Will The Swiss People Resist The Massive Anti-Gold Propaganda?

Commodities / Gold and Silver 2014 Nov 28, 2014 - 04:32 PM GMTBy: GoldSilverWorlds

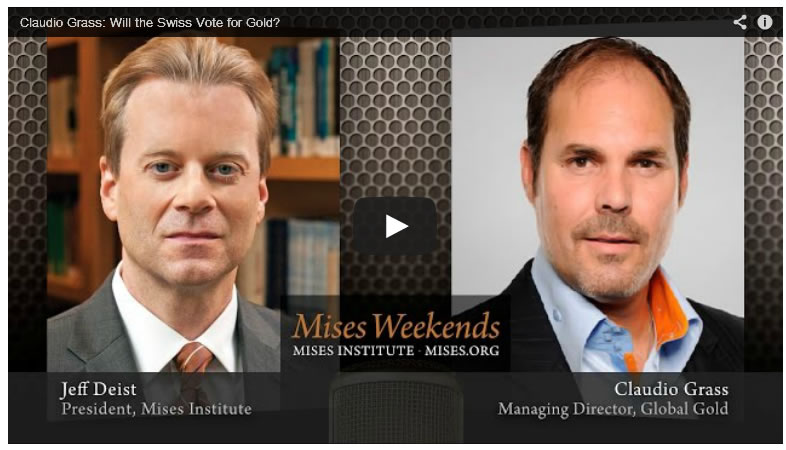

In this article, Claudio Grass, Managing Director at Global Gold Switzerland, provides an update on the context in which the Swiss vote is taking place this weekend. On Sunday, November 30th, end of day, the world will know whether Switzerland is going back to a form of a gold standard or not. What are the key takeaways right before the results of the gold vote?

In this article, Claudio Grass, Managing Director at Global Gold Switzerland, provides an update on the context in which the Swiss vote is taking place this weekend. On Sunday, November 30th, end of day, the world will know whether Switzerland is going back to a form of a gold standard or not. What are the key takeaways right before the results of the gold vote?

The most striking observation of the vote is probably the huge propaganda that has been going in November. Claudio Grass, being a Swiss citizen but also working in the precious metals industry, points out that in October there was no public debate whatsoever about the vote. The establishment has been very quiet on the topic and there were no plans for any exposure on TV or in other media.

That situation thoroughly changed when the first polls showed that the “pro gold” camp was in the lead. At the end of October, the polls indicated that 44% of citizens would vote “yes” (for sure or very likely) and 39% would vote “no”. Since then, Switzerland has experienced a huge anti-gold propaganda. The political debate in the Swiss TV Arena, a room which is used for national political discussions, has been the most noticeable of them all. Claudio Grass confesses that he has never before seen such a propaganda campaign, at least not on such a large scale in which all political parties and the president of the Swiss National Bank (SNB) have been involved. In particular, the SNB President normally never makes public appearances. As a result, the country has seen a stream of communications in the mass media and print media against gold, with the red line being that the “pro gold” camp is a right wings movement and that they have no understanding about the economy.

That has undoubtedly helped to understand the results of the second poll which came out on November 20th: : 38% would vote “yes” and 47% would vote “no”. The company which conducted the poll has a close link with the national and government owned Swiss TV station and is doing regular work for the government. Also, the second poll involved only 1200 people. Any coincidence?

If one thing became clear, it is that the establishment and government have been very scared.

Now that seems a strange reaction because, in the last decades, Switzerland has held 40% of its reserves in gold, while the aim of November 30th is to vote for a backing of 20%. Switzerland has been holding less than 20% of its reserves in gold since 2008. So it is not a radical idea at all.

By following the debate and opinions from people all over Switzerland, Claudio Grass believes that still a substantial part of the population does not realize that paper money has always been a receipt for gold and is therefore the “superior currency” or better said real money. The simple fact that a nation can strengthen its currency by holding physical gold is not sufficiently clear amongst people. A stronger currency means more purchasing power for the nation’s citizens. When buying physical gold as an insurance against the risks related to a fully un-backed paper money system, selling gold does not make any sense at all, especially not in a harsh crisis scenario.

Even Alan Greenspan, who has laid the foundation of the 2008 bubble and resulting financial crash, is nowadays talking about gold and “the superior currency” and is explaining why central banks hold gold. He noted recently that central banks have been holding gold as a protection against crisis and currency issues.

As a side note, it should be noted that the peg, which is in fact a ceiling of 1.20 of the Swiss Franc against the Euro, has not been decided by the Swiss people; it was a unilateral decision by the SNB at the time. There is undoubtedly a link between that fact and the anti-gold propaganda against the gold vote.

Whatever the outcome of the gold vote will be on Sunday November 30th, the Swiss National Bank will always remain in the lead of monetary policy. Even with a “yes” vote, the SNB could decide to print Swiss Francs to buy gold, which results in the fact that they could further inflate the Swiss Franc.

Related to that, the issue is that the SNB is not very transparent in communicating their actions and decisions. For instance, very recently, when the Swiss Franc got close to the maximum exchange rate of 1.20, the SNB has bought 500 million of Euro based assets to debase the Swiss Franc compare to the Euro. That is typically something they do not communicate.

Investors have a preference for the Swiss Franc for its safe haven characteristic. There are good reasons for that. One of the strengths is that Switzerland has an economy is doing fine and there is a political stability because of the country being a direct democracy which is limiting the power of the politicians.

Can the peg then hold forever? Mr. Draghi is doing everything he can to inflate the Euro. At some point in time, when all those printed Euros will reach the real economy, his inflationary objective will succeed. This will be the point where it will be very hard to keep the peg between the Swiss Franc and the Euro.

From the point of view of the Swiss citizens, their key concern should be their impoverishment as a result of monetary policy. The weaker their currency, the more wealth is being redistributed from bottom to top. It is really no coincidence that the lower ranks of the social hierarchy (say, the average Swiss hard working citizen) are more in favor of gold.

As an example of anecdotal evidence, Claudio Grass refers to a recent discussion he had with someone who proclaimed to understand that the export industry should be promoted (“no” vote) but simultaneously realized that he is becoming poorer with a weak currency (“yes” vote). This is a typical example where people see the pieces of the puzzle but cannot connect the dots.

The “anti-gold” camp has been firmly reproaching the “pro-gold” camp that they do not understand the economy because it is too complex. In two days, the world will learn whether the “anti-gold” propaganda has worked or whether the Swiss citizens had been able to figure out there were sufficient benefits for their own future to vote “yes.”

Whatever happens this Sunday, it is obvious that besides all the oppression in the mainstream media, this initiative has reached out to a substantial amount of people, starting to scrutinize the existing system, motivating them to think more independently and of course to question centralized government. As the flaws and cracks in our system are more and more accentuated, this initiative has pushed the demands for sound money and essential concepts of the Austrian School such as non-centralization and individual liberty.

This article is based on an interview conducted by The Mises Institute’s President Jeff Deist.

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.