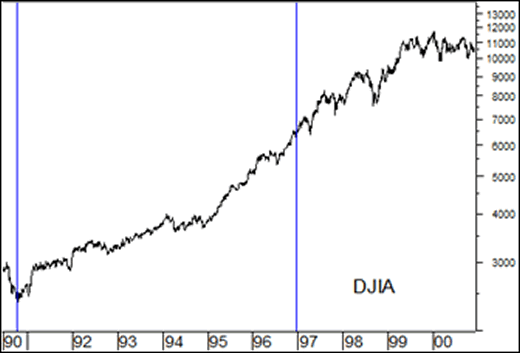

The 1920’s super bull market, fueled by the introduction of electricity into homes and factories, transforming lives, lasted a record nine years (before ending with the 1929 crash). Seventy years later, the 1990’s super bull market, fueled by the introduction of computers and automation, established a new record, lasting 9.3 years (before ending with that bubble bursting in 2000).

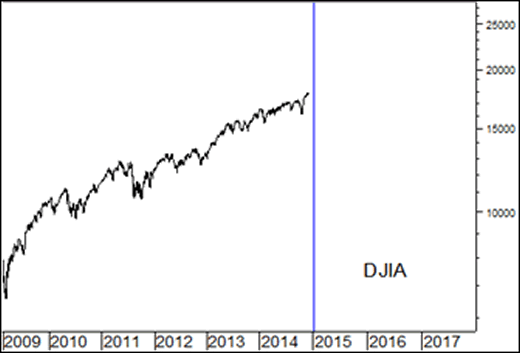

The current bull market has now lasted 5.8 years.

Is it near an end? Or as it enters its seventh year will it, as the 1990s market did in 1997, continue on to significantly higher highs? That is, did another ‘once in a lifetime’ super bull market begin in 2009, just nine years after the last one ended?

There are interesting similarities to the 1990’s bull market that support that thought.

Both periods began with high and worsening annual budget deficits, and government debt at record levels, resulting in dire forecasts for the country’s future. In both periods, an anemic economy was taking an inordinate length of time to recover from a recession. Politically, in both periods, voters elected a charismatic young president who promised changes that would produce a recovery. In their first terms, both were criticized for seeming to be more interested in social reforms than the economy. However, they were re-elected.

In their second terms, the economic recoveries began to show progress, and the budget deficits began to decline, almost unnoticed but quite dramatically.

In the 1990’s bull market, as the 7th year began, investor enthusiasm for the latest new thing, dotcom companies, began to manifest itself. Their attraction was not rising profits. Most were operating at substantial losses. Their allure was the growth in their number of users, which they would surely learn how to monetize - or so investors thought. And the bull market continued.

As we enter the 7th year of the current bull market, we have similar excitement being created by the many social media companies seemingly coming out of nowhere, hoping to follow the earlier success of Facebook and Twitter. Most are not profitable in spite of a surging number of users.

In the 1990s, the market was supposedly under the protection of the ‘Greenspan put’, confidence that the Greenspan Fed would do whatever was needed in the way of stimulus and low interest rates to prevent a market decline.

In the current bull market, much support has come from similar confidence in the ‘Bernanke Put’, which has now morphed into the ‘Yellen Put’; that the Fed will do whatever it takes to prevent a market decline.

In the late 1990’s, we had corporate insiders selling, and hedge funds, institutional investors, and others, warning that market valuation levels, investor bullishness, and other conditions were at levels indicating a significant market top was imminent. They were wrong. Small investors were right in their enthusiasm, as the market continued ever higher. (The so-called smart money eventually capitulated and joined in the enthusiasm).

Currently, we have a similar situation. Insiders have been periodically selling heavily for two years now. Hedge fund billionaires and others have been warning for some time that the market is over-valued. So far they have been wrong. Hedge funds are currently in the news for being on the wrong side of the market and underperforming for a second straight year. Meanwhile, as in the late 1990s, investor sentiment and confidence remains unperturbed, and the market keeps making new highs.

Do I believe another ‘once in a lifetime’ super bull market began in 2009, just nine years after the last one ended, and has several more years to go without a correction of the excesses?

Nothing has happened so far in the 5.8 years since 2009 to contradict the possibility.

However, be careful with that thought. The odds are much greater that normality will prevail rather than another once-in-a- lifetime ‘this time is different’ experience.

A big difference this time is that the Fed created a housing bubble and two stock market bubbles in an eight-year period, each time with devastating results for the economy when they burst. It seems determined not to allow this bull market to follow that pattern.

It has already eliminated its QE stimulus. The surprisingly strong jobs report, on top of the surprise upward revision of 3rd quarter GDP growth, will quite likely have it raising interest rates sooner than expected, and probably faster than expected if the market moves too much further toward bubble levels.

My intermediate-term technical indicators remain on a buy signal. My subscribers and I continue to take advantage of the market’s tendency to make most of its gains in its favorable winter season.

However, the market is short-term overbought, and I expect another pullback of 4 to 5% to alleviate that overbought condition before the rally resumes. Concerns that the Fed will begin to raise interest rates sooner than expected may well be the catalyst.

Beyond the intermediate-term, conditions will be quite different when this favorable season ends, if the economy continues to improve, if the bull market continues further into high valuation levels, if the Fed is beginning to raise interest rates.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.