China Stock Investing - Follow the Money!

Stock-Markets / China Stocks Nov 24, 2014 - 02:11 PM GMTBy: Ned_W_Schmidt

On morning of 17 November, while Western investors were sleeping, China opened the door to its investment world. On that day China began two way trading between the Shanghai and Hong Kong stock exchanges. This development essentially opened the Chinese stock market to investors around the world through Shanghai-Hong Kong Stock Connect. They said to investors around the world, "Welcome, just bring your money and come right in".

On morning of 17 November, while Western investors were sleeping, China opened the door to its investment world. On that day China began two way trading between the Shanghai and Hong Kong stock exchanges. This development essentially opened the Chinese stock market to investors around the world through Shanghai-Hong Kong Stock Connect. They said to investors around the world, "Welcome, just bring your money and come right in".

Investors would be well advised to be aware of the money flowing into the Chinese stock market, and possible ramifications of that money movement.

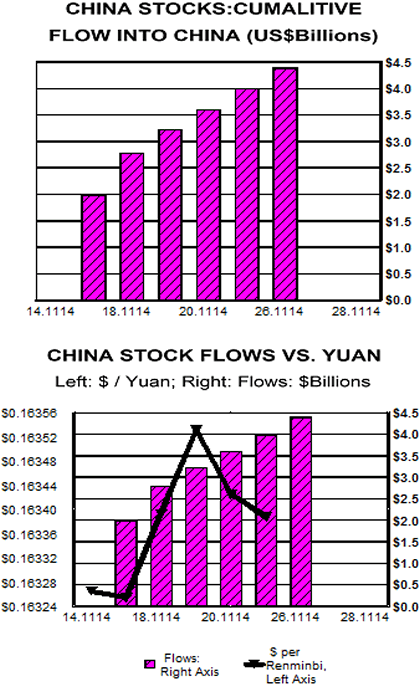

Money is like water flowing across the earth, it fills in the low spot. To foreign investors, and in particular dollar-based institutional funds, the Chinese stock market is a "low spot" to be filled in with money. Foreign investors will fill that "low spot" with their money. Institutional money managers cannot ignore the most important economy in the world, and one destined to be the largest. As the chart at right portrays, the cumulative dollar flow into China's stock market is off to a good start. At present the daily limitation on investment money inflow is 13 billion Yuan, or roughly $2.1 billion, per day. Actual money flows have been below that limit, but it is just the first week of the rest of time. Note especially that we only have a week of data, and the discussion that follows is about trends that will unfold over time.

In order to buy Chinese stocks one must have Renminbi to pay for them. To a dollar-based investor that means selling dollars and buying Renminbi. Those transactions should put downward pressure on the dollar and upward pressure on the Renminbi. While a myriad of factors will influence the value of the Renminbi, this money flow, which will be massive over time, will contribute to the secular uptrend in value of Chinese Renminbi already in place. Second chart above portrays the cumulative money flows into Chinese stock market with dollar value of the Renminbi. As that black line is rising, the Chinese currency is appreciating and the dollar is depreciating. While our focus here is on the dollar, other currencies, such as the Euro and yen for example, will come under similar selling pressure.

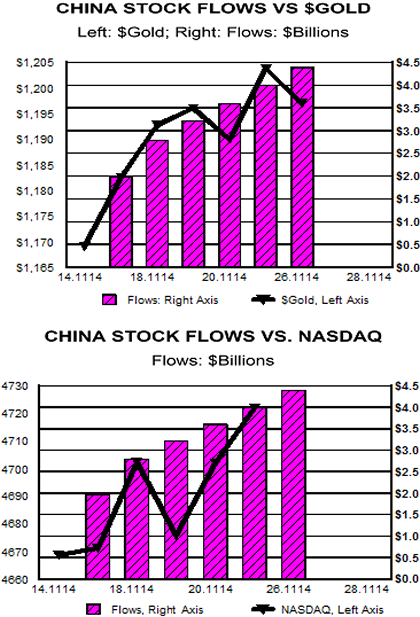

As money flows out of dollars and other currencies, the value of Gold in those currencies should rise. In the chart to the right is plotted the cumulative flow of money into Chinese stock versus price of US$Gold.

Another question that arises is from where will this money come. Near all the money flowing into Chinese stocks will come from institutional funds of all kinds, especially U.S. based speculative funds. While we know not from where in their portfolios money for purchases of Chinese stocks will come, one clear candidate for a money source is the NASDAQ traded issues. Many of those stocks are over owned in institutional portfolios. In the bottom chart is plotted again the cumulative money flow into Chinese stocks verus the NASDAQ Composite Index, left axis.

In reviewing this situation several possible strategies present themselves for consideration by investors. With a money flow over coming years into Chinese stocks that will be measured in the hundreds of billions of dollar, buying Chinese stocks is clearly one possibility. For a variety of reasons, this approach may not fit many individual investors. Hong Kong exchange may be more viable and friendly route.

Second, consideration should be given to investing in the Chinese Renminbi as it is likely to rise in value versus your home currency. Most desirable route is through a Renminbi denominated bank deposit. These accounts are available through many banks around the world and on the internet. In U.S. banks those deposits are insured. Exchange Traded Currencies(ETCs), a form of ETF, are also available. However, investors should probably avoid Exchange Traded Notes(ETNs).

A third alternative should be obvious from the above discussion. Gold is a form of currency that moves opposite the value of national currencies. Dollar and most other national currencies should depreciate versus the Chinese Renminbi. That action should add support to the value of Gold in those currencies. For many, this investment route may be more comfortable than the previous two.

Finally, note that the above prognostications are the future, a time period measured in years. They are not forecasts of what might happen tomorrow afternoon. We prefer you become wealthier over time rather than feed the hope for one lucky trade.

Ned W. Schmidt,CFA is publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food Super Cycle, and The Value View Gold Report, a monthly analysis of the true alternative currency. To contract Ned or to learn more, use either of these links: www.agrifoodvalueview.com or www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.