Gold Market Capitulation? Not Likely

Commodities / Gold and Silver 2014 Nov 15, 2014 - 03:44 AM GMT If you’re waiting for capitulation in the gold market, don’t hold your breath – An argument for why the bottom in gold will come with a whimper, not a bang and why the mainstream media might be looking for capitulation in the wrong place.

If you’re waiting for capitulation in the gold market, don’t hold your breath – An argument for why the bottom in gold will come with a whimper, not a bang and why the mainstream media might be looking for capitulation in the wrong place.

ca·pit·u·la·tion noun \kə-ˌpi-chə-ˈlā-shən\

When investors give up any previous gains in stock price by selling equities in an effort to get out of the market and into less risky investments. True capitulation involves extremely high volume and sharp declines. It usually is indicated by panic selling.

Having just finished reading the umpteenth article on gold going to $700 an ounce on a wave of panic selling reminiscent of the 1987 stock market crash, with ‘complete despair with even the most ardent of gold bugs’, I found myself again shaking my head in disbelief. This is what you get, I suppose, when you have a CNBC stock shill analyst covering the gold market.

"More Pain Ahead for Gold Bugs”, was another headline. The assault against gold has…wait for it…reached mania levels, with price predictions that border on outrageous finding their way into financial headlines daily. Does this sound familiar? It does to me. The last time this happened was when gold was charging past $1800 in a swirl of a US credit downgrade and full throttle QE. Calls for $2500, $3000, $5000 and more in the gold price littered the mainstream press. The consensus was that the gold bull market would top out in a blaze of parabolic glory. Everybody loves a good bandwagon (especially, I’m learning, the mainstream financial press – see current position on gold), and even the most ardent of gold bears were on board. But as it turned out, gold came off its highs at $1920, and traded within about a 15% band of that high for the next 16 months. Hardly a parabolic blaze of glory, and a top, that while obvious in retrospect, was rather subtle at the time.

Back to the present. The almost painfully redundant prediction I keep seeing regarding the gold price is that ‘when gold bottoms, you’ll know it, and its going to be painful.’ In other words, complete and total capitulation. But is capitulation a realistic future for the gold market, or is the notion nothing more than the latest buzzword of a biased, shortsighted mainstream financial media?

My answer, as you’d likely expect, is the latter.

As the definition cited at the beginning of this article notes, capitulation is marked by complete abandonment of an asset class to the point of panic selling, causing massive downward volatility in the price. But that characterization fails entirely to factor in the mentality of the physical gold owner, and the mentality of countries like China and India, where the role of physical gold ownership is innately understood, not questioned.

The average gold owner isn’t going to bother going to his safe deposit box to pull out his physical gold to sell because the price is dropping. To him, gold is insurance. Despite new stock market highs and steady stream of ‘all’s well’ news, in his estimation, the world hasn’t changed enough to warrant selling his monetary insurance. If anything, to the asset preservation minded investor, dropping prices seem like a good opportunity to supplement his or her holdings – in fact as the price dropped just recently, mints around the world reported an explosion in gold and silver bullion coin sales (see US mint figures here).

Health insurance - Wealth insurance

Here is a little story to put this into context:

A guy walks into his doctor’s office for a physical exam. After all the tests come back, the doctor sits him down and tells him, “Congratulations, you’re in excellent health. Keep a healthy diet and continue to exercise and you’ll likely stay that way.” The patient remarks, “That’s great!” and proceeds to pull out his cell phone and immediately dial away. The doctor, trying not to appear irritated inquires, “Can’t this wait?” The patient replies, “No, this is great. You just said I’m in perfect health, right? Well there’s not a moment to lose. I’m canceling all of my health insurance immediately! This is going to save me a fortune!”

Nobody would do this. Why? Because you own insurance to protect against the things you cannot plan for - for the things that do not show up in the tests. Similarly, gold is wealth insurance. To say that the average believer in gold will one day capitulate because of a falling price is akin to saying the average person would cancel his or her health insurance after a successful well visit to the doctor.

We invite you to sign-up to receive Review & Outlook free of charge in your mailbox. We will not deluge you with e-mails and you can opt out at any time. Broaden your view of the gold market with quality analysis like what you are now reading. |

The more I read, the more I realize that those reporting in the mainstream financial media have basically no understanding of the mentality of the gold owner (either as private individuals or as nation-states). They live in a fairytale world where P/E ratios and cash flow models are infallible value metrics, and anything that can’t be valued through these methods must surely be worthless. They try to pigeonhole gold as a risk asset, and predict its performance accordingly. So in a way, I can’t blame them for calling for a capitulation in gold. To them, it is logical. But I have a question for these opinion makers: Do you even know why stock owners ‘capitulate’? Because when the bottom starts to fall out, their scared out of their minds that their pieces of paper are going to be 100% worthless!!! – A fear, mind you, that is rooted in historical reality.

By contrast, the average gold owner owns gold specifically because he knows that it will NEVER go to zero!

China shares the same sentiment toward gold, begging the question: Why in the world would a country that has been steadily acquiring metal over the past decade suddenly capitulate and drain their gold holdings because of a falling price? They wouldn’t, unless of course Gordon Brown was their prime minister. If anything, they’d acquire more, and you can bet China is licking its chops at the prospect of any such ‘capitulation’. Whether or not they can find any metal to buy if this happens is another story altogether.

Speaking to that point: Did you also know that if gold does go to $700, it will be approximately $500 below mining production costs, and almost $700 below all-in costs for the major producers? Did you also know that with the falling price and the already committed assets and manpower, mines are now mining their highest-grade ore just to stay profitable? Many mining analysts believe that we are right smack dab in the middle of peak production for gold mines, right now. It doesn’t take a PhD in Economics to see that $700 an ounce is not the kind of price that can sustain a stable supply/demand paradigm.

Capitulation more likely with the paper gold market shorts than physical metal owners

Moreover, if there ever were to be a capitulation in the gold market, it would come in the paper market, where traders of the metal treat gold as a number on a screen rather than a wealth preservation asset. BUT THERE’S ONE HUGE PROBLEM WITH THIS! The traders (especially at the institutional level) are overwhelmingly SHORT! Not to mention that many would argue these short positions - and their inherently limitless supply - are actually one of the primary catalysts when gold declines in the first place. So simply put, how can there be capitulation amongst the speculators when the vast majority of the speculating volume is on the short side of the market to begin with?! If anything, when the downside proves resistant, your capitulation is going to come at the exhaustion of the shorts, not the longs.

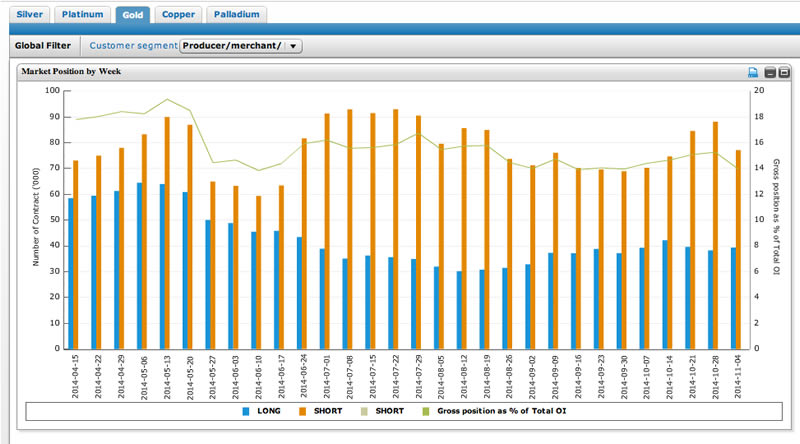

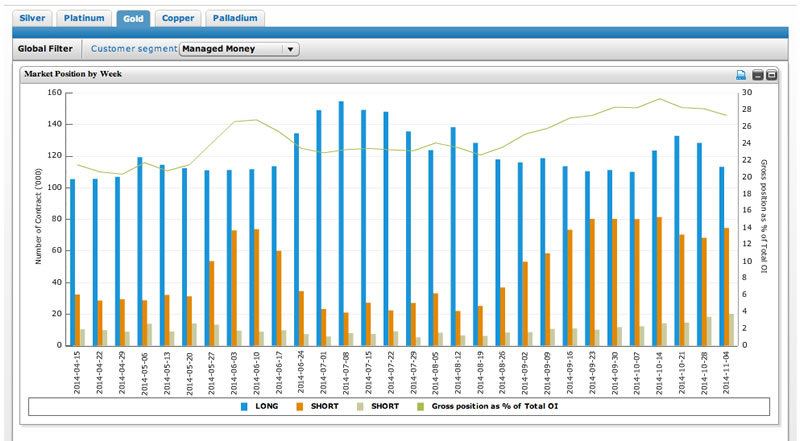

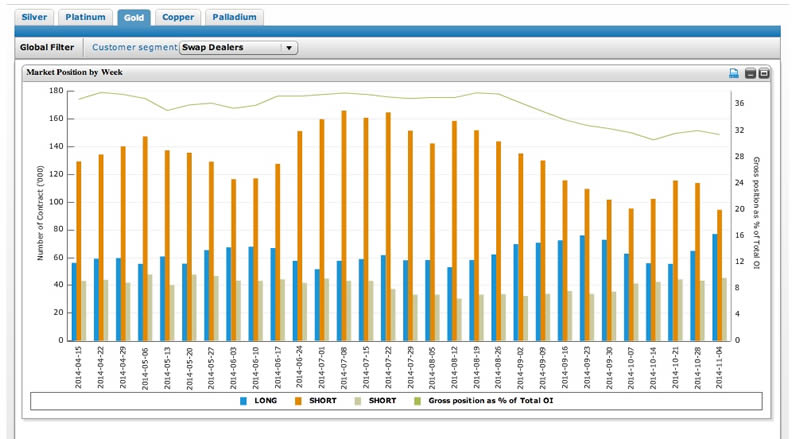

Don’t believe me: Check out these graphs/commentary on current futures positions in the market. Charts courtesy of the CME group.

Graph Commentary: The above graph shows the net long/short positions of the producer/merchant/processor market participants. A producer/merchant/processor/user is an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage or hedge risks associated with those activities. While this segment of the market is always for more short than it is long, it is worth noting the increase in the gap between the shorts and longs from the beginning of the year to present. Moreover, the aggregate number of longs is about half of what it was at the beginning of the year.

Graph Commentary: The above graph shows the net long/short positions of the Managed Money positions in the market. A "money manager," for the purpose of this report, is a registered commodity trading advisor (CTA); a registered commodity pool operator (CPO); or an unregistered fund identified by CFTC. These traders are engaged in managing and conducting organized futures trading on behalf of clients. Put simply, this is the best representation of ‘the public’.

While still slightly more long than short, it is worth noting that the short positions are over triple where they were at the beginning of the year, or even as recently as the beginning of August. Put another way, the managed money market is three times as short as it was 12 weeks ago! Also very telling is the rapid increase in shorts at the beginning of September, coinciding perfectly with the near top seen in gold in the mid $1320’s and the decline we’ve experienced ever since. "

Graph Commentary: The above graph represents the Swap Dealer net positions within the market. A "swap dealer" is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions. The swap dealer's counter parties may be speculative traders, like hedge funds, or traditional commercial clients that are managing risk arising from their dealings in the physical commodity. In other words, we’re talking about the big boys.

Again, always short more than they are long, especially near the interim top in gold back in July, I was actually taken aback by the trend differences here when compared to the Managed Money market. Clearly, the gap between short and long at the swap dealer level has closed considerably from where it was over the summer. In fact, as of November 4th, Swap Dealers are representing more long contracts and fewer short contracts than they have had at any point this year. November 4th also happens to be the day that gold bottomed (for the time being) at $1140.00.

Makes you wonder, who has it right?

When adding the data from all three of the market segments together, the futures market is about 4.5 million ounces more short than it is long. To give that some context, that is akin to being short 140 tonnes of gold, or just over 5 billion dollars worth of the yellow stuff – paper yellow stuff that is. As recently as a month ago, the gap was closer to 200 tonnes and $7.5 billion dollars.

When we talk of capitulation, I reiterate a thought I posed earlier. It appears in these reports, especially when focusing on the Managed Money positions, that the herd money is on the short side, not the long. Look no further than the obvious spike in retail short positions in just the last three months. It seem to me that these shorts are actually the weakest positions in the market, and the ones most likely to ‘capitulate’ when the trade doesn’t go their way. You might even say, that is what’s happening right now. As I put the finishing touches on this article, gold has stormed back $30+ intraday, and is pushing back toward the $1200 level.

All told, I can’t say if this is the bottom in gold or not, but I’m inclined to think that a massive panicked wave of selling is as outrageous at the $700/ounce predictions associated with it.

Here’s my call:

Whether its already behind us, or it comes next week, next month or next year, the gold market will bottom with a whimper, not a bang, and every one of these financial pundits will miss it. The one thing they always seem to overlook is that the herd can, and will, run in either direction, and when that occurs, these same pundits will find themselves ironically returning to square one with their predictions.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.