What Are The Odds in 2015: Inflation or Deflation?

Economics / Deflation Nov 13, 2014 - 10:32 AM GMTBy: Submissions

TCE writes: Like other Central Banks, the U. S. Federal Reserve has “printed” copious quantities of money. Despite better GDP numbers and positive media commentary, much of the American economy continues to be lethargic. The Eurozone appears increasingly vulnerable to recession. Financial and geopolitical risks could derail economic growth. What are the long term trends that will shape the outcome?

TCE writes: Like other Central Banks, the U. S. Federal Reserve has “printed” copious quantities of money. Despite better GDP numbers and positive media commentary, much of the American economy continues to be lethargic. The Eurozone appears increasingly vulnerable to recession. Financial and geopolitical risks could derail economic growth. What are the long term trends that will shape the outcome?

The Case for Inflation

Oil

As I have documented several times, the rate of inflation is sensitive to the price we pay for a barrel of oil. Political turmoil in Iraq, Iran and North Africa threatens to decrease potential production. New discoveries are not keeping up with consumption. However, a combination of sluggish world demand, increased American production, and Saudi production strategy, has temporarily depressed oil prices.

There is a fundamental economic problem with fracking. It is capital intensive per barrel of oil produced because even “good” wells deplete very quickly. Depletion rates can exceed 70% in the first year and economic well life can be less than 5 years. That means oil exploration and production companies must recover well capital costs over a relatively short period of time. After accounting for the costs of well production and company operations, it will be a struggle – at current oil prices – for many companies to generate enough cash flow from future production to pay off accumulated debt.

Lower oil prices have also savaged the profitability of oil sands production. According to the International Energy Agency, about 25 percent of the synthetic crude produced from the sands is no longer profitable at $80 per barrel.

It is difficult to understand how one can predict increased oil production from fracking or sands at current oil prices. This conflict of revenue versus cost is not sustainable. Unless there is an unlimited amount of junk bond debt available, aggregate production will decrease. Speculation will quickly drive up the price of Brent and WTI crude.

Conclusion: expect oil price inflation in 2015. Current expense items –such as food and fuel – are extremely vulnerable to the price of oil.

Government

Public debt financing, along with entitlement and contract obligations, will force Federal and State government administrations to increase taxes. Look for increases in investment, estate, property, income, sales, and corporate taxes. The idea that only incomes over $200,000 ($250,000 for married couples) will be taxed is a politically expedient myth. Every worker will pay more personal income taxes. All consumers (including welfare recipients) will pay more direct and indirect taxes when they purchase goods and services. The cost of living goes up. That’s inflation.

Obamacare, Medicare, and Medicaid costs are out of control. Individual premiums will skyrocket in 2015. Medical care continues to be a critical driver of inflation.

Despite the growing availability of competitive on-line education, college, university, high school and grammar school costs will continue to escalate at rates that exceed the base rate of inflation.

State and Federal Environmental Protection Agency (EPA) rules will continue to increase the cost of doing business while decreasing economic growth. Proposed rules will raise the price of goods and services for all consumers and businesses.

State and Federal regulation of employment, welfare, business, banking, and consumer activity continues to increase the cost of doing business. Lawmakers typically ignore the economic damage. Businesses that manage to survive will have to raise the prices they charge for the goods and services they sell.

Conclusion: government bureaucracy and regulation will be a primary source of inflation in 2015.

Banks

Central Bank financial policy has not resulted in a sustained economic recovery, witness the declining fortunes of Western Europe and the declining financial condition of the American family (except for the very rich). Printing copious amounts of money (paper and electronic) has increased national debt burdens. It could be argued low interest rates are actually impeding economic activity because money is flowing into financial instruments (including rank speculation) rather than business building financing instruments. The health of the stock market is an illusion.

John Maynard Keynes, that icon of Central Banking and liberal intelligencia, believed government spending and regulation could modify economic cycles. Liberals have perverted his theories into a socialist political ideology that believes government should manage the economy. Liberals do not understand, or choose to ignore, a simple economic truth: the wealth of a nation is created by its people. Liberals ignore the “cultural” part of Cultural Economics. No government has ever been able to mechanically manipulate sustained economic activity with a politically motivated financial policy. Monetary accommodation (lower interest rates and public spending) can stimulate aggregate final demand – BUT – only if these stimulus funds flow into private commercial activity, the consumer has manageable debt burdens, and families have (at least the hope of) increasing real income. There is no money multiplier if the consumer is broke, and small businesses are unable to secure loans. It is people, after all, who make investment decisions including personal time, personal risk and personal money. It is government bureaucrats, on the other hand, who always bury economic activity under the dung pile of excessive regulatory restrictions, and it is politicians who will make politically expedient spending decisions without regard for the eventual financial consequences. These are structural problems that will forever trash the Keynes monetary management thesis.

Which brings us to the value of money: the cocktail circuit likes to talk about dollar deflation, as though the declining value of the dollar is deflationary. For democrats and liberals, such talk may be politically correct and politically expedient, but it is based on a deliberate perversion (or outright ignorance) of economic reality. When the value of the dollar (or Yen, or Euro, or ...) goes down (deflates) the price of goods and services that can be purchased with that dollar goes up. We know national governments make a huge effort to obfuscate the rate of inflation (because inflation hurts the proletariat), but if the article I bought yesterday cost $1.00, and today it costs $1.10, that’s inflation. Anytime the dollar devalues, the price we pay for goods and services goes up. That’s inflation.

Some central banks are suggesting the devaluation of their national currency in order to compete with the (declining) value of other national currencies. The easiest way to accomplish their objective will be to print money. If a currency war breaks out, there is no upper limit to the rate of inflation.

Conclusion: Central banks, particularly in Europe and the United States, have created a dung pile of debt. The winds of economics will bring in higher interest rates and currency devaluation. It’s all inflationary.

The Case for Deflation

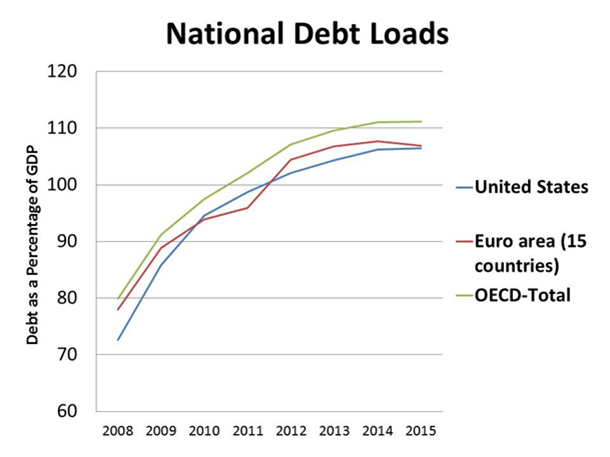

The public debt bubble will collapse. Chinese capital spending is not sustainable. According to the OECD, Japan’s “official” debt to GDP ratio is projected to be 232% in 2015, followed by Greece (188%), Italy (147%), Portugal (142%), Ireland (132%), France (116%), Spain (111%), the United States (107%), Belgium (105%), and the United Kingdom (103%). As shown in the following graph, the 15 country Euro area has a debt to GDP ratio of 107%, and the total average debt burden for all OECD nations is 111%. These “official” debt burden numbers do NOT include forward spending commitments for promised welfare payments, “off the books” public debt, or the effect of higher interest rates on public debt service. There is NO credible plan to pay off these debts. The bubble just keeps getting larger, and larger....

Should we be concerned when tepid economic growth and low inflation are accompanied by increasing public and private debt? Are we borrowing just to stay alive? National debt loads accelerated from 2008 through 2012, and then moderated into 2014. Although existing commitments for 2015 call for a moderation of debt spending, the weakness of the Euro area economy could easily derail these plans. The key point: national governments will increase national debt loads in order to stay in power. This means printing money and/or paying higher interest rates on newly issued or refinanced debt. The load of national debt will continue to increase until one or more nations default. Then the national debt bubble will burst. The ensuing financial panic will trash bond values. Derivative values will be worth pennies on the dollar. The net effect will most certainly be deflationary. We don’t know how long it will take for this scenario to play out.

If the world economy unravels, then unemployment, underemployment, and fear will combine to reduce consumption. Investment and GDP will decline. The economy will deflate. Just like the 1930s.

If the world economy deflates, fixed asset values will decline. Rental properties are especially vulnerable. Stagnant incomes, increasing unemployment, and credit card debt guarantee consumers will prioritize spending decisions based on urgent need: food, fuel, and then rent (or mortgage payments). In periods of declining economic activity, rental property owners (homes, apartment buildings, shopping malls and so on) face potential bankruptcy because of higher vacancy rates. It will also become increasingly difficult for rents to keep up with property, debt, tax, and maintenance costs.

Expect a flood of cheap imports into the OECD nations followed by ever increasing national protectionist trade policies. Asia will export deflation; and that will work until the protectionist trade barriers go up.

Despite current optimism, we know the stock market will collapse. Aggregate stock valuations and derivative values will decline. That’s deflation.

Expect confidence in the financial viability of the public sector to erode. Because national central banks will continue to print money, public debt ratings will likely decline. Federal and state agencies will have to pay higher rates of interest in order to offset the perceived risk of buying public debt. It will become increasingly difficult and more expensive to sell new bonds, or to roll over maturing issues of existing public debt. But as public sector bond interest rates go up, bonds not held to maturity will decline in value.

Recession makes it increasingly more expensive to sell new bonds, or to roll over maturing issues of existing private sector debt. As interest rates go up, bonds not held to maturity will decline in value.

Bond devaluations and declining property rents jeopardize the asset base that supports existing pension plan and insurance annuity contract payments. Aggregate plan values decrease.

Forecast

The International Monetary Fund (IMF) has recently forecasted World GDP to increase by 3.8 percent in2015. GDP is expected to increase by7.1 percent in China, 3.1 percent in the U.S., 2.7 percent in the U.K., 1.3 percent in the Euro area, and .8 percent in Japan.

But this scenario appears to be optimistic. In order to sustain a stable economy through 2015, we have to assume:

WTI oil prices below $105 for most of 2015,

No disruption of oil supplies,

No substantial increase in taxes,

Medical costs are brought under control,

Restrictions will be placed on Federal and State EPA regulatory authority,

Federal and State regulations will favor private business activity,

Central Banks will refrain from printing money,

Central Bank policy will compel the banking system to support private business activity,

Governments will not increase national debts,

Nations will not engage in deliberate currency devaluations,

The Stock Market will not collapse,

Vladimir Vladimirovich Putin will not try to annex more nations, and last – but not least -

Relative calm will prevail in the Middle East, Africa, and elsewhere. (Note 1)

Since liberal economic and social philosophy dominates OECD national political agendas, we can expect liberal financial solutions will be imposed to solve OECD financial problems. Liberal ideology is unlikely to support the creation of national wealth, very likely to increase government spending, and absolutely certain to increase the transfer of income and savings from “rich” to “poor”. Although it decreases national wealth, growth in public employment is seen as beneficial. Fiscal discipline is (deliberately) ignored. Liberal ideology will encourage (and demand) national central banks print copious amounts of money. The resulting currency devaluation is likely to increase the cost of living. It is possible the net effect will be to drive OECD nations into a long period of high inflation accompanied by declining business activity. Expect high rates of unemployment and underemployment. Poverty and liberal theology will drive widespread social unrest.

But, I could be wrong. Perhaps the collapse of the financial system will usher in a period of deflation like the 1930s. Perhaps currency devaluations will result in high rates of inflation. And maybe the IMF is right.

Do your own homework and then judge for yourself. As usual, any text published on this blog is subject to the Legal Information found in http://tceabout.blogspot.com/

TCE

Note 1: OK. I left out some problems. But you get the point.

Note 2: for more information about food and fuel inflation see: http://www.tceconomist.blogspot.com/...

For an analysis of the relationship between the price of oil and the rate of inflation, see: http://www.tceconomist.blogspot.com/2011/06/...

http://tceconomist.blogspot.com...

© 2014 Copyright TCE - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.