What The Fed Has Wrought, Who Needs Wage Earners Anyway?

Politics / US Federal Reserve Bank Nov 17, 2014 - 03:11 PM GMTBy: James_Quinn

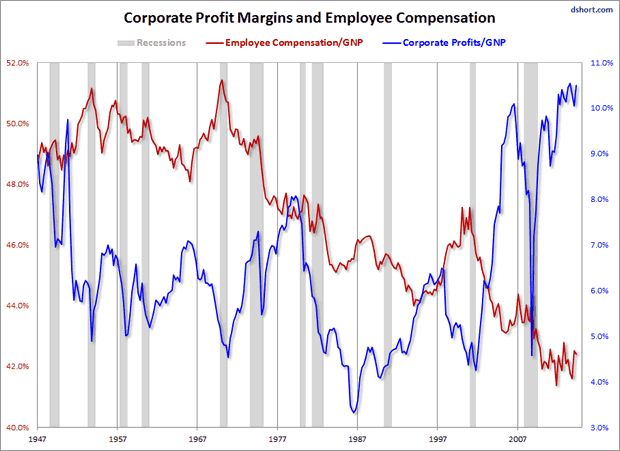

The chart below might be the most powerful indictment of the Federal Reserve and our corporate fascist empire of debt ever created. Some people don't get charts. Charts tell a story. This chart tells the story of elitist bankers supporting the agenda of a corporate fascist state, resulting in the gutting of the middle class. Anyone who views this chart in a positive manner is either a Federal Reserve banker or their paycheck is dependent upon the continuation of the pillaging of the working class. Corporate profits are at all-time highs. Profit margins have always reverted to the mean throughout modern history. If they remain at all-time highs then something is terribly wrong.

The chart below might be the most powerful indictment of the Federal Reserve and our corporate fascist empire of debt ever created. Some people don't get charts. Charts tell a story. This chart tells the story of elitist bankers supporting the agenda of a corporate fascist state, resulting in the gutting of the middle class. Anyone who views this chart in a positive manner is either a Federal Reserve banker or their paycheck is dependent upon the continuation of the pillaging of the working class. Corporate profits are at all-time highs. Profit margins have always reverted to the mean throughout modern history. If they remain at all-time highs then something is terribly wrong.

"Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly." - Jeremy Grantham, Barron's

Here is the story I see in that chart. Corporate profits as a percentage of GNP have averaged 6.5% over the last 67 years. As you can see, it is a volatile figure. Corporate profits rise during expansions and fall during recessions. That has been a given over time. The reason corporate profits have always reverted to the mean was due to the basic tenets of free market capitalism. When a company is generating outsized profits, that industry will then attract new competitors, resulting in price competition and lower profits. From 1950 through 1971, corporate profits as a percentage of GNP fluctuated in a narrow range between 5% and 7%. This was a reflection of a market driven by competition, a non-interventionist Federal Reserve, and a government not captured by corporate interests.

It is no coincidence since Nixon closed the gold window in 1971 and unleashed greedy bankers, feckless politicians, and self serving corporate executives to utilize easy money and prodigious amounts of debt to financialize our economic system and deform capitalism, corporate profits have boomed and busted. The Fed created booms and busts are clearly evident on the chart. Nixon toady Arthur Burns created an inflationary boom in corporate profits to 8% of GNP in the late 70's followed by the collapse to 3% caused by Volcker having to raise rates to extreme levels to crush the Burns created runaway inflation.

You can see exactly when the Maestro assumed command at the Fed and proceeded to introduce the Greenspan Put, encouraging speculation, borrowing and mal-investment. His easy money boom led to the dot com bubble that doubled corporate profits from their 1987 low. Of course the profits vaporized in an instant and plunged to 4% of GNP in 2001. Greenspan and then Bernanke proceeded to drive interest rates to record lows creating a prodigious housing bubble resulting in the greatest level of mal-investment and financial fraud in world history. Corporate profits as a percentage of GNP skyrocketed from 4% to 10% in the space of six years. The banking cabal had captured the system.

The Fed orchestra kept the music playing and Wall Street kept dancing the rumba with their corporate CEO dates. The Keynesian acolytes were ecstatic. The Austrians warned of the impending bust. No one listened. The collapse of the worldwide financial system was portrayed by the corporate mainstream media, bankers like Dimon, corporate CEOs like Immelt, billionaires like Buffet, captured government bureaucrats like Paulson, and politicians like McCain and Obama, as a systematic risk that required a taxpayer rescue of criminals.

The $800 billion gift to bankers and mega-corporations by the Washington DC Party of captured politicians was chicken feed compared to the $3.5 trillion of newly printed fiat handed to Wall Street and corporate America by Bernanke and Yellen. Five years of 0% interest rates have impoverished senior citizens and savers, but they have done wonders for Wall Street and mega-corporation profits, along with executive bonuses. Corporate profits soared from 4.5% of GNP to an all-time high of 10.5% in the space of three years and have remained at this elevated level.

Who Needs Wage Earners Anyway?

Is it a coincidence that corporate profits as a percentage of GNP are at record highs while employee compensation as a percentage of GNP is at record lows? Is it a coincidence that employee compensation as a percentage of GNP peaked at 51% in 1971? That year certainly seems to be a turning point in U.S. economic history. Gold's purpose as a check on statists, Keynesians, politicians, bankers, and the military industrial complex couldn't be any clearer. The decline has multiple causes, but the storyline about technology being the major cause is patently false. My observations are as follows:

- From the end of World War II until the mid-1970s employee compensation as a percentage of GNP was consistently between 49% and 51%. The middle class saw their standard of living rise as wages outpaced inflation, savings rates were high and led to capital investment, debt was used for long term purchases like a home or automobile, and bankers accepted deposits and made safe loans. Technological progress over the thirty years was constant, but did not result in declining wages.

- From the moment Nixon closed the gold window, employee compensation as percentage of GNP relentlessly declined for the next quarter of a century from 51% to 44%. Over this time frame our economy deformed from a goods producing system driven by savings and capital investment into a service/financial economy built upon consumer debt, conspicuous consumption and market gambling. Our iconic mega-corporations fired Americans and hired Chinese slave laborers, lobbied for tax breaks, invested in their own stock, kept wage increases below the level of true inflation, and paid extravagant compensation packages to their Harvard MBA executives.

- The brief upturn created by Greenspan's irrational exuberance 90's boom was short lived. The relentless decline resumed after the dot com collapse, even as Greenspan and Bernanke blew their epic bubble. Their financial engineering machinations on behalf of Wall Street did nothing for the average worker on Main Street. Employee compensation as a percentage of GNP declined from 47% to 44% BEFORE the financial collapse.

- Unequivocal proof that Bernanke's sole purpose of QE and ZIRP was to benefit his Wall Street owners can be seen in the continued decline from 44% to 42% since 2008. There has been no recovery for the average American. Wall Street is rolling in dough. Corporate America is rolling in dough. Politicians are rolling in dough. The average American worker is rolling in dog shit.

The mouthpieces for the Deep State insist corporate profits have reached a permanently high plateau. It's another new paradigm. Just like 1929, 1999, and 2007. Jeremy Grantham is right. The system is broken. The inmates are running the asylum. But financial engineering will not work permanently. Baijnath Ramraika and Prashant Trivedi in their outstanding article Why Jeremy Grantham is Right about Corporate Profit Margins prove that corporate gross margins have not grown, technological advancement has not been a major factor, innovation and capital investment are non-existent, and corporate CEOs have utilized one time schemes to boost profits.

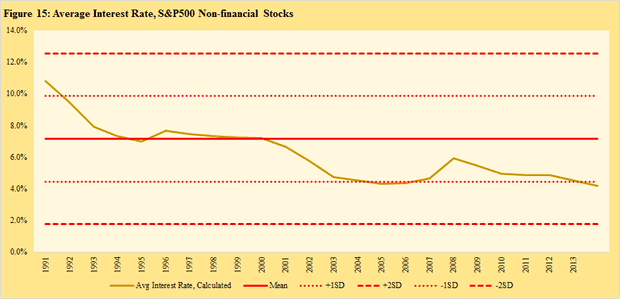

There are a few major reasons for record corporate profits. The Fed's gift to banks and mega-corporations of zero interest rates have allowed S&P 500 corporations to refinance their existing debt and take on new debt at below market interest rates. The average interest rate paid by S&P 500 companies is now at all-time lows. Any normalization of interest rates would crush corporate profits.

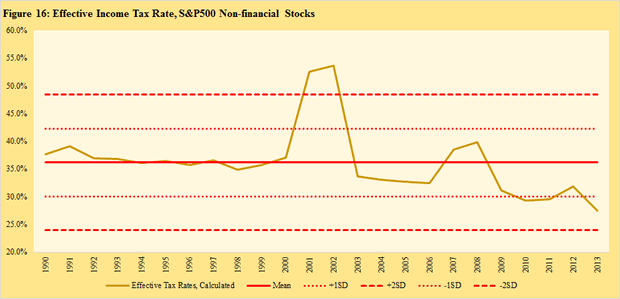

Even though you hear constant propaganda from the corporate MSM, corporate CEOs, and captured politicians about the dreadful level of corporate taxes, the truth is that mega-corporations are paying record low levels of actual taxes. When profits are at record highs and tax payments at record lows you know they have captured the system. "Creative" tax avoidance and the FASB allowing banks to mark their assets to fantasy have played an enormous role in record profits.

The short term oriented casino mentality of corporate CEOs can be plainly seen in the fact depreciation expense as a percentage of revenue is at 25 year lows, resulting in short term profits but long-term decline. Instead of investing in capital to increase efficiency or expand their business, greedy myopic CEOs have chosen to buy back their own stock at all-time high prices. They did the same thing in 2005 - 2007. Driving up quarterly earnings per share to boost their own stock option compensation is how it rolls in corporate America today. Investing in their workers through higher wages isn't even a consideration. They don't teach that in Ivy League MBA programs. SG&A expenses as a percentage of revenue have been driven to all time lows, as outsourcing, downsizing, and working people to death have done wonders for corporate profits.

Ramraika and Trivedi reach damning conclusions of corporate America, based on their detailed unbiased research:

As the world moved increasingly towards the idea of shareholder-value maximization, time horizons for management and the shareholders have shortened. As Montier shows, the average lifespan of a company in the S&P 500 in the 1970s was about 27 years and is down to about 15 years now. In tandem, the average tenure of CEOs is down from about 10 years in the 1970s to about 6 years now. Combine this with the incentive systems prevalent today (think stock options), and it is only logical that a CEO who is going to be around for as few as six years and is going to get a large chunk of her rewards in stock options will want to see higher stock prices.

Cutting SGA expenses and postponing capital investments -- actions that carry positive short-term earnings impact at the expense of a business' competitiveness in the long-term -- look promising to managers whose payoffs depend on stock prices in the short-term. Not surprisingly, the renters (there are hardly any owners any more) clamor for just such actions. The problem with this thinking is that the long-term eventually shows up. And when it does, profit margins will have no choice but to remember their long forgotten tendency to revert to mean.

Are interest rates going to be driven lower for corporations? Are taxes going to be driven lower? How many more people can corporations fire? Have economic downturns been eliminated by the Federal Reserve? Will record profits not result in increased competition and price wars? Can wages be driven even lower?

The financial, economic and political system has been captured by corporate fascist psychopaths. The Federal Reserve has aided and abetted this takeover. Their monetary manipulations have resulted in this deformity. Psychopaths always go too far. The American middle class has been murdered. Decades of declining real wages have left them virtually penniless, in debt up to their eyeballs, angry, frustrated, and unable to jump start our moribund economy by buying more Chinese produced crap. Yellen, her Wall Street puppeteers, and the corporate titans should enjoy those record profits and record stock market highs. It won't last. Short-term profits will be wiped out, as long-term consequences always arrive when you least expect it. The artificial boom will lead to a real depression. Luckily for the oligarchs, most middle class Americans are already experiencing a depression and won't notice the difference.

"True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression." - Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2014 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.