Economic Statistics Con Game to be Exposed, Bigger Impact than Housing Bust

Economics / Recession May 25, 2008 - 11:38 AM GMT Soaring oil prices were mostly to blame for the past week's stock market sell-off, but renewed concerns about US economic growth, corporate earnings and mounting angst about inflation pressures also featured prominently in determining the market's fate.

Soaring oil prices were mostly to blame for the past week's stock market sell-off, but renewed concerns about US economic growth, corporate earnings and mounting angst about inflation pressures also featured prominently in determining the market's fate.

David Fuller ( Fullermoney ) commented as follows: “As the world's most important commodity by far, this surge in the oil price is bearish for the majority of stock markets. Consequently I would assume that rallies seen since March have either been capped or are unlikely to make much upward progress until investors see evidence that crude oil has commenced a medium-term correction.”

The FOMC released the minutes from its April 30 meeting on Wednesday. Members acknowledged uncertainty about what constituted an appropriate monetary policy in the current economic environment, resulting in the rate reduction (by 25 basis points to 2.0%) being a “close call”.

The surprise of the minutes was the Fed showing increasing concern about inflation expectations, as gleaned from the following: “… risks to growth were now thought to be more closely balanced by the risks to inflation … several members noted it was unlikely to be appropriate to ease policy in response to information suggesting that the economy was slowing further or even contracting slightly in the near term, unless economic and financial developments indicated a significant weakening of the economic outlook.”

Market participants were further unnerved by the Fed slashing its real GDP growth projections for this year (0.3% to 1.2% – down from 1.3% to 2.0% in January), together with raising its forecasts for PCE inflation (3.1% to 3.4% – up from 2.1% to 2.4%) and the unemployment rate (5.5% to 5.7% – up from 5.2% to 5.3%).

I will be braving 34 hours of traveling time from Cape Town to Laguna Beach in California later this week to attend Rob Arnott's Research Affiliates ' annual gathering of its advisory panel. Our investment management company, Plexus Asset Management, has an exclusive licensing agreement with Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African region.

I am thrilled about attending this event as it will afford me the opportunity to meet with financial luminaries such as Peter Bernstein, Burton Malkiel, Harry Markowitz and Jack Treynor for the first time. This has the prospect of being a truly “whoa” experience! Needless to say, my blogging activity will be rather light over the next week, but I am sure that I will return with an abundance of interesting investment ideas.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

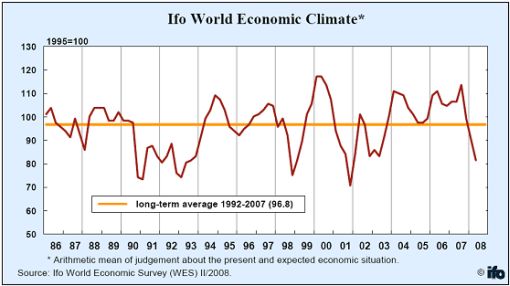

The Ifo World Economic Climate Index has worsened further in the second quarter of 2008, the indicator having fallen to its lowest level in six years.

The Ifo World Economic Climate Index has worsened further in the second quarter of 2008, the indicator having fallen to its lowest level in six years.

Overall, last week's US economic reports failed to brighten up investors' mood. Weekly initial claims and the leading economic indicators data were mildly encouraging, but were overshadowed by inflation concerns tied to a gloomy Producer Price Index, the jump in oil prices and the downbeat statements in the FOMC's minutes. In addition, a stark housing inventory situation implied that additional price declines were in store.

BCA Research summarized the US economic picture as follows: “…policymakers remain nervous about the outlook, and are keeping their options open. The markets are pricing in a 50% chance that the Fed will hike rates by 25 basis points before the end of the year, but that seems premature given the prospect that the economy will continue to struggle.”

Elsewhere in the world, the Bank of Japan elected to leave its official rate unchanged at 0.5%. The German ZEW economic sentiment index pointed to investors' outlook continuing to worsen, although the Ifo Business Climate Index edged up, suggesting German industry and trade are still doing well. The UK economy, however, seems to be heading for its most protracted slowdown since the early 1990s, according to detailed growth forecasts from the Bank of England.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior | |

| May 19 | 10:00 AM | Leading Indicators | Apr | 0.1% | 0.1% | 0.0% | 0.1% | |

| May 20 | 8:30 AM | Core PPI | Apr | - | 0.2% | 0.2% | 0.2% | |

| May 20 | 8:30 AM | PPI | Apr | 0.2% | 0.4% | 0.4% | 1.1% | |

| May 20 | 8:30 AM | Core PPI | Apr | 0.4% | 0.2% | 0.2% | 0.2% | |

| May 21 | 10:30 AM | Crude Inventories | 05/17 | -5317K | NA | NA | 176K | |

| May 21 | 2:00 PM | FOMC Minutes | Apr 30 | - | - | - | - | |

| May 22 | 8:30 AM | Initial Claims | 05/17 | 365K | 370K | 372K | 374K | |

| May 23 | 10:00 AM | Existing Home Sales | Apr | 4.89M | 4.85M | 4.85M | 4.94M | |

Source: Yahoo Finance , May 23, 2008.

The next week's economic highlights, courtesy of Northern Trust , include the following:

1. New Home Sales (May 27): Sales of new homes are expected to have fallen in April. Purchases of new homes in March were down 62.1% from their peak in July 2005. Sales of new homes have declined by 36.3% from a year ago in March. Consensus : 522,000 versus 526,000 in March.

2. Durable Goods Orders (May 28): Durable goods orders (-0.5%) are predicted to have dropped in April largely due to aircraft orders that have risen for two straight months. Orders of defence items may have risen following a drop in March. Consensus : -1.1% versus -0.3% in March.

3. Real GDP (May 29): The net impact from recently published data is an upward revision of real GDP growth to 1.0% in the first quarter of 2008 from a 0.6% increase in the advance estimate. Consensus : 1.0%.

4. Personal Income and Spending (May 30): The earnings and payroll numbers for April suggest only a small gain in personal income (+0.1%). Auto sales fell sharply to 14.4 million units in April and non-auto retail sales were soft, which points to a steady reading for consumer spending with service outlays providing the offset. Consensus : Personal income +0.2%, consumer spending +0.2%.

5. Other reports : Consumer Confidence (May 27), Consumer Sentiment Index (May 30).

Markets

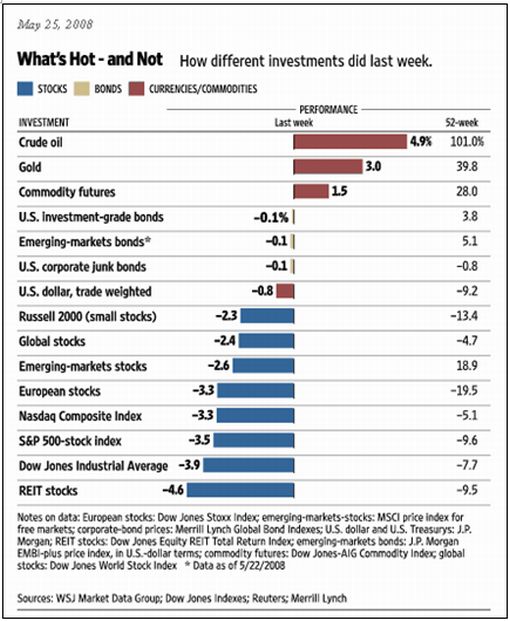

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , May 25, 2008.

Equities

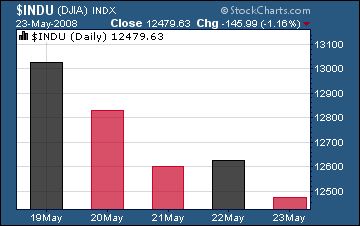

After a number of major stock market indices hit four-month highs on Monday, a surge in oil prices and renewed growth concerns triggered a sharp turnaround, taking the MSCI World Index 2.4% lower by the close on Friday. No market, including emerging markets (-2.6%), was spared the downside. The Nikkei 225 Average (-1.5%) recorded the smallest decline among the leading indices.

The US stock markets were in the thick of things, as shown by the last week's index movements: Dow Jones Industrial Index -3.9% (YTD -5.9%), S&P 500 Index -3.5% (YTD -6.3%), Nasdaq Composite Index -3.3% (YTD -7.8%) and Russell 2000 Index -2.3% (YTD -2.3%).

The Dow Jones Transportation Index witnessed a big 4.2% drop, but is still 11.2% in the black for 2008. Gold and silver stocks (+0.1%) were some of the few to keep head above water during the sell-off.

Tim Bond, head of global asset allocation at Barclays Capital, offered the following advice: “Equity exposure should be narrowed to energy, basic resources, industrial goods and services and – once the write-offs are complete – financials. During inflationary periods, these are the only sectors that deliver positive real returns.”

Fixed-interest instruments

Mounting inflation worries put strong upward pressure on government bond yields in most parts of the world. Although yields were almost unchanged in the US, this concealed a fair amount of volatility during the week.

Bill Gross , manager of the World's largest bond fund (Pimco's Total Return Fund), called Treasuries “the most overvalued asset”. “If there was a bubble, the popping has produced a counter-bubble in quality securities. The safe haven has been way overdone. Treasuries are yielding 2% to 3%, there is no real return on that at all,” he said. “This is an asset class that is held by sovereign wealth funds and central banks … but that is not any reason to follow them.”

Credit market stress increased as shown by the widening spreads in both the US and Europe. The CDX (North American, investment grade) Index rose back through the psychological level of 100 basis points to 109, and the Markit iTraxx Europe Crossover Index jumped by 50 basis points to 455.

Currencies

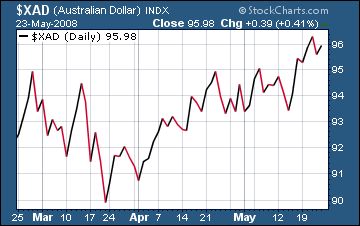

The US dollar could not manage to escape the Fed's downbeat economic outlook and record oil prices, dropping by 1.1% to a two-month low against the euro (where a rate cut by the European Central Bank does not seem imminent). The greenback also declined against the Swiss franc (-2.2%), the Canadian dollar (-1.5%), the British pound (-1.2%) and the Japanese yen ( 0.6%).

The US dollar could not manage to escape the Fed's downbeat economic outlook and record oil prices, dropping by 1.1% to a two-month low against the euro (where a rate cut by the European Central Bank does not seem imminent). The greenback also declined against the Swiss franc (-2.2%), the Canadian dollar (-1.5%), the British pound (-1.2%) and the Japanese yen ( 0.6%).

Rising commodity prices and hawkish comments from the Reserve Bank of Australia pushed the Australian dollar to a 24-year high against the US dollar, closing 0.5% higher at $0.9615 – not too far away from parity. The New Zealand dollar gained 1.8% against its US namesake on the back of unexpected tax cuts.

Commodities

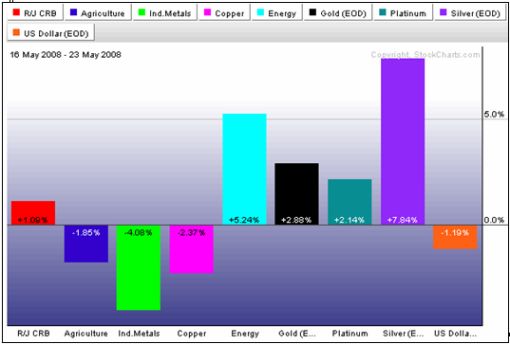

Although the CRB Index (+1.1%) closed the week higher, the chart below shows that the commodities complex comprised both winners (energy and precious metals) and losers (agriculture and industrial metals).

Crude oil was again in the limelight, with West Texas Intermediate closing the week 4.9% higher at $132.19. Speculative action (notably short-covering), a drop in US oil inventories and huge demand from China ahead of the Olympics boosted prices. Long-term oil contracts (+15%) rose by even more than spot as the market braced itself for a “super spike” of $200 a barrel as predicted by Arjun Murti of Goldman Sachs. Prices for diesel (+6.7%), heating oil (+7.2%) and gasoline (+4.2%) all scaled fresh peaks.

Rising inflationary pressure as a result of the strong oil price, expectations that US interest rates will remain negative in real term for quite a while, together with a weaker US dollar, positively impacted on gold (+2.9%), platinum (+2.1%) and silver (+7.8%).

As far as agricultural commodities were concerned, wheat dropped to a nine-month low, having almost halved since its peak in February on the back of the prospects of an excellent crop.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in steering our investment portfolios on a profitable course. And to our American friends, have a fabulous Memorial Day weekend.

Source: The Economist , May 1, 2008.

Bill King (The King Report): Tim Bond – structure portfolios for inflationary conditions

“Tim Bond, head of global asset allocation at Barclays Capital, offered the following investment advice:

• To invest successfully in inflationary conditions, portfolios need to be narrowly focussed on the handful of assets that cause – or benefit from – inflation.

• Portfolio diversification is deadly, destructive and will diminish wealth.

• Bonds of all types – aside from index-linked – have no place in portfolios at current yields.

• Even index-linked bonds' ability to protect wealth from inflation is currently hobbled by very low real yields.

• Equity exposure should be narrowed to energy, basic resources, industrial goods & services and – once the write-offs are complete – financials. During inflationary periods, these are the only sectors that deliver positive real returns.

• Maintain an overweight position in physical commodities.

• Accept that much higher-than-normal portfolio volatility is the price to pay for positive real returns when inflation is high.”

Source: Bill King, The King Report , May 19, 2008.

Telegraph TV: Jim Rogers – Why the US dollar is doomed

“Jim Rogers, author, investor and co-founder of the Quantum Fund, tells Robert Miller why the dollar is doomed and the US Federal Reserve Bank is a disaster.”

Source: Telegraph TV , May 20, 2008.

Financial Times: Buffett – effects of crisis “far from over”

“Warren Buffett … on Monday said he thought the effects of the financial crisis were ‘far from over'.

“Mr Buffett was speaking at a press conference in Frankfurt, where he is meeting German family-owned businesses as part of a four-country tour of Europe.

“‘It is rippling – there are secondary and tertiary effects. I think the Wall Street crisis is mostly over although I don't know. The [Federal Reserve] with its Bear Stearns rescue largely stopped that. But I don't think we are half way or even a quarter of the way through the impact in the general economy,' he said.

“The ‘Sage of Omaha' said the effects of the crisis were beginning to be felt not just by those who had behaved the ‘silliest' but also now by people ‘who did sound things'.

“Mr Buffett on Monday began his first big business trip to Europe as he seeks buying opportunities among the Continent's largest family-owned companies. His visit will include Germany, Switzerland, Spain and Italy as he looks for candidates for what would be only his second major acquisition outside the US.”

Source: Francesco Guerrera, Financial Times , May 18, 2008.

Willem Sels (Dresdner Kleinwort): More credit woes to come

“The worst of the credit crisis is not behind us, warns Willem Sels, head of credit strategy at Dresdner Kleinwort.

“He says that while liquidity tensions are easing, the market is entering a second phase of the crisis. Real credit losses are accelerating and many areas of the market have yet to see the worst of the crunch. He says corporate defaults have only just started rising and he expects high yield defaults to accelerate sharply to 7% to 11% by mid-2009, particularly in the US.

“The market, however, is only currently pricing in a 6% rate of default, he estimates. Mr Sels says rising corporate and consumer defaults will lead to real losses in portfolios, leading credit spreads wider, especially for non-financials.

“He notes the weakness in the housing market seems to be gathering momentum and could still provide a shock to the economy.

“‘Even if we get a W-shaped economic recovery, the current mid-cycle credit rally seems overdone,” says Mr Sels. ‘We believe the recent rally has been exacerbated by investors who are ‘afraid to miss out' or who are too impatient to recognise the lags with which the economy and the profit cycle typically react to shocks.'

“Bank risk appetite will remain low and lending will therefore remain depressed, leading to a long period of sub-trend GDP growth and weakening corporate profit margins, Mr Sels believes.”

Source: Willem Sels, Dresdner Kleinwort (via Financial Times ), May 19, 2008.

Bloomberg: Paulson – financial markets showing signs of progress

“US Treasury Secretary Henry Paulson speaks in Washington about the US housing and credit markets, the impact of the fiscal stimulus plan on the economy and recommendations for financial regulation.”

Source: Bloomberg , May 16, 2008.

Ifo: Renewed decline in Ifo World Economic Climate Index

“The Ifo World Economic Climate has worsened further in the second quarter of 2008, the indicator having fallen to its lowest level in six years. The decline is mainly due to more unfavourable assessments of the current economic situation, but also the expectations for the coming six months have again been revised downwards.

“The worsening in the Ifo World Economic Climate has again affected above all North America and Western Europe. The strongest decline in the climate indicator … was in the US. Here, however, the fall was attributable exclusively to the clearly less favourably assessments of the current situation whereas the expectations for the coming six months are no longer quite so pessimistic. In Western Europe above-average declines in the indicator have been reported in France, Italy and Spain. The indicator has worsened relatively less strongly in Germany, Austria and Switzerland. The climate indicator has also fallen in Asia, especially in South Korea and Hong Kong. Also in Japan negative economic expectations continue to prevail.

“Inflation expectations in the US for 2008 at 3.5% are much higher than the price increases reported by World Economic Survey (WES) experts for 2007 (2.8%). Also in Western Europe inflation expectations for 2008 at 2.9% are considerably above the reported rate of inflation for 2007 (2.1%). In Asia the picture is similar, where the inflation expectations for 2008 are one percentage point higher than the average price increase for 2007 (3.9% vis-à-vis 2.4% in 2007).

“As in the previous survey, a majority of WES experts expects a decline in central bank interest rates. In contrast, long-term interest rates will rise at a moderate pace in the coming six months, in their opinion.

“Especially the US dollar and to a lesser extent the Japanese yen are still seen as undervalued. In contrast, the WES experts consider the euro to be overvalued. Independent of the fundamental assessments of the currencies, they expect the US dollar to continue its weakening trend in the coming six months.”

Please click here for the full report.

Source: Hans-Werner Sinn, Ifo Institute for Economic Research , May 20, 2008.

Financial Times: Moody's launches review in wake of errors

“Moody's has initiated an external review of its ratings of $4 billion of complex debt products after revelations that the agency had awarded incorrect ratings because of a bug in its computer models.

“Charles Schumer, the New York senator, called Wednesday for the SEC to investigate the matter, which triggered a fall of 16% in its share price. Mr Schumer also said, if a probe proved mistakes had occurred, that the US regulatory agency should impose ‘appropriate sanctions' in the form of fines.

“The letter to Christopher Cox, SEC chairman, was in response to a report in Wednesday's Financial Times that detailed how some senior staff at Moody's knew in early 2007 that the ratings on products known as constant proportion debt obligations – complex derivative instruments conceived at the height of the credit bubble – had incorrectly received triple A ratings. Some of the CPDOs should have been rated up to four notches lower due to a computer coding error that was later corrected.

“‘The ratings inaccuracies that were disclosed are deeply troubling,' Mr Schumer wrote in a letter sent Wednesday. ‘However, the fact that Moody's only downgraded these incorrectly rated products in January of 2008, nearly a full year after they became aware of the problem, is much worse, and is indicative of a culture of shirking responsibility that must end.'

“Moody's said Wednesday night: ‘Moody's recognizes the seriousness of questions raised by [the] Financial Times article concerning the analytical models and methodologies used in our European constant-proportion debt obligation ratings process.

“‘The integrity of our ratings and rating methodologies is extremely important; as such, when the questions were recently raised to us, we retained the law firm of Sullivan & Cromwell and initiated a thorough external review of our European CPDO ratings process. Upon completion of the review, we will promptly take any appropriate actions.'”

Source: Sam Jones, Paul Davies, Stephanie Kirchgaessner and Joanna Chung, Financial Times , May 21, 2008.

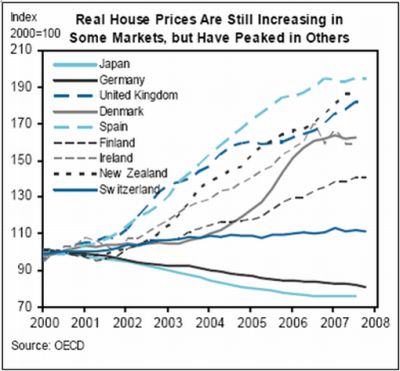

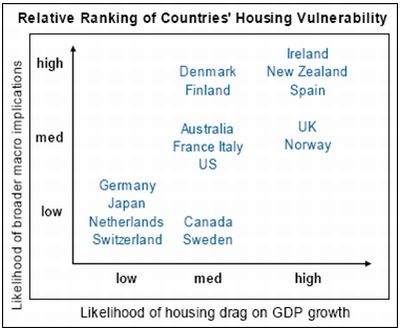

Goldman Sachs Global: Houses in the industrial countries – built on rock, or on sand?

“We find that a further cooling of real house prices is likely. In the UK, Spain and Ireland, much has been said about the drag to growth from residential investment, but whether the private sector's spending behaviour materially changes as a result remains a very open question.

“Countries that look relatively more vulnerable to both a correction in home prices and possibly a broader economic adjustment are New Zealand, followed at a distance by Denmark and Finland. In New Zealand, we continue to recommend gaining long exposure to the front-end of the yield curve and shorting the currency.

“The increase in real house prices in Canada, Norway and Australia, and the related deterioration in house purchase affordability, need to be viewed against the backdrop of a large favourable terms of trade shock from commodity exports.

“Property markets in Germany, Japan and Switzerland all stand to benefit from the decline in long-term interest rates that ensued from the bursting of the US housing bubble.”

Please click here for the full report.

Source: Goldman Sachs Global , May 14, 2008.

Bloomberg: James Galbraith – US housing problem to last “long time”

“James Galbraith, an economics professor at the University of Texas, talks with Bloomberg's Matt Miller from Austin, Texas, about the outlook for the US economy and the challenges facing the next president, the impact of Federal Reserve monetary policy on inflation, and the state of the US housing market.”

Source: Bloomberg , May 16, 2008.

Financial Times: Wall Street fears prolonged credit crisis

“According to Meredith Whitney and a team of analysts from Oppenheimer, the extended credit crisis will result in further multi-billion dollar revenue reversals at the major banks.

“‘We believe the real harrowing days of the credit crisis are still in front of us and will prove more widespread in effect than anything yet seen,' Ms Whitney said.

“The culprit is less the writedowns themselves than the ‘shut-down' in the securitisation market which at its height provided 66% of household borrowings in the first quarter of 2007.

“Without that market, consumer credit losses may be ‘far worse than what is currently estimated, even by the most draconian of investors'. Ms Whitney and her colleagues also slashed their 2008 earnings estimates for the large-cap banking stocks they cover by an average of 17%.”

Source: Jeremy Lemer, Financial Times , May 20, 2008.

Bloomberg: Barton Biggs – golden age of Wall Street is over

“The credit meltdown runs so deep that the prosperous years on Wall Street that began in 1982 are probably drawing to a close, says Barton Biggs, 75, managing partner at Traxis Partners, a New York- based hedge fund.

“‘We had a spectacular era of financial success that was extended by the subprime mortgage mania to 2007,' says Biggs, who was chief global strategist at Morgan Stanley until 2003. ‘But I think the golden age of Wall Street is over.'”

Source: Edward Robinson, Bloomberg , May 21, 2008.

BCA Research: The Fed – Nervously on hold

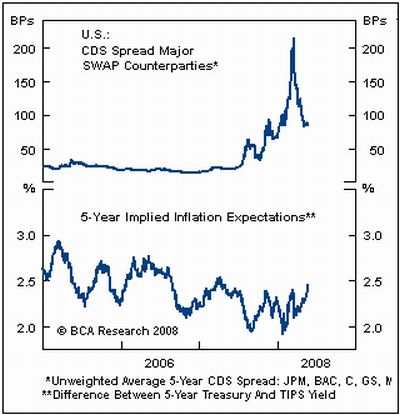

“The latest FOMC minutes noted that the April decision to lower rates was a ‘close call'. The Fed's economic expectations are subdued with a mild first-half recession, followed by a moderate upturn. But there is no appetite for a more aggressive easing given lingering concerns about upside risks to inflation. The reduction in credit market strains is a further reason to stay on hold.

“Nonetheless, the minutes, together with recent remarks by Vice-Chairman Kohn, highlight that policymakers remain nervous about the outlook, and are keeping their options open. The markets are pricing a 50% chance that the Fed will hike rates by 25 basis points before the end of the year and that seems premature given the prospect that the economy will continue to struggle.”

Source: BCA Research , May 23, 2008.

MarketWatch: Statistical con game to be exposed

“No matter who's elected president, America will soon see a massive statistical curtain pulled back, exposing a con game of historic proportions. And when that happens, you and I will suffer another ear-splitting global meltdown, bigger than today's housing-credit crisis, dragging us deep into a recession and bear market for years.”

Source: Arroyo Grande, MarketWat ch , May 20, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.