VIX is Reversing, Other Stock Market Indicators are Faltering

Stock-Markets / Stock Markets 2014 Nov 28, 2014 - 04:47 PM GMT The NYSE Hi-Lo index is acting strangely today. It appears that it may fail at exceeding its prior high of 420.00 from the previous week. That would complete a “failed” point 5 of its Orthodox Broadening Top that I also pointed out last week. A bearish portent for the Hi-Lo.

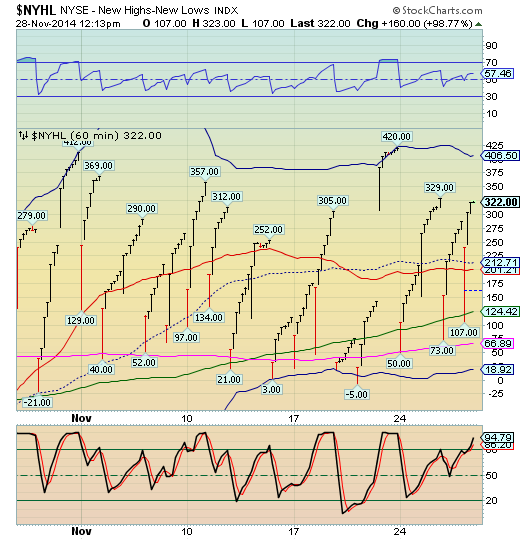

The NYSE Hi-Lo index is acting strangely today. It appears that it may fail at exceeding its prior high of 420.00 from the previous week. That would complete a “failed” point 5 of its Orthodox Broadening Top that I also pointed out last week. A bearish portent for the Hi-Lo.

That may explain the action in the SPX, which made a new high at the open, but is treading beneath the upper trendline of its trading channel.

Note that volume has picked up considerably and not all of it is positive. Again, we must see SPX drop beneath 2060.00 to have a reversal in place. That would give us an aggressive sell signal that, for the time being, would not be supported by the Hi-Lo index.

VIX, on the other hand, appears to be on the upswing, although its must break mid-Cycle resistance at 13.58 just to get an aggressive sell signal. The 50-day Moving Average is at 15.80, where the sell signal would be elevated to a confirmed status. Of course, that would also constitute a breakout of the sub-Minute Wave (iv) high, which also confirms the sell signal.

Wednesday’s low at 11.91 makes a probable Master cycle low in VIX, giving a probable month or more of rally in the VIX.

We also see a probable declining Broadening Wedge, which is very bullish for VIX. A rally above the upper trendline at 15.00 would give a probable target near the Head & Shoulders neckline at 31.06.

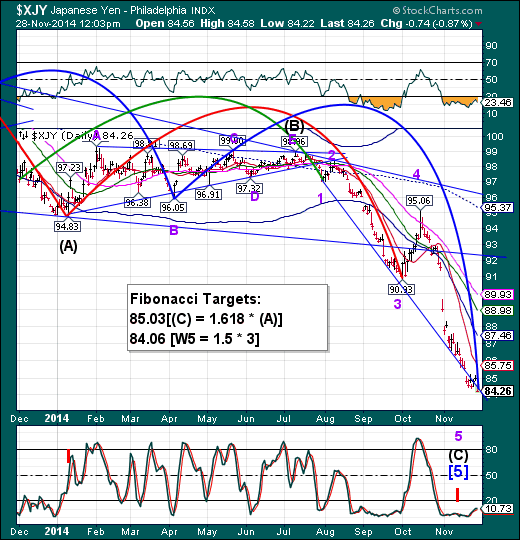

The Yen is due for a triple Trading Cycle low either today or Monday. I have seen double clusters of Pivots before, but this is the first triple Pivot. Two of the three pivots fall today, so this may be why SPX is still above support. By Monday, all three of the pivots may be in effect, telling us a very powerful reversal in the Yen may be at hand.

This, in turn, may remove the liquidity of the Yen Carry Trade that has boosted the SPX for the last 43 days.

The Euro, on the other hand, may experience a triple Pivot reversal between Monday and Wednesday next week. It still has a final probe to make to its Probable target of 122.00.

From there, XEU should rally to its mid-Cycle resistance at 132.96 before resuming its decline.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.