SPX Gaps Down, Crude Oil Price Continues to Slide

Stock-Markets / Financial Markets 2014 Dec 01, 2014 - 01:27 PM GMT Good Morning!

Good Morning!

As indicated on Friday, the SPX Premarket has declined beneath both the lower trendline of its Ending Diagonal formation and the upper trendline of the Orthodox Broadening Top. It appears to have bounced off Short-term support at 2052.12 and remains between its new support and resistance lines.

ZeroHedge reports, “Another day full of global macroeconomic disappointments is certain to send the S&P500 to all time-higherest records as 100,000 or so E-mini contracts exchange hands between central banks and Citadel's algos.

It started with the shocking NRF announcement that US holiday sales cratered 11% over the extended Thanksgiving weekend (which the NRF blamed on an "improving economy", to which even Goebbels bows down his head), but also China's latest manufacturing print miss expectations for the 2nd month in a row and drop to 8 month low, and moments thereafter, Eurozone releasing a downward revision to its October PMI data, with the all-important German PMI now openly in contraction, revised down from 50.0 to 49.5. And the punchline: the basket case that is Japan was finally downgraded by Moody's to A1 from Aa3 by Moody’s which sent the USDJPY first to a new 7-year high at 119.14, only for USD/JPY to fall to new session low at 118.08 as everyone now realizes the Japanese endgame is just around the corner.”

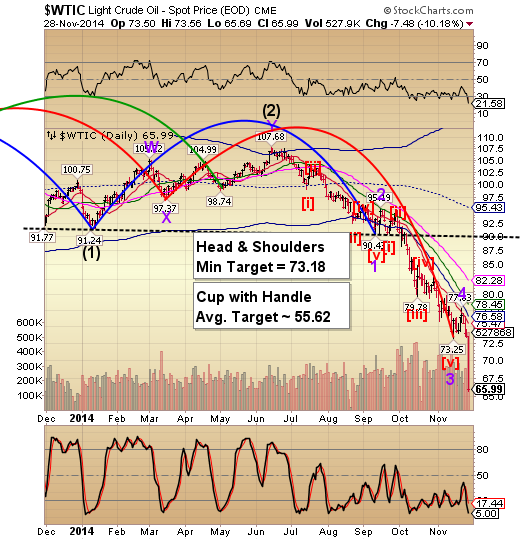

Crude oil is still in the limelight as massive liquidations occur over the weekend.

Charles Hugh Smith (oftwominds.com) has an interesting take on this. Given the presumed 17% expansion of the global economy since 2009, the tiny increases in production could not possibly flood the world in oil unless demand has cratered.

The term Black Swan shows up in all sorts of discussions, but what does it actually mean? Though the term has roots stretching back to the 16th century, today it refers to author Nassim Taleb's meaning as defined in his books, Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets and The Black Swan: The Impact of the Highly Improbable:

"First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme 'impact'. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable."

Gold found some support over the weekend at 1141.80, but is still trapped beneath the Lip of the Cup with Handle formation at 1184.00, suggesting a further decline is yet to come. There is a Trading Cycle Pivot due on Friday this week and stronger Pivots due by mid-December.

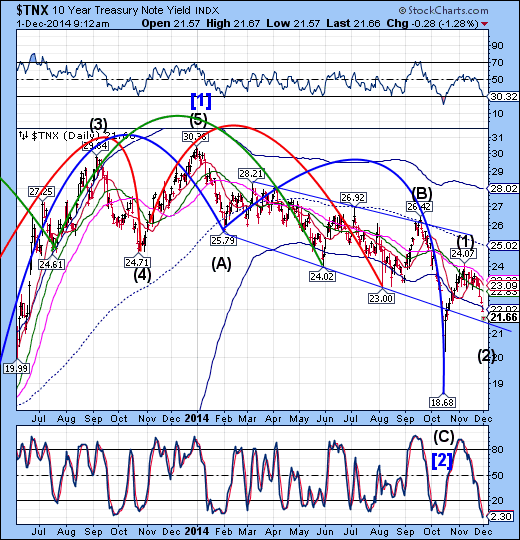

Finally, TNX may be finding Wave (2) support at the lower trendline of its trading channel. It is in the middle of a triple pivot cluster that may provide the impetus for a reversal.

We will monitor TNX for such an event.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.