Black Friday for Gold and Silver

Commodities / Gold and Silver 2014 Nov 29, 2014 - 12:49 PM GMTBy: Jordan_Roy_Byrne

Black Friday has a few meanings. It has the retail connotation and interestingly also marks a Friday in September 1869 when the Gold price plummeted after two speculators attempted to corner the market. Today wasn't that bad for precious metals but it was a Black Friday given the severe selloff and the particular day and time of year. Gold declined over 2% and Silver lost nearly 7% while gold miners slipped 8% (GDX) and nearly 12% (GDXJ). Oil drove the decline but showed how vulnerable precious metals still are. Black Friday marked the end of the current rebound while raising the probability that Gold has yet to bottom.

Black Friday has a few meanings. It has the retail connotation and interestingly also marks a Friday in September 1869 when the Gold price plummeted after two speculators attempted to corner the market. Today wasn't that bad for precious metals but it was a Black Friday given the severe selloff and the particular day and time of year. Gold declined over 2% and Silver lost nearly 7% while gold miners slipped 8% (GDX) and nearly 12% (GDXJ). Oil drove the decline but showed how vulnerable precious metals still are. Black Friday marked the end of the current rebound while raising the probability that Gold has yet to bottom.

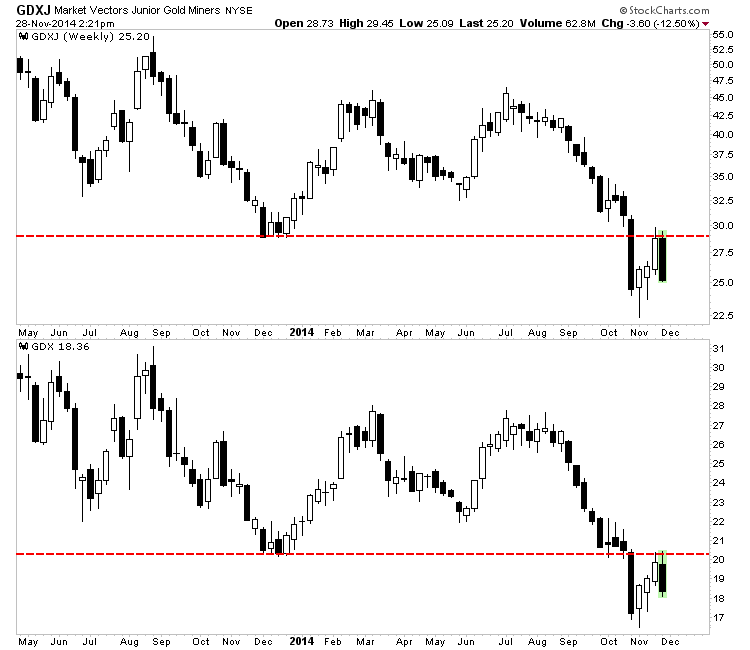

For the miners the significance of the decline is best illustrated on the weekly candle chart. Below are GDXJ and GDX. Simply put, the miners rallied back to previous support and retested the recent breakdown. After rallying for three straight weeks the miners tested resistance in each of the past two weeks. New resistance held and has ushered in the next decline in violent fashion.

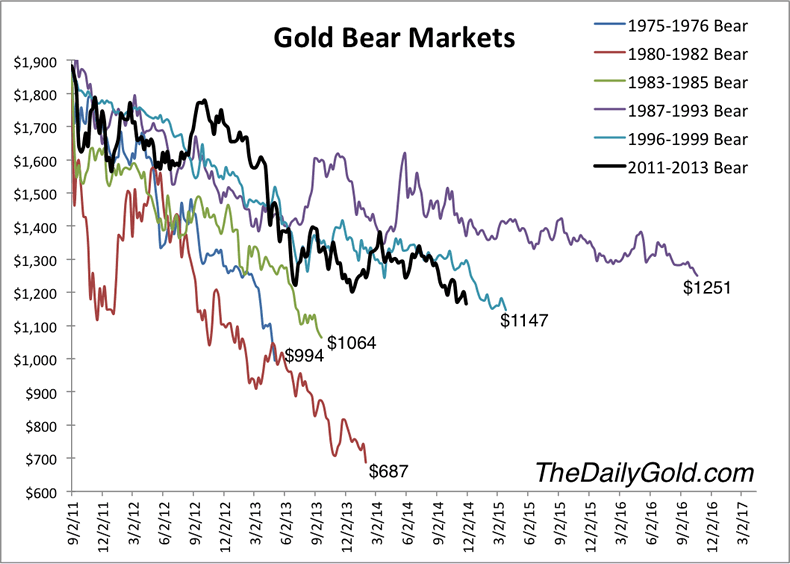

While the miners often lead the metals, we recently realized that Gold has been the better barometer. It's weakness (and not the miners' relative strength in 2014) was correct. As we penn this, Gold is trading below $1170/oz and essentially at a new weekly low. The bear analog chart puts this bear in proper context. It appears likely to end up worse than a normal bear (excluding the crash) and that could be the result of the preceding 10 years without a significant bear market.

Almost every metric or indicator we look at makes a strong case for buying near $1000/oz Gold. Gold has tried but has been unable to bottom at $1200/oz. It ($1000/oz) is the next strong support and major target. The above bear analog makes the case that the current bear has more to go but not too much more. Furthermore, we've noted how a decline below $1100 should push various sentiment and volatility indicators to the kind of extremes that can induce a major trend change.

Gold has appeared very close to bottoming multiple times in the past 18 months yet its always rebounded before it could make its last plunge. Gold is once again trading at a new weekly low and in the coming weeks figures to inch closer and closer to major support. I am working hard to prepare subscribers to take advantage of what could be a lifetime buying opportunity.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.