Gold Rises After Unusual Russian Central Bank Gold Buying Announcement

Commodities / Gold and Silver 2014 Nov 19, 2014 - 12:53 PM GMTBy: GoldCore

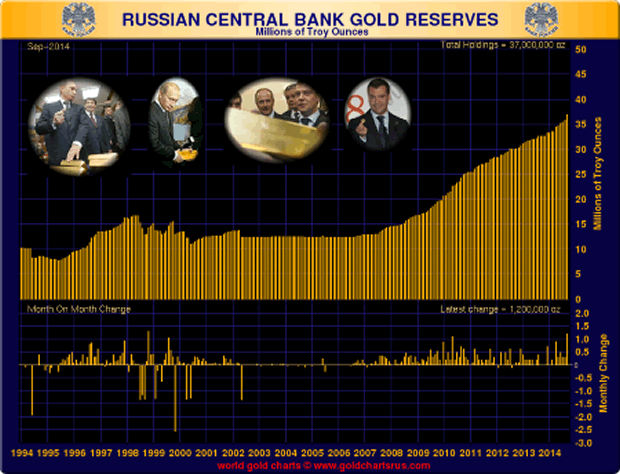

Russia’s central bank bought about 150 metric tons of the metal this year, announced Governor Elvira Nabiullina yesterday. The pronouncement immediately created buying in the market, prompting gold to rise to a two week high at $1,200 an ounce.

Russia’s central bank bought about 150 metric tons of the metal this year, announced Governor Elvira Nabiullina yesterday. The pronouncement immediately created buying in the market, prompting gold to rise to a two week high at $1,200 an ounce.

Head of Russian Central Bank Elvira Nabiullina

Russia's central bank Governor Elvira Nabiullina told the lower house of parliament about the significant Russian gold purchases. She is an economist, head of the Central Bank of Russia and was Vladimir Putin's economic adviser between May 2012 to June 2013.

This announcement is unusual and to our knowledge has not happened before. The announcement by the Russian central bank governor was likely coordinated with Putin and the Kremlin and designed to signal how Russia views their gold reserves as a potential geopolitical and indeed financial and currency war weapon.

Gold currently constitutes for around 10% of the bank's gold and forex reserves, she added. Official purchases were about 77 tons in 2013, International Monetary Fund data show.

MARKET UPDATE

Today’s AM fix was USD 1,200.75, EUR 957.61 and GBP 766.08 per ounce.

Yesterday’s AM fix was USD 1,202.00, EUR 959.68 and GBP 767.81 per ounce.

Gold climbed $10.40 or 0.88% to $1,196.80/oz yesterday. Silver rose $0.06 or 0.37% to $16.22/oz.

Gold remained firm at $1,200 an ounce as the market digested very robust Russian central bank demand and announcement and await next week's Swiss gold referendum and later today, the U.S. Federal Reserve minutes at 1900 GMT.

If the Fed increases interest rates it could hurt non-interest-bearing gold in the short term. However rising interesting rates are more bearish for stocks and bonds as was seen in the rising interest period of the 1970s when gold prices surged.

The Swiss gold referendum is around the corner on November 30th and if passed this could force the Swiss National Bank to keep 20% of its holdings in gold bullion, force the SNB to repatriate gold holdings and end all gold sales.

The dollar hit a seven-year high against the yen today. Silver was up 0.5% at $16.24 an ounce. Spot platinum was up 0.5% at $1,206.65 an ounce, while spot palladium was flat at $769.98 an ounce.

Shares fell in Europe and Asia on Wednesday while the dollar rose broadly, hitting a new seven-year high against the yen, as investor nervousness on the diverging outlooks for the world's major economies.

The dip in gold prices has spurred purchases from Asia. Trading volumes on the Shanghai Gold Exchange’s (SGE) benchmark bullion spot contract jumped this week and India’s imports surged in October.

Russian President Vladimir Putin holds a gold bar while visiting an exhibition at Russia's Far Eastern gold mining center of Magadan November 22, 2005. Putin on Tuesday supported the idea of boosting the share of gold in Russia's central bank reserves, which are the largest of any country outside Asia. (Photo: REUTERS/ITAR-TASS/PRESIDENTIAL/)

The International Monetary Fund said the latest figures showed an almost double jump over the country's registered purchases of 77 tonnes in 2013. It said that historically, Russia started buying gold again since the end of September, perhaps at an initial 35 tonnes.

Nabiullina, who said the bank's total foreign reserves is made up 10 percent of gold, likewise told the Russian parliament on Tuesday there is no need to place restrictions on gold exports. A number of lawmakers had proposed to put a moratorium on the exports of the safe haven yellow metal so the country would be able to secure enough gold amid the sanctions it is experiencing.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.