Is Bitcoin the Future?

Currencies / Bitcoin Dec 01, 2014 - 05:03 PM GMTBy: John_Mauldin

Bitcoin is a topic of discussion almost everywhere I go. My introduction to Bitcoin came when I was speaking at a gold conference in Palm Springs and three bright-eyed, bushy-tailed college students approached me with a video camera and asked for my thoughts on Bitcoin. Noting my confusion, they began to evangelistically espouse the virtues of Bitcoin and tell me how it would save us from the evils of the Federal Reserve. I kept from rolling my eyes (you do want to encourage passion in the young) and mentioned a meeting that I had to go to – at that very moment as it turned out.

Bitcoin is a topic of discussion almost everywhere I go. My introduction to Bitcoin came when I was speaking at a gold conference in Palm Springs and three bright-eyed, bushy-tailed college students approached me with a video camera and asked for my thoughts on Bitcoin. Noting my confusion, they began to evangelistically espouse the virtues of Bitcoin and tell me how it would save us from the evils of the Federal Reserve. I kept from rolling my eyes (you do want to encourage passion in the young) and mentioned a meeting that I had to go to – at that very moment as it turned out.

Since that time Worth Wray and I and our entire team at Mauldin Economics have done a great deal of research on Bitcoin. We will soon release a video documentary that is one of the best productions I’ve ever been involved with and that does a good job of explaining both the controversy around Bitcoin and its considerable promise. We talked with skeptics, enthusiasts, and people willing to put up tens of millions of dollars betting on the future of Bitcoin.

Worth Wray has written this week’s letter as a summary of what we know about Bitcoin. Delving into its history and bringing us up to date, he also offers a glimpse of the future. At the end of the letter I offer a few of my own thoughts on the relationships among gold, fiat money, Bitcoin, and financial transactions.

If nothing else, Bitcoin offers a provocative way to think of the future of money. Now let me turn it over to Worth.

Is Bitcoin the Future?

By Worth Wray

“Growth demands a temporary surrender of security.”

– Gail Sheehy

“When people write the history of this thing, of bitcoin, they are not going to write the story of 6 million to a billion. What is truly remarkable is the story of zero to 6 million. It has already happened! And we’re not paying attention! That’s incredible. That’s what had one chance in a million, and it already happened.”

– Wences Casares, Founder & CEO of Xapo

“[Virtual currencies] may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”

– Ben Bernanke, Chairman of the Federal Reserve, USA

Before I teamed up with John Mauldin in July 2013, I worked as the portfolio strategist for an $18-billion money manager in Houston that, among its other businesses, co-managed (with an elite team of investors from the university endowment world) one of the largest registered funds of funds in the United States.

I had a front-row seat for every investment decision in a multi-billion-dollar portfolio for almost five years, and for a bright-eyed kid from South Louisiana it was a life-changing experience that no graduate school in the world could have offered… an opportunity to learn from some of the most experienced minds in finance and hone the skills I would need to identify disruptive macro trends and build more balanced portfolios with those forces in mind.

That opportunity to learn, not just about investments but also how to think about emerging trends, continues to inform everything I do today; and Morgan Creek Capital Management’s Mark Yusko – a man who has built his career on incorporating investment talent and macro themes into highly diversified portfolios – continues to be one of my most important teachers.

In the course of his daily business (which involves bouncing around the world searching for new ideas and world-class talent), Yusko has evolved a rule for vetting new ideas:

If I hear something once, I remember it. If I hear it twice, I write it down. If I hear it three times, I do something about it.

It sounds simple, as the most valuable investment insights usually are; but Mark is not just talking about “new” ideas that appear on the front page of the New York Times or the opening segment of CNBC’s Squawk Box. He’s saying that in the course of tapping into a large pool of truly world-class thinkers – who range from hedge fund legends like Julian Robertson and Stanley Druckenmiller to venture capitalists like David Hornik and Marc Andreesson – it pays to pay attention.

Innovative ideas can grow into consensus views and missed investment opportunities before our very eyes in a world awash with information. With constant access to the web through our computers, tablets, and smart phones, it’s easy for investors to filter out valuable information in an effort to cut through all the noise; but even still, it’s possible to catch emerging trends early enough in their life cycles by holding to a homework rule: When an idea comes up over and over again – especially when it’s validated by experienced investors who command and influence vast sums of capital – it’s not necessarily time to buy, but it’s time to do your homework.

And when it comes to Bitcoin, I should have done my homework earlier.

Thank goodness it’s still early…

Bitcoin is a peer-to-peer digital currency that trades on public exchanges and can be instantly transferred between any two people anywhere in the world with the speed of an email… and at FAR lower cost than for transactions processed through the traditional financial system.

While a lot of people have experimented with digital currencies in the internet age, Bitcoin’s mysterious creator, “Satoshi Nakamoto,” was the first person to solve the issue of “double spending” in a completely decentralized network, meaning that all transactions are made directly between parties, with no middlemen, yet in a way that is verifiable across the entire network and virtually impossible to counterfeit.

Much like the internet itself, the Bitcoin hive is essentially a distributed network of computers and people that are relying on a common technological process – the Bitcoin protocol – to confirm and validate every transaction made, using a unit of account called a “bitcoin” that can be broken down into fractions, thereby enabling previously impossible micro-transactions.

The genius behind the Bitcoin protocol is an element of the system called the “blockchain” – essentially a giant, globally shared ledger of every bitcoin and every transaction in the history of the network. Whenever two people follow through with a transaction, it is broadcast throughout the entire network, and the blockchain expands as that exchange is automatically lumped together with other transactions in a new “block.”

While it requires a MASSIVE amount of computing power to verify, confirm, and record every transaction that occurs within the network, it’s basically a self-funding system.

Bitcoins are created through a process called “mining,” which happens to be the same mathematical process that seals blocks of new transactions onto the blockchain by verifying that every exchange is valid and using real bitcoins. By rewarding “miners” with new bitcoin for devoting their time and computing power to maintenance of the blockchain, the Bitcoin protocol provides the incentive for the network to continue running in a completely decentralized manner.

In the early days, the mining process could be competitively and profitably run from a series of graphics cards linked to a home computer, but in recent years bitcoin mining has become a BIG business. Today, a lot of the mining is done on massive server farms in places like Iceland, where temperatures are cool and power is cheap.

There is an upper limit of 21 million bitcoins that can ever be minted, and the protocol is designed to release a “reward” of a new bitcoin every 10 minutes until every unit of the digital currency has been created. As of today, roughly 13.5 million bitcoins have been mined, with roughly 7.5 million to go.

Source: Coinbase

On paper, Bitcoin is an elegant and efficient way to streamline a global payments system; but in practice, the web of businesses and support structures around the Bitcoin protocol must pass a wide range of tests, from storage security and compliance to the creation of tradable derivatives and merchant adoption, before any kind of digital revolution can begin.

That said, Bitcoin – or something like it – has the potential to do for finance what the internet has done for communications and commerce… and we’re already six years into the process.

When I heard about Bitcoin for the first time, I dismissed it almost immediately. It seemed like a half-baked scheme cooked up by a bunch of technically skilled but financially naïve computer nerds to disrupt a global financial system that none of them really understood.

Early adopters espoused ideas about freeing the individual from the tyranny of a government-controlled money supply; but in order to pull off their grand vision, Bitcoin’s programming forefathers had to convince enough people to put their trust in the system – without governments shutting them down in the process. It seemed unlikely.

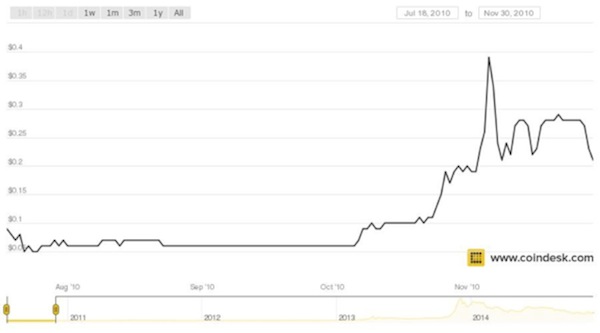

In the early days – 2009 and 2010 – a single bitcoin traded for pennies… – but its value was basically unknowable. The digital currency had virtually no daily trading volume; its price swung around wildly (volatility that only became more pronounced over time); and aside from experimental transactions within a small online community, it was virtually useless as a reliable unit of account or medium of exchange.

Internet legend has it that the first real-world Bitcoin transaction was a long-distance arrangement made on May 18, 2010, between an American programmer named Laszlo Hanyecz and a fellow enthusiast he met on the Bitcoin Talk forum. Apparently, Hanyecz offered to pay 10,000 bitcoins to anyone willing to buy him pizza, and an Englishman took him up on the offer… making an international phone call to a Papa John’s in Jacksonville, Florida, in exchange for roughly $25 in bitcoins at the then-current exchange rate.

I can’t help but wonder if that Englishman turned around and spent his 10,000 bitcoins or saved them for a rainy day. At today’s US dollar exchange rate, they would be worth nearly $3.8 million.

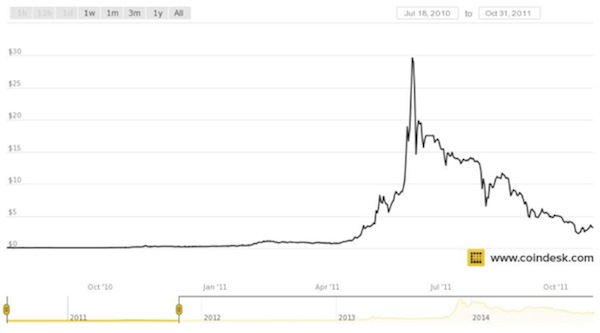

The second time I heard about Bitcoin (about a year later), it sounded a lot more interesting as a medium of exchange; but it seemed imminently doomed by regulation. The virtual currency had risen from a price around of $0.0025 the day of Laszlo Hanyecz’s pizza purchase to nearly $30 in early 2011 as Bitcoin became the basis for real-world transactions within the Bitcoin community… and the preferred medium of exchange for nefarious activities on the web.

Following the embarrassing release of US diplomatic cables to the general public in late 2010, the US government organized a financial blockade against the hacker/whistleblower Julian Assange and his nonprofit firm WikiLeaks. When Bank of America, Visa, Mastercard, PayPal, and Western Union refused to transmit donations to WikiLeaks, the nonprofit started accepting donations in Bitcoin.

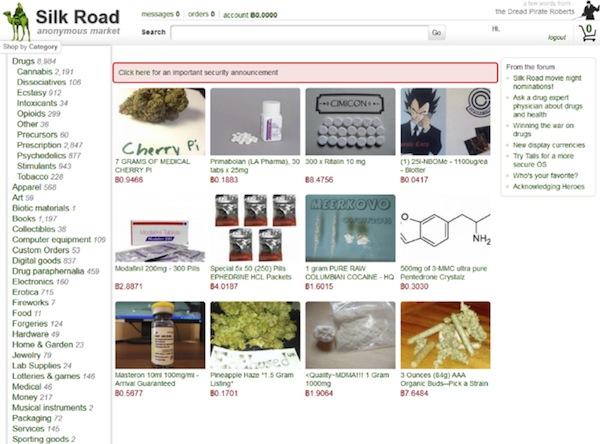

As the price of Bitcoin began to rise, it saw another big uptick in volume when an online black market named Silk Road launched in early 2011, enabling the sale of illicit drugs and forged IDs exclusively in exchange for Bitcoin.

Business boomed, and the Bitcoin community expanded from computer nerds to mischievous hackers and anonymous drug dealers who wished to skirt the financial system and/or the eyes of the law. And for the libertarians and anarchists who embraced Bitcoin as an anti-QE investment at this stage, it essentially became an enlightened bet against corrupt governments.

Within a few months the price of Bitcoin surged to nearly $30… and then Mt. Gox, the most popular Bitcoin exchange, was hacked and trading suspended for several days in June 2011.

In the following months the price collapsed by roughly 90% to less than $3, but that was not the end of Bitcoin.

“Naturally there were teething issues,” my friend Grant Williams explained in his April 2013 letter, “Bit Happens,” “exchanges were hacked and wallets full of bitcoins stolen after being left unprotected on users’ computers; and [there was] much bad press… but slowly and steadily the marketplace weathered the growing pains and, as more and more merchants began accepting payment in bitcoins, the community broadened into something more than just a weird underground movement.”

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.