How to Profit From Oversold Crude Oil Price

Commodities / Oil Companies Nov 18, 2014 - 08:03 PM GMTBy: Investment_U

Christopher Rowe writes: There's a seismic macroeconomic shift going on right now. It's happening on a global scale, and it will shake up investment portfolios everywhere in the world.

Christopher Rowe writes: There's a seismic macroeconomic shift going on right now. It's happening on a global scale, and it will shake up investment portfolios everywhere in the world.

Mistakes will be made, but fortunes will be made, too.

The price of oil is at a four-year low, and investors are asking these questions:

- If I step in and buy energy stocks here, am I trying to catch a falling dagger?

- Should I get the heck out now before the real pain begins?

- Is this the greatest buying opportunity I'm going to see for many years to come?

But I think the most profitable question you can ask yourself is: Which companies are being sold off for the wrong reasons?

Let me back up for a moment. Take a look at this 20-year chart of light sweet crude oil futures.

So let's start with the very basic technical picture. Oil is at super oversold levels. We just hit a four-year low and the weekly momentum, as measured by the very popular "RSI Wilders" indicator (at the bottom of the chart), is at a level not seen anywhere else on the chart. The closest we've been to being this oversold in two decades was back at the 2008 bottom.

The unprecedented strength in the U.S. dollar index and revolutionary drilling technologies have combined to send oil prices lower. Thanks to hydraulic fracturing and horizontal drilling, the U.S. is seeing its highest crude oil production in more than 2 1/2 decades.

But the old adage says, "Oversold doesn't necessarily mean over." Even if crude oil is a "bargain" at this level, it doesn't necessarily mean it's a great "buy," because it can decline further.

So what's the best way to profit from a bloodbath?

Many investors think a decline in oil means "the oil sector" is a bad place to be. But that's only true if you don't understand the sector. If you know which stocks are likely to benefit from this huge change in price, you can exploit the mistakes of those who don't.

That means energy companies whose bottom lines are not very affected by low oil prices, such as midstream companies involved in the gathering and storage of oil, tankers and oil pipeline companies. These are companies that make money from higher volume (oil through their pipes) and higher oil production.

Mergers and Acquisitions

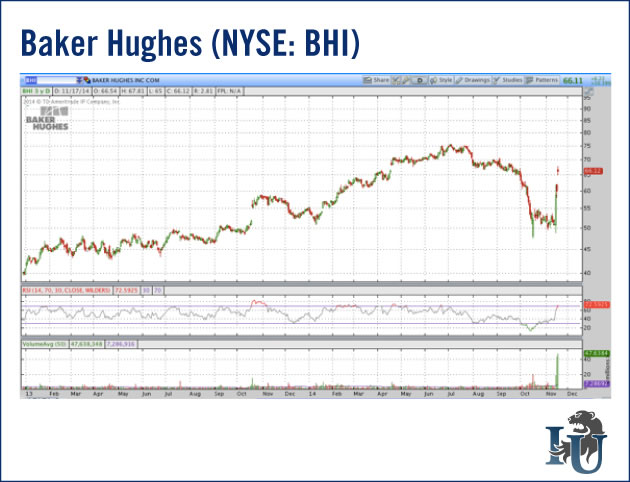

Halliburton (NYSE: HAL), which is the second-largest oil services provider, said Monday that it would acquire Baker Hughes (NYSE: BHI). Baker Hughes is up 34% in the last two trading days alone.

Because crude sold off so dramatically, equipment makers and oil explorers have had their stock prices hit, which turns well-capitalized companies like Halliburton into interested buyers.

The same set of circumstances that brought these two firms together is likely to create an environment for more M&A activity to come. Halliburton's purchase of Baker Hughes, which makes drill bits and pressure-pumping tools, helps insulate it from a sustained oil market downturn.

Who Benefits From Lower Oil?

Preparing to own the right energy stocks within a severely oversold energy sector is one way to take advantage of this rare market environment. But don't forget that some companies' stocks are benefiting from lower oil prices right now. For example, United Parcel Service (NYSE: UPS), which generally has a huge energy expense, just broke out to a new all-time high, reaching $109.40.

Stocks in the airline sector are hitting new highs too. Among the strongest are Southwest Airlines (NYSE: LUV), Hawaiian Holdings Inc. (Nasdaq: HA) and United Continental Holdings (NYSE: UAL), which just broke out past its 2007 bull market high.

I hope this article helps you avoid making the costly mistakes that many investors will make during this energy sell-off. There's huge money to be made if you look in the right parts of the sector - and there are huge mistakes to be made if you think all energy stocks are the same.

Good investing,

Chris

P.S. There are no energy analysts out there whose expertise I respect more than our very own Sean Brodrick. (For example, he recommended UPS on October 1, just before its current charge started.) And on Thursday, Sean will be talking at length with The Oxford Club's Dave Baumann about the hottest plays in the energy sector via a special online event hosted by The Oxford Club. Click here for the details.

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.