Gold Waiting for Godot

Commodities / Gold and Silver 2014 Nov 28, 2014 - 12:23 PM GMTBy: Alasdair_Macleod

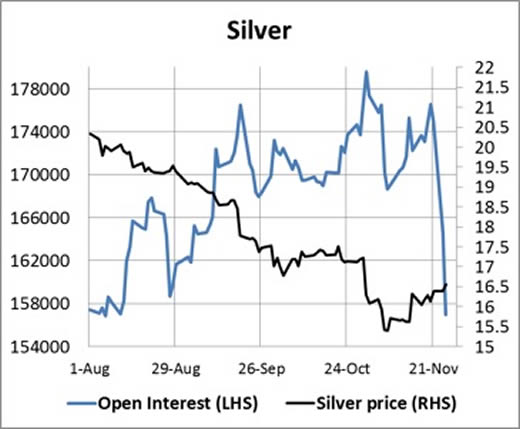

Alternatively, watching paint dry. That’s how it has felt this week with gold’s volatility slowing to a crawl ahead of Thanksgiving yesterday and the Swiss gold referendum on Monday. However, Open Interest[i] on Comex[ii], has suddenly collapsed for both gold and silver, indicating something interesting is going on.

Alternatively, watching paint dry. That’s how it has felt this week with gold’s volatility slowing to a crawl ahead of Thanksgiving yesterday and the Swiss gold referendum on Monday. However, Open Interest[i] on Comex[ii], has suddenly collapsed for both gold and silver, indicating something interesting is going on.

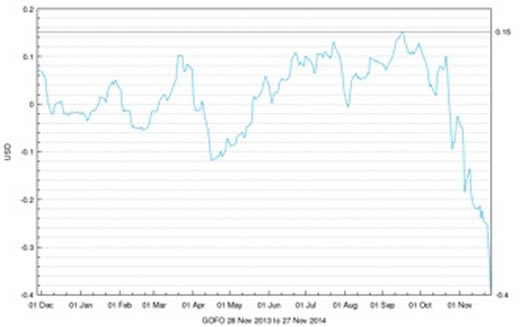

At the same time, the gold forward rate in London (GOFO) has gone sharply negative to -0.4% as shown in the next chart, from the LBMA.

The chart covers the year so far, and it can be seen how the rate has fallen deep into negative territory over the last six weeks. It is now in the largest backwardation[1] seen since 9th March 2001 when a sudden bullion shortage appeared to be rapidly resolved, presumably from the Bank of England’s vaults (Britain was reducing her gold stock at that time). Before that in September 1999 GOFO had hit record negative territory, after which gold shot up by 20% in a week. In both these previous cases GOFO rates spiked deep into backwardation which was quickly reversed. Today there does not appear to be the liquidity from central banks or anywhere else to resolve the bullion shortage, so goodness knows how it will be resolved this time.

So how does this tie in with the collapse in open interest on Comex? We will have a better idea when we see the Commitment of Traders (COT)report later tonight, but subject to what the COT report reveals, it is most likely to be spread positions being closed, which could have become loss-making due to the unexpected surge in backwardation in the physical market. On 18th November, total spread contracts in gold were 104,445 contracts and in silver 40,580 contracts, which would fit this explanation. Furthermore, the effect on the market has been broadly neutral, which would not have been the case had naked bull or bear positions been liquidated.

Backwardations have been a feature of the physical gold market from time to time this year as the GOFO chart shows, but they have not been as persistent or extreme as they are today. If central banks have withdrawn as liquidity providers, we could be seeing early warning signs of more serious problems developing in the market which would be more difficult to resolve than in the past.

Meanwhile prices traded most of the week around the $1190-1200 level ahead of next Monday’s Swiss referendum on gold, though the gold price dipped below this level yesterday afternoon and overnight on a sharp fall in oil prices in the wake of an OPEC meeting.

In other news Holland repatriated 122.5 tonnes of her gold from New York in a move that seems likely to upset Germany, which had booked its position at the head of the queue for gold from the Federal Reserve Bank of New York. And China’s public took a further 52.48 tonnes last week, so no wonder GOFO rates are in such serious backwardation.

Next week

Monday. Japan: Vehicle Sales. UK: Halifax House Price Index, BoE Mortgage Approvals, Secured Lending, Markit Manufacturing PMI, M4 Money Supply. Eurozone: Manufacturing PMI. US: Manufacturing PMI, ISM Manufacturing

Tuesday. Eurozone: PPI. US: Construction Spending, Vehicle Sales.

Wednesday. Eurozone: Composite PMI, Services PMI, GDP (2nd Est.), Retail Trade. US: ADP Employment Survey, Non-Farm Productivity, Unit Labour Costs, ISM Non-Manufacturing Index.

Thursday. UK: BoE MPC Base Rate, Eurozone: ECB Deposit Rate. US: Initial Claims.Friday. Japan: Leading Indicator. US: Non-Farm Payrolls, Trade Balance, Unemployment, Factory Orders, Consumer Credit.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.