Where Is the Price of Crude Oil Price Going?

Commodities / Crude Oil Nov 25, 2014 - 09:50 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Friday, crude oil gained 0.47% as Thursday's solid U.S. data and talks that OPEC may consider trimming production continued to support the commodity. As a result, light crude left the recent consolidation and closed the day above $76. Will we see a rally to $80 in the coming days?

On Friday, crude oil climbed to an intraday high of $77.83 as the combination of solid U.S. data continued to support the commodity. How did this increase affected the very short-term picture of crude oil? (charts courtesy of http://stockcharts.com).

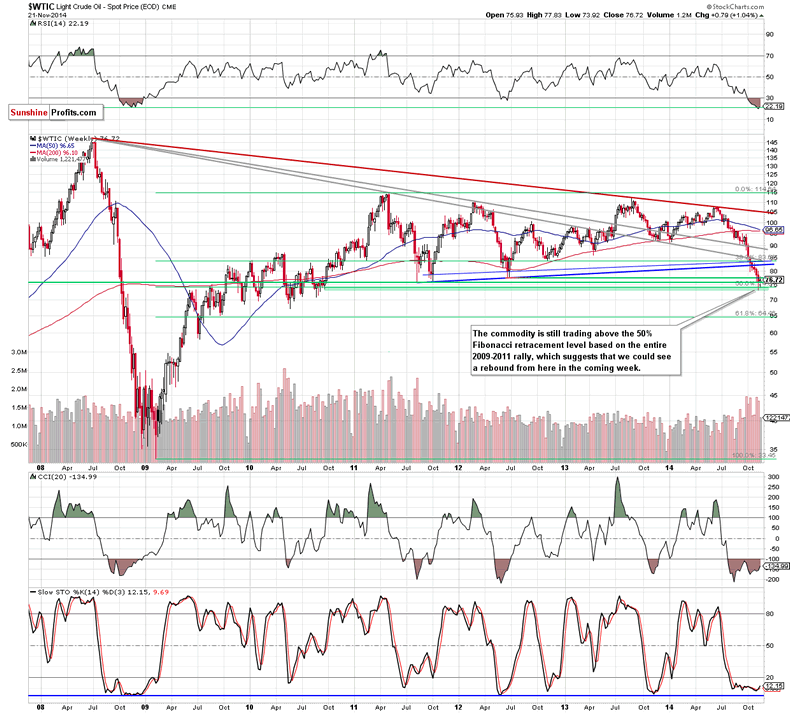

From the medium-term perspective, we see that the situation hasn't changed much as crude oil is still trading above the key support created by the 50% Fibonacci retracement based on the entire 2009-2011 rally.

What can we infer from the very short-term picture?

In our previous Oil Trading Alert, we wrote the following:

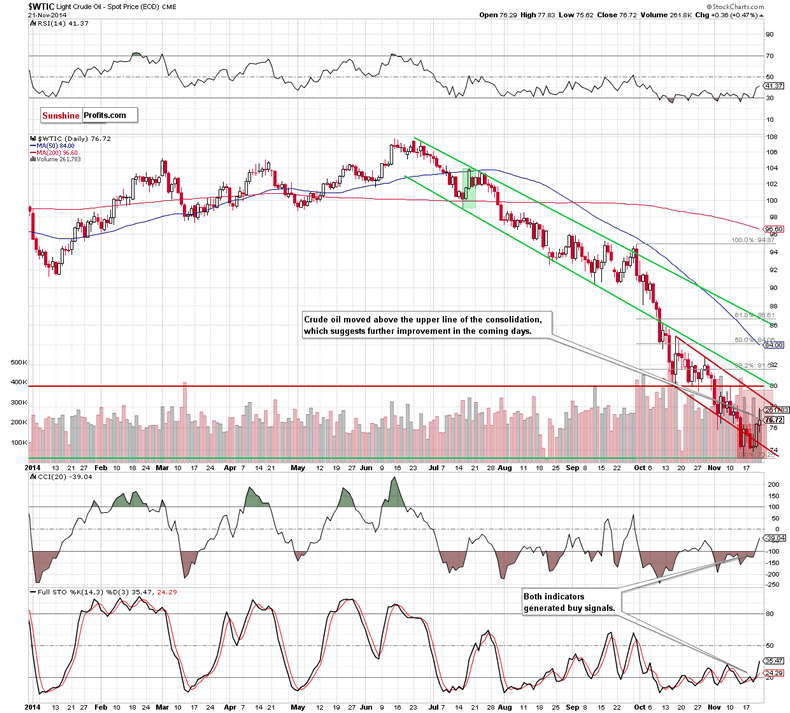

(...) The first thing that catches the eye on the daily chart is an invalidation of the breakdown below the previously-broken lower border of the declining trend channel. Although we saw a similar price action in mid-Nov, this time oil bulls managed to push the commodity not only well above this support line, but also above the upper border of the consolidation (marked with red). These are strong bullish signals, which suggest further improvement in the coming days.

Looking at the above chart, we see that oil bulls pushed the commodity higher as we expected. As a result, crude oil bounced off the upper line of the consolidation and approached the Nov 12 high. Although light crude gave up some gains, it still remains above the consolidation range, which means that as long as there is no invalidation of the breakout further improvement is likely. How high could light crude go? We think that the best answer to this question will be our last commentary:

(...) Taking into account the breakout from consolidation, crude oil will likely climb to around $79.50, where the size of the upswing will correspond to the height of the formation. At this point, it's worth noting that this target is in a solid resistance area where the upper line of the declining trend channel, the previous lows and the barrier of $80 are. Therefore, we think that further rally will be more likely, if we see a breakout above this zone. In this case, the next upside target for oil bulls would be around $81.68, where the 38.2% Fibonacci retracement based on the Sep 30-Nov 14 decline is. (...) the CCI and Stochastic Oscillator generated buy signals, supporting the bullish case.

Summing up, we are convinced that keeping long positions (which are already profitable) is still justified from the risk/reward perspective as crude oil broke (and closed the day) above the upper line of the consolidation and buy signals generated by the CCI and Stochastic Oscillator remain in place, supporting further improvement.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.