ECB Draghi’s QE Battle With Germany; Rules Out ECB Gold Buying

Commodities / Gold and Silver 2014 Dec 05, 2014 - 02:24 PM GMTBy: GoldCore

The European Central Bank will decide early next year whether to follow the Federal Reserve, Bank of England and the Bank of Japan with quantitative easing or money creation to buy government bonds and other assets but will not buy gold, its president Mario Draghi said yesterday.

The European Central Bank will decide early next year whether to follow the Federal Reserve, Bank of England and the Bank of Japan with quantitative easing or money creation to buy government bonds and other assets but will not buy gold, its president Mario Draghi said yesterday.

Speaking in the ECB's new 1.3 billion euro headquarters, an imposing Frankfurt skyscraper designed to show the strength of the ‘single’ currency, Draghi threw down the gauntlet to Germany and signaled that he would not allow opposition from Germany or anyone else to stop the ECB’s QE.

Despite the fact that it has failed in Japan and is meeting with mixed success in the UK and U.S.

In his clearest language yet, Mario Draghi underlined his desire and commitment to debt monetisation, and argued the case for creating new money to buy assets such as government bonds. He made the comments during the question and answer period of his monthly press conference following the ECB’s monetary policy meeting.

Interestingly, Draghi ruled out the printing of money to buy gold bullion. He was asked what types of assets the ECB would buy as part of its quantitative easing program. He responded, “we discussed all assets but gold.”

Speculation arose that gold could be part of the central bank’s asset purchases after Yves Mersch, a member of the ECB executive board and former Governor of the Central Bank of Luxembourg, said on November 17 that the ECB could buy a range of assets as part of its quantitative easing program.

The fact that the ECB may soon print money to buy very risky European corporate, bank and sovereign debt from vulnerable economies such as Spain, Italy and Greece and has, from some unexplained reason, ruled out buying gold will make the Germans and others opposed to ECB QE very nervous.

This is likely leading to increasing tensions and divisions. Indeed, Die Welt reported yesterday that Draghi had lost the support of the majority of the ECB Executive Board.

Draghi’s remarks, which came within minutes of a meeting where he clashed with German officials over his ambitions, set him on a possible collision course with the euro zone's biggest and single most important country.

Painting a gloomy picture of the euro bloc's prospects, Draghi announced that the ECB expected economic output to be lower in the coming years than it had predicted three months ago, while a slump in the price of oil may lead to lower inflation.

Consumers and businesses are welcoming the fall in oil prices and lower inflation but today low inflation is seen as a trigger by central bankers including Draghi, the ex Goldman Sachs banker, to print money to buy government bonds.

Savers, people and businesses concerned about inflation throughout the world and indeed in Germany oppose this.

"QE has been shown to be effective in the United States and UK," Draghi told journalists at a press conference. He ignored the fact that the Bank of Japan’s QE appears to have failed as it has not led to a revival of the moribund Japanese economy.

However, a somewhat strident Draghi made clear that he would face down the considerable political opposition to further radical action.

Last week, Sabine Lautenschlaeger, Germany's appointee to the ECB's Executive Board, said now was not the time for state bond buying. But Draghi said there was no need for all 18 countries to agree.

Draghi lacks the crucial German support for doing full-blown QE but combatively, he said he did not need that support.

"Do we need to have unanimity to proceed on QE or can we have a majority? I think we don't need unanimity," Draghi said, delivering a strong message to Germany.

Lautenschlaeger and Jens Weidmann, the head of Germany's Bundesbank, opposed a decision on Thursday to harden up Draghi's goal of bolstering the ECB's balance sheet of assets, such as credit to banks, central bank sources told Reuters.

The ECB has set itself a goal of expanding its balance sheet -- buying assets from banks and others in return for cash it hopes will be pushed into the economy -- by up to 800 billion or even 1 trillion euros ($1.24 trillion).

New forecasts by the ECB predicted the bloc's economy would grow just 1.0 percent next year rather than the 1.6 percent predicted just three months ago.

Inflation is seen at just 0.7 percent in 2015, down from a September forecast of 1.1 percent and way below the target of just under 2 percent.

The European Court of Justice will deliver a non-binding ruling on Jan. 14 about the legality of the ECB’s OMT program, which was credited with stopping a rout in European government bonds in 2012 by pledging to buy debt of countries signing up to reforms. A negative judgment by the court could ultimately impinge on the ECB’s freedom to intervene in sovereign-debt markets.

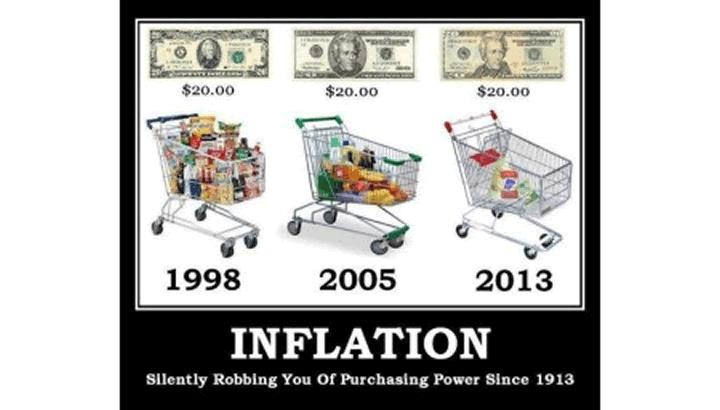

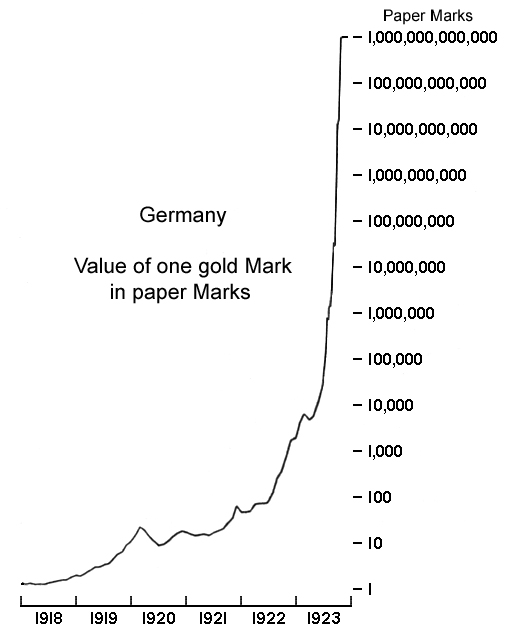

German opposition, due to their genuine and valid concerns about currency debasement, inflation and hyperinflation, nonetheless remains an obstacle.

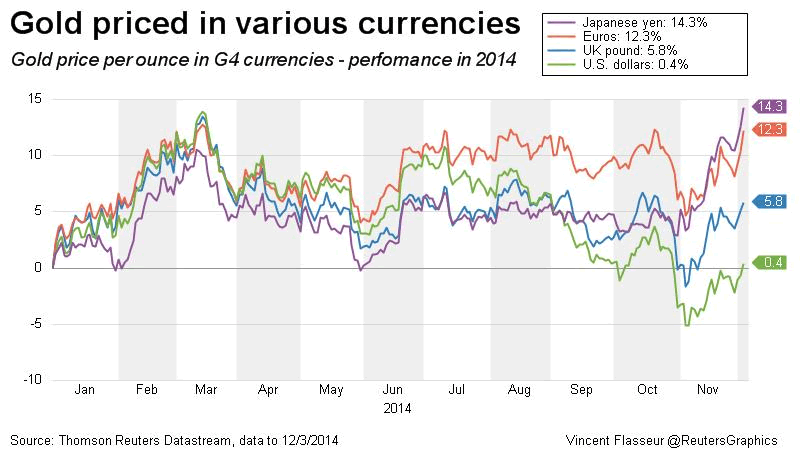

It would appear that a titanic battle is taking place in the ECB. If Draghi and the uber monetary doves win, expect euro QE and a devaluation of the euro in the coming months.

Get Breaking News and Updates On Gold Markets Here

MARKET UPDATE

Today’s AM fix was USD 1,204.50, EUR 974.28 and GBP 768.37 per ounce.

Yesterday’s AM fix was USD 1,204.00, EUR 977.59 and GBP 767.42per ounce.

Gold fell $4.20 or 0.35% to $1,206.30 per ounce yesterday. Silver climbed $0.04 or 0.24% to $16.46 per ounce.

Gold looks set for a 3% gain for the week - its biggest jump in ten months- since last February. Most of the gains were seen on Monday (see chart) when gold surged the day after the Swiss gold referendum, to have a mandatory 20% gold backing for the Swiss franc, was badly defeated.

Gold in USD - 5 Days (Thomson Reuters)

Indeed, after initial falls in Asia, gold surged over 6% from peak to trough - from below $1,150/oz to over $1,220/oz. Gold has consolidated on those gains this week.

Gold was marginally lower in London ahead of the U.S. non farm payrolls November report due at 1330 GMT. Spot gold was down 0.1% at $1,202 an ounce in late morning trading in London. Silver was off 0.1% at $16.43 an ounce. Spot platinum was up 0.2% at $1,234.96 an ounce, while spot palladium was up 0.7% at $807 an ounce.

Investors will look for guidance from the U.S. non farm payrolls number. A weaker than expected number after disappointing retail sales this week would lead to a safe haven bid. A better than expected number, would likely see traders sell positions or go short.

A reform to Venezuela's central bank law will allow the country to hold international reserves in a broader range of currencies than before as well as in diamonds and precious metals.

The bank will now also be able to hold reserves in diamonds and precious metals other than gold, which already makes up the majority of its reserves.

The change may help the OPEC nation shore up its tumbling international reserves by allowing it to include loans from China that are denominated in renminbi.

Finance Minister Rodolfo Marco this week traveled to China to discuss financing deals. Reserves last month hit an 11-year-low due to tumbling oil prices and capital flight driven by an exchange control system that heavily over values the country's bolivar currency.

Venezuela used a $4 billion loan from China to bolster reserves, though these then fell again and currently stand at roughly $21.7 billion, according to the central bank website.

Demand in China continues to be robust and premiums out of China remain steady at $1-$2.

Middle East gold demand also appears to have picked up again. Turkey's gold imports surged in November to 46.9 tonnes, a massive jump from October when the country imported 6.6 tonnes of gold bullion, data from Bourse Istanbul showed on Friday.

The country's gold imports were at 19.3 tonnes in November 2013. The Istanbul Gold Exchange released data that showed gold imports into Turkey more than doubled year on year to 46.9 tonnes in November, which registered its highest monthly imports in over six years.

Global gold demand remains robust which bodes well for gold in 2015.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.