US's Debt Not Such a Big Deal - Mr. Gold

Commodities / Gold and Silver 2014 Dec 05, 2014 - 09:36 AM GMTBy: Gary_Tanashian

Mr. Gold's last paragraph is the tell on his bias, as he is unwilling or unable to conceal the contempt he has for people who were absolutely right for 10 years+ and are now suffering a bear market, both to their asset of choice and in sound monetary thinking.

Mr. Gold's last paragraph is the tell on his bias, as he is unwilling or unable to conceal the contempt he has for people who were absolutely right for 10 years+ and are now suffering a bear market, both to their asset of choice and in sound monetary thinking.

"The vastly improved fiscal situation may last only a few years, but it's a big plus for U.S. markets and the U.S. dollar -- and another nail in the coffin for the gold bugs and doom-and-gloomers who can add one more item to the long list of things they got really, really wrong."

Why the US's Debt is No Longer Such a Big Deal - Howard Gold writing at MarketWatch

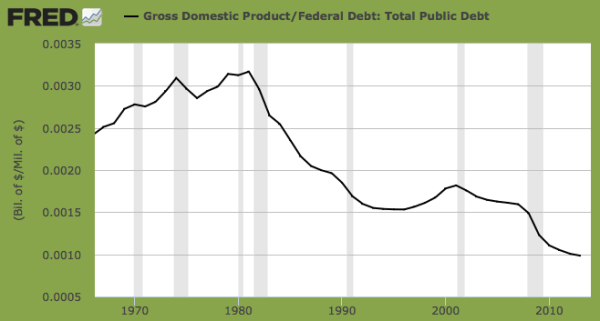

Before we find out about Howard's thoughts on the debt situation (I am only going by the headline right now) let's divide the GDP by the Federal Debt. This is a view of a deluded nation going right down a sink hole in service to greed and denial.

Now let's see what Mr. Gold (not the discredited and now strangely silent 'gold bug' Mr. Gold) has to say in regard to "the US debt is no longer such a big deal".

Shhh! Don't tell anyone, but over the past couple of years, the U.S.'s debt burden, the big issue that swept Tea Party-led Republicans into control of the House of Representatives in 2010, has quietly improved.

Obligatory political baiting opens the article. Politics and financial markets never mix. Major political parties argue over certain details as favors their constituencies, but they are the two heads on the same freakish animal.

According to the Congressional Budget Office, the federal budget deficit was $506 billion for fiscal 2014, which ended in October. That's about a third the size of the deficit in 2009, in the depths of the Great Recession.

According to the CBO, eh? Okay then, facts are facts. The deficit is improving.

And although federal debt held by the public should reach 74% of GDP this year -- the highest percentage since 1950 -- the CBO projects it, too, will remain steady for the rest of the decade.

Ha ha ha... Howard, the CBO projects debt-to-GDP will remain steady for the next decade? Well, why worry then? The Congressional Budget Office has made a projection... based on what exactly?

The big improvement in the federal debt should be a boon to the U.S., which has been a magnet for global capital over the last couple of years.

What big improvement? Look, I know you sell newsletters with a premise of long America with a side of anti gold bug rants, but what big improvement, the one in your own mind? Sorry, but we live in the real world, not in your mind.

Global capital is magnetized to the US because the reserve currency, the US dollar is the beneficiary of a cessation of QE as other nations are just ramping up similar operations. It's a cyclical thing Howard. There is no big improvement in the Federal debt; you yourself just said so. There is an improvement in the budget deficit, not the Federal debt. WTF are you talking about?

Still, if we don't address long-term obligations like Social Security and Medicare, the decade of the 2010s may turn out to be a quiet respite before the retirement of millions of Baby Boomers puts us back in the fiscal soup.

To add a tone of gravity to the piece Howard adds some things for us to be concerned about. Can't have it be 100% fluff after all.

But for now, the improvement is impressive even to economist A. Gary Shilling, one of the few to warn about a housing bubble and impending debt storm long before the financial crisis hit.

"The federal government is recovering faster than the household sector," he told me, mainly because of the economic rebound.

"You've had stronger tax collections, especially in the corporate area," he explained. "When you've had any kind of economic growth, you really have a big jump in tax revenues. Economic growth covers a multitude of sins, and a lack of growth exposes them."

Out trots the big gun, Gary Shilling, whose simply giddy views we parsed on July 31: Is Gary Shilling? Ooooh, it's Gary Shilling; a straight shooter who'll call it bearish if need be. A perfect point of reference for a perma-bull selling a bright and sunny viewpoint.

Meanwhile, state and local governments have cut more than 600,000 jobs, which along with higher tax revenues have markedly improved the fiscal condition of even big spending states like New York and California.

That is good.

Unfortunately, Shilling told me, U.S. households are recovering much more slowly.

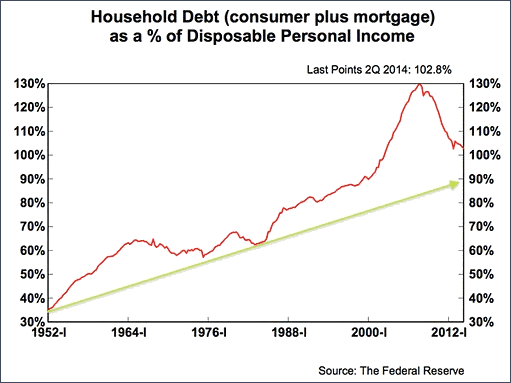

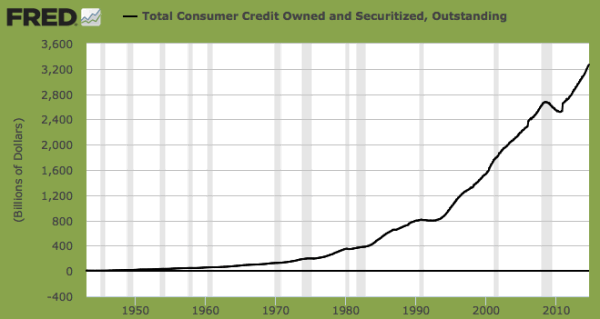

Because of the housing and credit bubbles, total household debt (including car loans, credit cards, student loans and home mortgages) doubled from 65% of disposable personal income (DPI) in 1980 to a mind-boggling 130% in 2007. (The chart below was provided by A. Gary Shilling & Co.)

Okay, so 103% is not so mind boggling? I added the arrow to your (actually the Fed's) chart. Looks like we're just recovering back to trend... which is up.

Similarly, the savings rate dropped from 12% of DPI to a minuscule 2% in 2005. Who needed to save money when you could refinance your mortgage and spend your home equity?

The savings rate is up to 5%, and total household debt has fallen to 103% of DPI, Shilling said. Usually it takes a decade for consumers to work off the debt they racked up during a boom.

So we are extrapolating today's metrics into the future, to complete the typical 10 year recovery in the consumers' collective balance sheet. Okay, I get it. Steady as she goes.

But now, he said, "you've been at this process for six years. At this rate, it would take a lot longer than four years to complete. ... It's a long way from where I think it's going."

Consumers' deleveraging and stagnant middle-class incomes have depressed consumer spending for all but the affluent. "You no longer have the consumer spending like a drunken sailor," said Shilling.

No, he's just spending like a sailor who's still on his first bottle of rum. The improvement as a percentage of income all the way down to 103% makes an assumption of continued economic strength and hence the 'jobs' recovery.

Here's the thing Howard. This particular gold bug who's writing up this wise guy rebuttal to your Bug-baiting puff piece caught the ramp up in the Semiconductor equipment sector (as noted at the time in NFTRH), projected coming strength in manufacturing and by extension 'jobs'. We also noted that this was most definitely not a positive fundamental backdrop for gold.

Enter you and your kind, who have held court ever since admonishing the lowly gold bug for his utopian desire for more honesty (and less debt) in the system. This brings us right up to the current moment, when you are allowed to write articles like the above at a major financial media outlet, servicing (read into that word as you will) a trend following public.

Taking it back full circle, and in consideration of the QE3 exit and stronger US dollar, which we also projected before the herd got the story, we are now watching for what is ahead, not lazily extrapolating current trends. Here Howard, I'll give you one such item to watch so that this time you may see (as opposed to react to and tout) future trends.

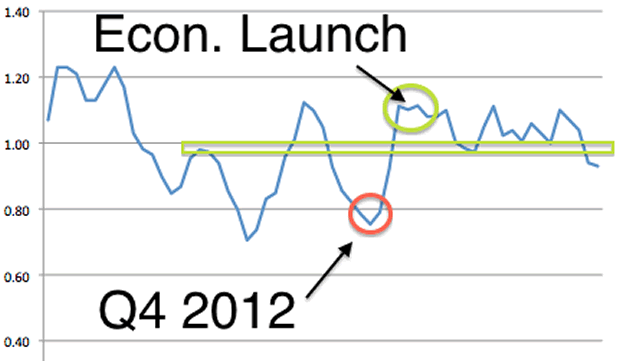

The Semiconductor equipment ramp up (and associated book-to-bill ratio) launched our view that US manufacturing would strengthen nearly 2 years ago. Today, based on the data I compiled (and graphed) from Semi.org, we have a different signal that could be gathering itself.

Of course, tomorrow is 'jobs' day and it could well be strong because even if the Semi's do go on to project a coming easing in manufacturing, these things do not filter down in real time, especially in what is still a heavily consumer driven economy.

But articles like the above are little more than rationalizations for the current trend. Perfect for mainstream media, and nearly useless for anyone looking ahead (CBO projections aside). To be sure, the trend is Howard's friend right now and writers like him use the power of that trend to full effect while it's at their back.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.