Bitcoin Price Strong Move Around the Corner?

Currencies / Bitcoin Dec 03, 2014 - 08:58 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Tim Draper, the venture capitalist who bought almost 30,000 bitcoins off the U.S. government during the auction of the coins seized from the black market Silk Road, has shared what made him believe in the cryptocurrency, we read on the Wall Street Journal website:

One event that inspired venture capitalist Tim Draper to amass a huge stash of bitcoin was the same one that turned other investors away.

(...)

Continued bitcoin use by merchants and others after investors lost money in Mt. Gox "made me realize that there is a need for this," Mr. Draper said in a recent interview. "It is so important to people that they were willing to put up with that."

(...)

In an interview, Mr. Draper shrugs off the recent drop in bitcoin prices. He has recently predicted that the price will rise to $10,000 in three years.

"I am looking at this as a great long-term opportunity," he says, adding that he checks the price only every two or three weeks.

$10,000 seems a little far-fetched but looking at Bitcoin as a long-term opportunity possibly isn't. So, while we're definitely not sure that Bitcoin could go as far as Draper thinks, but it definitely seems to have long-term potential.

This might have been proved by the fact that the whole Bitcoin market didn't break down following the Mt. Gox collapse, as Draper mentioned. The cause for concern is obviously the slump from the January top. It doesn't mean, however, that Bitcoin has to go down all the time. We'll be looking for new developments in the market.

For now, let's take a look at the charts.

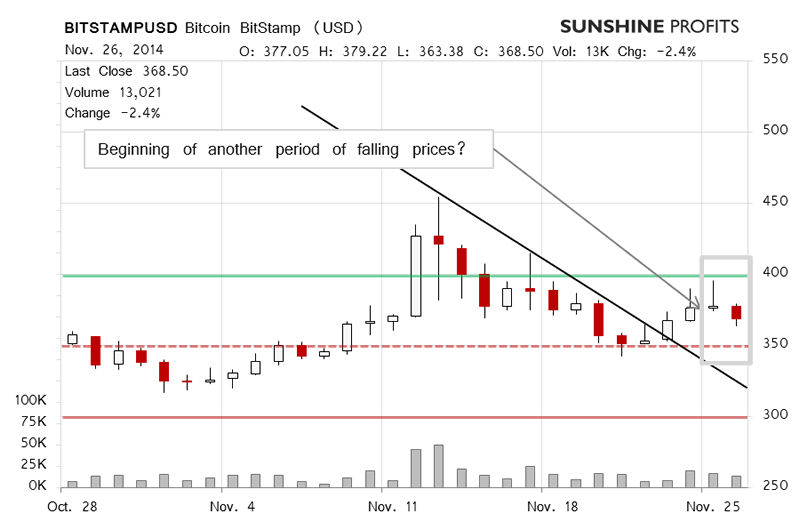

On BitStamp, we saw Bitcoin go slightly lower on increased volume but the trading was not heavy enough to view this as an important development. Just as we see on the chart, Bicoin is now in the $350-400 range and we haven't really seen any really significant action in the market. But does this "boredom" mean that a strong move is just around the corner?

Today, Bitcoin has appreciated (this is written after 9:00 a.m. ET) but the movement hasn't been really strong, neither in terms of price, nor volume. This is pretty much in line with the environment we described yesterday:

(...) we've seen Bitcoin move up and down but not decisively. The currency is still below $380 and there has been no indication of a stronger move in either direction. Can such an environment be interesting in any way for traders?

It might, particularly since there hasn't been a strong move up. Right now, the levels to observe are $350 and $400. A move above $400 (solid green line in the chart) could herald a new rally. On the other hand, a breakdown below $350 (dashed red line) might be an indication of a move down to $300 or even lower.

At the moment, taking into account that we saw a move to $400 and the move faded out with volume falling might suggest that there is more weakness in the market.

As it is, it seems that the lack of action, or the weak move up on weak volume if you will, might be a sign that there is not enough buying power in the market and this might mean that more declines might come.

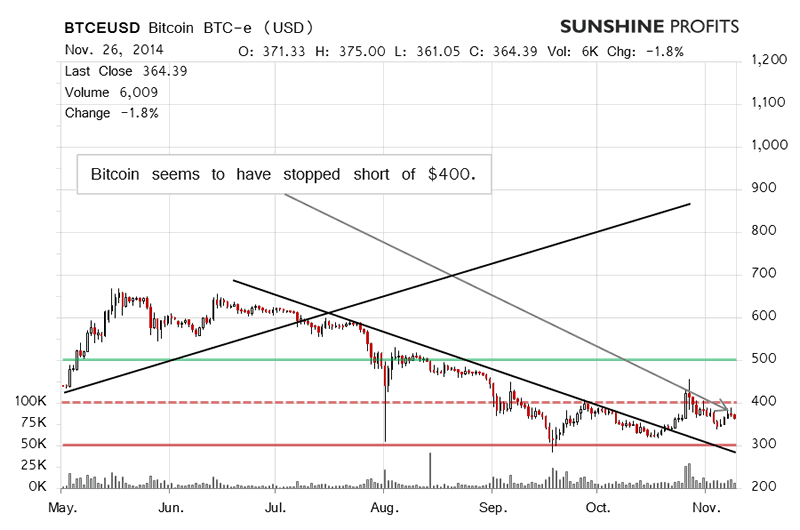

On the long-term BTC-e chart, we're seeing some of the recent appreciation but it definitely doesn't look to strong since the move has been shallow and the volume relatively low. This shows that our yesterday's comments are still very much up to date:

(...) Bitcoin has gone up slightly in the last couple of days, [but] we are still inclined to view the current developments as not supported by volume and not necessarily indicative of a bullish outlook. Consequently, we still prefer to see some clarification before suggesting any hypothetical positions.

This also shows that the fact that we're getting close to $400 (dashed red line in the chart) might suggest another stronger move. If Bitcoin breaks above this level, we might see a surge but currently we prefer to wait on the sidelines before suggesting any short-term positions.

Summing up, we don't support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.