Princes of the Yen: Central Banks and the Transformation of an Economy

Politics / Central Banks Dec 03, 2014 - 03:58 PM GMTBy: Jesse

"Central banks have the power to create economic, political and social change. This is how they do it."

"Central banks have the power to create economic, political and social change. This is how they do it."

While I cringed at some of the early parts of the film and the mid-century American attitudes towards the Japanese, even if it was in the aftermath of a long and viciously fought war, I think this documentary provides some valuable insights into the evolution of the modern economy that is Japan. I direct your attention to the things that we are often saying about different peoples today.

I struggle very hard not to judge other periods, cultures, and people with a righteous and twice removed temporal prejudice, enhanced by distance and hindsight. And I believe such liberality might serve us well, given that we will most likely appear like blundering, hapless baboons to our great grandchildren some day. What were they thinking!?

As a general observation based on experience, people everywhere are just people. Unless you are wearing the goggles of ignorance, fear, and hatred. And wicked men in business and government often encourage that sort of thing for their own ends. But, in the end, the madness serves only itself.

But some cultures do tend to encourage and reward certain traits of personality and behavior more than others. This has deep roots in their cultural, social, and religious heritage. So the same economic conditions in two different cultures might provide two very different outcomes.

I recall explaining some of this to a professor from England whom we had in business school. He could not quite understand how some of the things that were happening in Japan (Japan Inc. as it was known then) that ought not to be occurring in a two party system. The answer of course was that Japan at that time, in the early 1990's, was essentially a single party system with heavy ties to an embedded bureaucracy in partnership with corporate cartels. And Richard Werner does a fairly good job at describing the evolution and nature of that system.

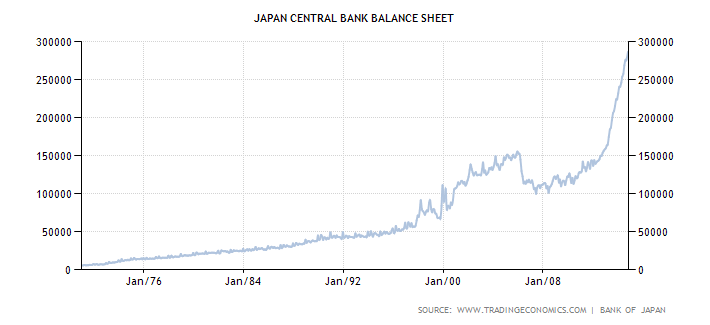

I think this structure helps to explain the long economic stagnation in Japan that puzzles so many, and has the Keynesians so befuddled. They have never met any stimulus that they didn't like, even when it was being poured into and abused by a corrupt and inefficient system.

Rather than being naturally more successful at its financial engineering, as fellows like Bernanke have snarkily suggested in their American exceptionalism, I think it is becoming painfully obvious that the US is 'turning Japanese' in its serial policy errors propagated by an insular, ruling elite and the moneyed interests with their political power.

Speaking of financial engineering, Professor Richard Werner has been a long time economic advisor to Japan, and coined the term quantitative easing for his recommendations to them.

Japan, and the 'Asian tigers' as well, were mercantilist in their outlook and crony capitalist in their composition. The enormous amounts of monetary stimulus were dissipated in supporting zombie corporations, a ruling elite, unproductive investments, and widespread soft corruption and insider dealing.

To engage in 'free trade agreements' under these circumstances with other command and control economies is foolish, especially when it puts domestic labor, social services, and the environment at par. Especially when such processes are disguised under layers of complex rules and commissions, and easily manipulated by global corporations. These are the bonds of global repression of the common people by concentrated power.

It rips the heart out of local autonomy and democracy under the banner of 'competitiveness.' It is corrosive of precious freedoms, and tramples the Constitution. But money has helped to ease the consciences of Western politicians.

Even moreso, can there be any doubt that the US, rather than helping to provide a positive example of a different way to Asia, inculcating freedom through its success of democratic and free markets, is in fact falling into the same model, a kind of a lowest common denominator of inverted totalitarianism under the standard of globalization.

I would like to think that Chalmers Johnson would most likely agree that if the Bank of Japan's economists are indeed the 'princes of the yen,' this is because they are now and have long been liege lords in the Empire of the American Dollar and the Anglo-American banking cartel.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.