China Secret Gold Buying ... How Could It Happen?

Commodities / Gold and Silver 2014 Nov 26, 2014 - 05:51 PM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

“How could it happen, Grandad?”

The old man’s eyes misted over as he looked down at his grandson, who sat at his feet, his young eyes alive with questions as he turned the heavy gold bar over in his hands.

”I’ve told you the story too many times to count,” said the man, half-pleading, but knowing full-well he’d soon be deep into the umpteenth retelling of a story he’d lived through once in reality and a thousand times more through the eager questioning of the young man now tugging at his trouser leg. “Why don’t I tell you the story of how I met your Grandma instead?”

“Because that’s boring.” The reply was borne of the honesty only a ten-year-old could possibly still possess.

“OK, OK,” said the old man, a smile creeping into the corners of his mouth, “you win.”

“It began in early November of 2014, when a man called Alasdair Macleod published a report on how the Chinese had been secretly buying gold for 30 years.

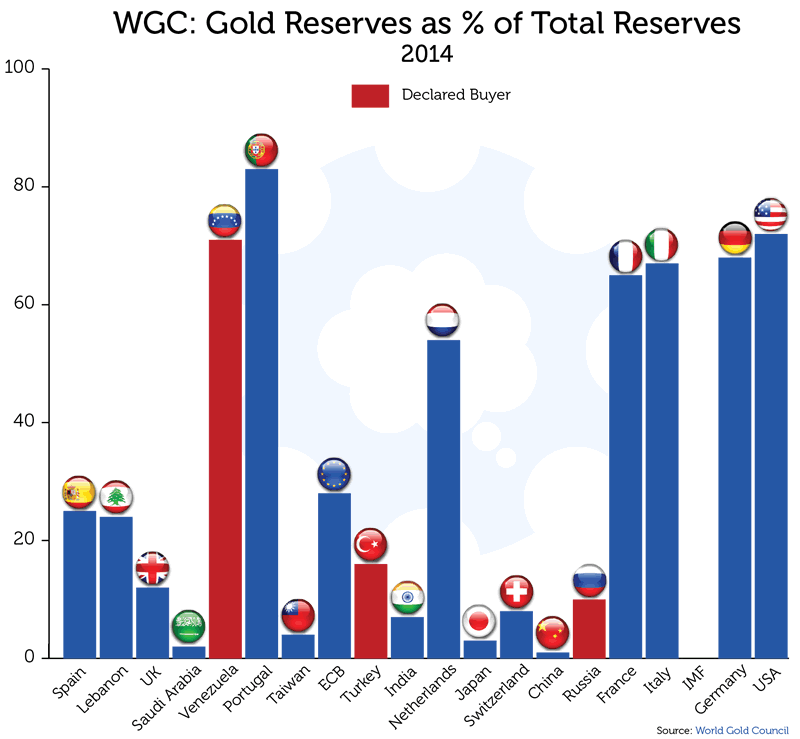

“Most people believed what the Chinese Central Bank had been telling the world — that they owned just 1,054 tonnes. That number, first published in 2009, had remained unchanged for over five years; but there was a group of people who refused to accept that the People’s Bank of China were telling the truth, and those people set about diligently doing their own analysis to try to determine what the real number might be.

“In early November of 2014, Macleod’s report — which went largely unnoticed because most people were busy celebrating new highs in the stock market and the fact that a newly strengthening dollar was forcing down the price of gold — laid out the case for there having been an astounding amount of gold bought by the Chinese over the previous three decades.

“According to Macleod, China saw an opportunity at a crucial time and, with a view on the longer term, they took it.”

Grandad dipped his thumb and forefinger into his vPad, which hovered just above the table, and pinched and cast a paragraph into the air before them. At the same time, they heard the voice of Alasdair Macleod himself read the words aloud:

(Alasdair Macleod): China first delegated the management of gold policy to the People’s Bank by regulations in 1983. This development was central to China’s emergence as a free-market economy following the post-Mao reforms in 1979/82. At that time the west was doing its best to suppress gold to enhance confidence in paper currencies, releasing large quantities of bullion for others to buy. This is why the timing is important: it was an opportunity for China, a one-billion population country in the throes of rapid economic modernisation, to diversify growing trade surpluses from the dollar.

“Macleod explained why what he was about to explain to the world was going to come as something of a surprise to most people.” Grandad dipped his fingers and cast again:

To my knowledge this subject has not been properly addressed by any private-sector analysts, which might explain why it is commonly thought that China’s gold policy is a more recent development, and why even industry specialists show so little understanding of the true position. But in the thirty-one years since China’s gold regulations were enacted, global mine production has increased above-ground stocks from an estimated 92,000 tonnes to 163,000 tonnes today, or by 71,000 tonnes; and while the west was also reducing its stocks in a prolonged bear market all that gold was hoarded somewhere.

“But Grandad, why was the West selling its gold? That’s just stupid!” the young boy interjected, right on cue.

Again the old man smiled. Every time he told the story, his grandson would pepper him with the same questions, with a regularity that brought a familiar rhythm to this very private dance the two of them had performed so many times.

He paused, as he always did, to create just the right amount of dramatic tension before answering.

“I know it seems stupid NOW, but don’t forget, you know what you know. Back then, the people in charge in the West weren’t really all that smart; and, besides, when the Golden Domino finally fell, it became obvious that they had been...” — the old man paused, choosing his words carefully, almost theatrically; but when they came, they were the same carefully chosen words he used every time — “... a little less than honest about a few things.

“Now,” he continued with mock indignation, “if you’ll allow me to get back to the story...”

The boy smiled, and his grandfather pushed on.

“Macleod’s report concentrated on the period between 1983 and 2002, because in 2002 two important things happened: the Chinese people became free to own gold, and the Shanghai Gold Exchange was established. He wrote that the reason they allowed these two events to take place was that they’d already accumulated ‘enough gold’ for what he called ‘strategic and monetary purposes,’ and they were happy to keep adding to their stockpile from their domestic mine production and scrap, rather than buy more in the market...”

The old man held up a hand to head off the question he knew was coming — “I know, I know... you want to know how much the Chinese would have had to accumulate in order to be able to do this, don’t you? Well, Mr. Macleod told us, remember?” He reached once more into vPad space, waggled his fingers a bit, and cast the following:

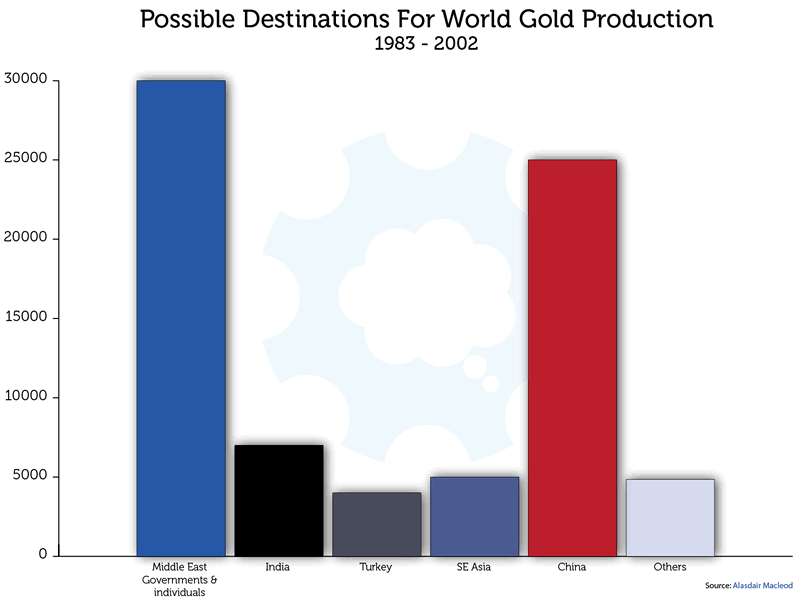

(Alasdair Macleod) Between 1983 and 2002, mine production, scrap supplies, portfolio sales and central bank leasing absorbed by new Asian and Middle Eastern buyers probably exceeded 75,000 tonnes. It is easy to be blasé about such large amounts, but at today’s prices this is the equivalent of $3 trillion. The Arabs had surplus dollars and Asia was rapidly industrialising. Both camps were not much influenced by Western central bank propaganda aimed at side-lining gold in the new era of floating exchange rates, though Arab enthusiasm will have been diminished somewhat by the severe bear market as the 1980s progressed. The table and chart below summarise the likely distribution of this gold:

| SIMPLIFIED GOLD SUPPLY 1983-2002 | Tonnes |

|---|---|

| Official Sales by Central Banks | 4,856 |

| Estimated Leasing (Veneroso) | 14,000 |

| Mine Production | 41,994 |

| Net Western divestment (bullion, jewelry & scrap (est.) | 15,000 |

| TOTAL | 75,850 |

The old man clipped his last sentence short to allow his young audience to make the (quite grown-up, the man thought) point that he always did at this juncture:

“But Grandad, you can’t just say things like ‘probable’ and make assumings like that. We always get told at school that you have to show your workings-out.”

His grandfather let the grammatical error slide — one more time.

“Ah yes, but THAT was the problem, wasn’t it? Everybody wanted proof that numbers like Macleod’s were accurate, but NOBODY wanted proof that the official figures were true, and THAT turned out to be the key lesson that the world learned from this whole sorry debacle.”

“But Grandad, YOU didn’t get hurt, did you?”

The old man looked through the window and out at the snowflakes settling on the tall pines that surrounded the ski field not 40 yards from where he sat, and smiled.

“That’s true,” he said, “but only because I was willing to think for myself and allow for possibilities that most people wouldn’t believe for a moment could actually happen. It wasn’t easy, and it wasn’t fun for many years, believe me. Now, where was I?”

“You were at the part where Mr. Macleod explained where all that gold had gone and...”

“Might have gone,” the man interrupted. “Remember, back then we didn’t know for sure.”

He smiled again and went on with the story.

“Macleod’s work suggested that, while a huge amount of gold had gone flooding into the Middle East during the oil boom of the 1970s (much of it ending up in Switzerland, which, back then at least, was famous around the world as being a safe haven for financial assets), in the mid-’90s, after the gold price had languished for many years, sentiment had changed.”

(Alasdair Macleod): In the 1990s, a new generation of Swiss portfolio managers less committed to gold was advising clients, including those in the Middle East, to sell. At the same time, discouraged by gold’s bear market, a Western-educated generation of Arabs started to diversify into equities, infrastructure spending and other investment media. Gold stocks owned by Arab investors remain a well-kept secret to this day, but probably still represent the largest quantity of vaulted gold, given the scale of petro-dollar surpluses in the 1980s. However, because of the change in the Arabs’ financial culture, from the 1990s onwards the pace of their acquisition waned.

By elimination this leaves China as the only other significant buyer during that era. Given that Arab enthusiasm for gold diminished for over half the 1983-2002 period, the Chinese government being price-insensitive to a Western-generated bear market could have easily accumulated in excess of 20,000 tonnes by the end of 2002.

“Now, I know this is all back-of-the-envelope stuff — assumings, as you call them — but remember, back then, in 2014, none of the other stuff had been exposed.”

“But, Grandad, why were the Chinese buying all that gold? And why did the Westerns let them have it? I mean, it’s worth so much. Why didn’t they just keep it?”

This was always the old man’s favourite part, and he leaned forward in his seat as his enthusiasm for the story returned. With a twinkle in his eyes, he beckoned the boy closer.

“Strategy,” he said, then, after a pause (and with what even he felt was a little more relish than usual) “... and STUPIDITY!

“The Chinese had become very rich during those years, but most of that wealth had come in the form of dollars...”

“What, US dollars?” the boy asked, incredulously. “But why would they ever have wanted lots of those?”

“Because,” the old man chuckled, “there was a time — long before you were born — when everybody wanted US dollars. I know that’s hard to believe NOW, but it was true. If I may...?”

“So-rry Gran-dad,” the boy answered rhythmically and with mock apology.

“Anyway, the Chinese were great students of history and knew that, over thousands of years, what used to be called ‘fiat currency’ had always ended up worthless; and so they planned for the day when that fate would befall the dollar. They began accumulating euros instead of dollars — not because the euro was better but because they didn’t want to own too much of any one currency.”

“Whatever happened to the euro, Grandad?” inquired the boy.

“One story at a time, little fella!” replied the old man. “Now, where was I? Oh yes, then, in the mid-2010s, China began signing all sorts of agreements with other countries, like Iran, Turkey, Russia...”

“And Switzerland!” the boy eagerly interjected.

“... and Switzerland,” his grandfather agreed.

“Those agreements enabled them to swap goods and services for currencies other than the US dollar — all so they could eventually break their ties to what they saw as a doomed currency. And all the while, quietly, in the background, they were swapping as much of that paper money as they could for...?”

“GOLD!!!” Right on cue the boy blurted out the answer, raising both hands in triumph.

“Gold,” the old man said, softly. “Remember what Mr. Macleod wrote?” He cast it up:

(Alasdair Macleod): Following Russia’s recovery from its 1998 financial crisis, China set about developing an Asian trading bloc in partnership with Russia as an eventual replacement for Western export markets, and in 2001 the Shanghai Cooperation Organisation was born. In the following year, her gold policy also changed radically, when Chinese citizens were allowed for the first time to buy gold and the Shanghai Gold Exchange was set up to satisfy anticipated demand.

The fact that China permitted its citizens to buy physical gold suggests that it had already acquired a satisfactory holding.

Since 2002, it will have continued to add to gold through mine and scrap supplies, which is confirmed by the apparent absence of Chinese-refined 1 kilo bars in the global vaulting system. Furthermore China takes in gold doré from Asian and African mines, which it also refines and probably adds to government stockpiles.

Since 2002, the Chinese state has almost certainly acquired by these means a further 5,000 tonnes or more. Allowing the public to buy gold, as well as satisfying the public’s desire for owning it, also reduces the need for currency intervention to stop the renminbi rising. Therefore the Chinese state has probably accumulated between 20,000 and 30,000 tonnes since 1983, and has no need to acquire any more through market purchases, given her own refineries are supplying over 500 tonnes per annum.

“A man called Simon Hunt, who had extremely good connections in China and, more importantly perhaps, a willingness to entertain possibilities most people couldn’t, told a fascinating story once about a visit paid by a friend of his to an army base in China...”

(Simon Hunt, Nov 14, 2014): China is in the process of making the RMB acceptable as an international currency. It wants its trading partners and others to see the RMB as a stable currency that does not play the game of devaluation when difficulties arise. It is the long-game in which Beijing hopes that their currency not only becomes acceptable in financing trade but that central banks can feel secure in adding the RMB to their reserves, as some are now doing.

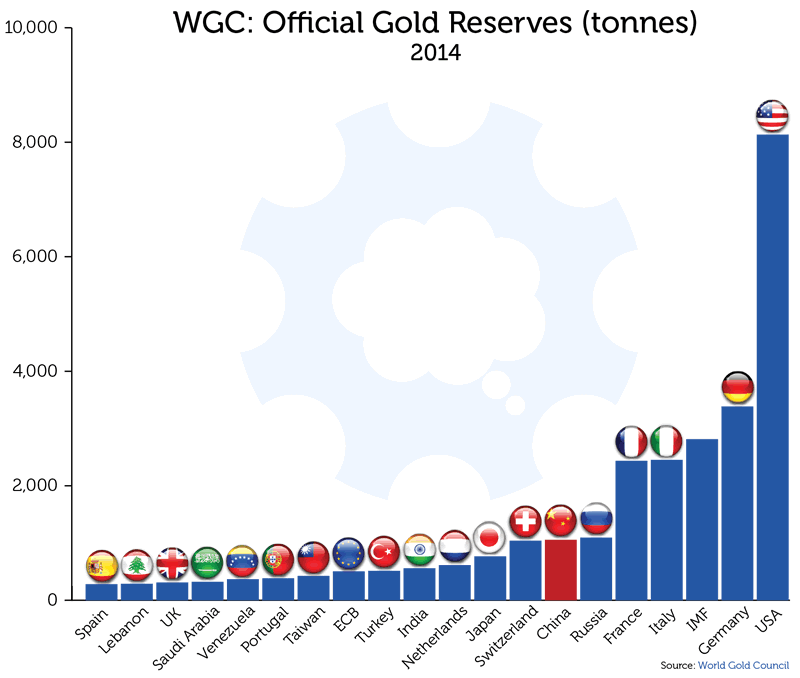

As we have discussed in earlier reports, China, not just the PBOC, holds far more gold than the market has been assuming, probably in the region of 30,000 tonnes, compared with the USA holding very little of its reported 8,300 tonnes.

Whilst in Japan we were told an interesting if not amusing story that supports this contention. A friend of ours has several factories in China and thus knows many senior people in different disciplines, one of which is a senior PLA officer. He was invited down to their HQ for drinks. After a few hours, his friend suggested they take a walk around the compound ending up at the entrance of a large warehouse. The door was opened and to my friend’s astonishment the warehouse was stacked from floor to ceiling with gold bars.

One day, when the timing suits Beijing best, the PBOC will link the RMB to gold. The West may dislike gold, or at least some of their central banks [do], preferring to operate with fiat currencies, but Eastern governments have a history of seeing gold as a store of value.

“NOW, of course, it seems that what Simon said should have been completely obvious; but all the way back in 2014, believe it or not, the idea that the Chinese would peg their currency to gold was something that most people here in the West just couldn’t even comprehend. I can’t even begin to tell you the number of times I talked to people about this stuff. For years it was obvious how things would end, but only a small group of people listened. Mostly, people just laughed and told me I was a fool. They said I should be buying shares and that a return to ANY kind of gold standard was a ridiculous idea. Do you know what I did?”

“Bought more gold?” The boy phrased it like a question even though he knew the answer. He just liked to let his grandfather have his moment.

“Bought more gold,” the old man said matter of factly. He threw up a chart they both knew well:

“But, but, you’ve jumped ahead, Grandad! The part where the Chinese link their currency to gold isn’t for ages yet. You skipped the bit about the Swiss gold! AND you left out the best part — the missing gold?”

“Sheesh!” the old man said in mock exasperation, “I’m coming to that part now! You are one impatient little fella, aren’t you?”

“But this is the best bit!” the boy replied excitedly.

Click here to continue reading this article from Things That Make You Go Hmmm… – a free newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.