Silver: What COT Analysis Tells Us

Commodities / Gold and Silver 2014 Nov 25, 2014 - 06:46 PM GMTBy: DeviantInvestor

Each week the CFTC publishes a Commitments of Traders Report (COT) in which “non-commercial” and “commercial” long and short futures positions are reported. Many people have expressed doubts as to the validity, accuracy and consistency of the data. However, my experience is that the data is mostly relevant, accurate, and useful in the long term, but not necessarily important each week.

Each week the CFTC publishes a Commitments of Traders Report (COT) in which “non-commercial” and “commercial” long and short futures positions are reported. Many people have expressed doubts as to the validity, accuracy and consistency of the data. However, my experience is that the data is mostly relevant, accurate, and useful in the long term, but not necessarily important each week.

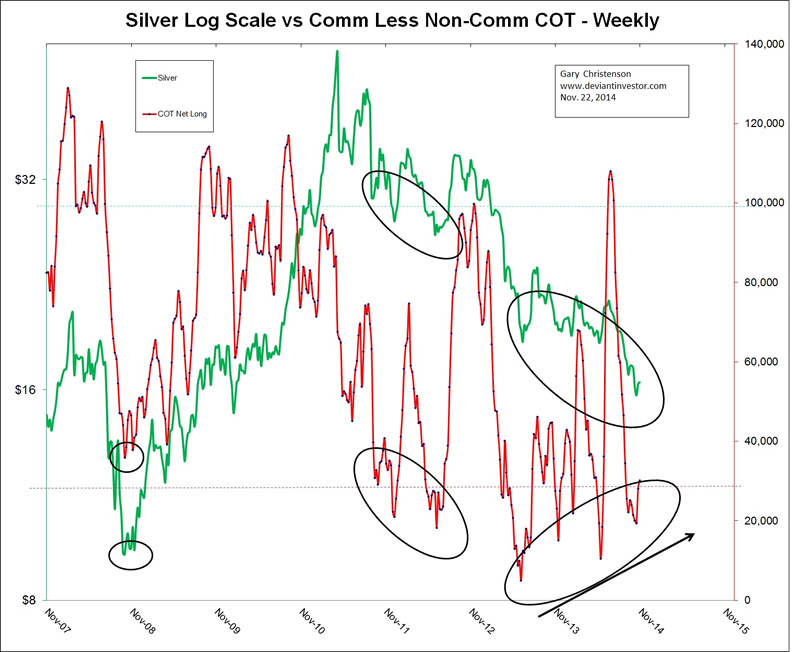

Graph the price of silver (green) on a log scale against the COT data showing “non-commercial” net longs less the “commercial” net longs. In theory this shows when the “smart” money is positioned to profit from high or low prices.

Silver (log) vs. Net Longs Comm less Non-Comm

The chart over the past 7 years is messy so focus on the lows in silver prices and the lows in the COT net longs as I defined above. Note the few times in the last 7 years when the net longs were less than 30,000. Each instance was followed by a bounce in the silver price, some huge and some short lived. Note also that the lows in silver prices during 2011 and 2012 were lower lows consistent with the lower lows in the net-long COT data. However, the lower lows in silver prices for 2013 – 2014 were unlike the higher lows in the net-long COT data. Important? Possibly, but it does support my view that silver just put in a major low.

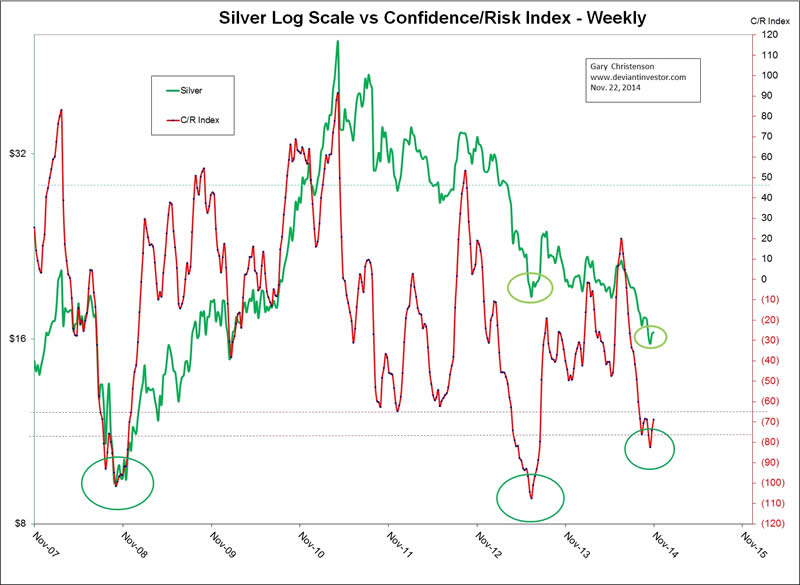

Graph the price of silver on a log scale against a weighted index that I call the Confidence/Risk Index (C/R Index). The index is composed of the above COT data, some moving averages, and the relative strength of prices. It combines the COT data, timing oscillators, and the spread between price and a long term moving average of price.

Silver (log) vs. Confidence/Risk Index

Note the silver lows (green) and the lows in the C/R Index. The C/R index is currently the third most over-sold in the past 15+ years. This index is currently indicating that a major bottom occurred in silver earlier this month. We won’t have confirmation for some time but the indications are strong.

Bullish Indications for silver:

- Demand for physical silver is strong. This includes industrial, medical, and especially investment demand.

- In the long term the price of silver correlates well with national debt, and the national debt is trending strongly upward.

- Increasing global warfare will be bullish for silver and commodities, and will increase anxiety which will drive more silver investment demand.

- In the present currency wars and their “race to the bottom” commodity prices will be the winners. Silver and gold will benefit.

- Much more fundamental and technical data supports the bullish case – but not listed here.

But this time is different (sarcasm alert!)

- The US congress will rein in spending, downsize the military, reduce entitlement spending, refuse contributions and payoffs from large corporations, and force the US government to live within its revenues. And then silver will decrease in price.

- Unbacked paper fiat currencies will retain their value, for the first time in history, and remain strong for the next century.

- Bubbles in bonds, the US dollar, stocks, and Wall Street bonuses will continue inflating for the next decade or two with only minor corrections.

- Government debts will rise exponentially forever.

- And American citizens truly like, respect, and trust their leaders.

This looks, for many reasons, like a major low in silver, and I expect to see silver at new highs in 2015 or 2016. Note the following graph of silver prices on a log scale since 2010.

Silver Log Scale

THE recognized expert regarding COT data is Ted Butler. His subscription service provides more detailed analysis of that data.

From Peter Schiff:

“But there is no great mystery or difficulty in creating inflation or cheapening currency. All that is needed is the ability to debase coined currency, print paper money or, as is the case of our modern age, create credit electronically.”

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.