Switzerland - Vote Yes on Gold Initiative

Commodities / Gold and Silver 2014 Nov 11, 2014 - 02:37 PM GMTBy: Axel_Merk

On November 30th, the Swiss are voting whether to amend their country's constitution on an initiative entitled 'Save our Swiss Gold.' The Swiss gold initiative appears widely misunderstood, both inside and outside of Switzerland. We discuss implications for gold, the Swiss franc and Switzerland as a whole.

On November 30th, the Swiss are voting whether to amend their country's constitution on an initiative entitled 'Save our Swiss Gold.' The Swiss gold initiative appears widely misunderstood, both inside and outside of Switzerland. We discuss implications for gold, the Swiss franc and Switzerland as a whole.

The motivation

The initiators of the gold initiative appeal to Swiss citizens desire not to sell out the 'family silver.' In the late 90's, the Swiss National Bank (SNB) owned 2,590 tons of gold; since then 1,550 tons have been sold at prices far lower than today's prices. While the Swiss might like their gold, they are fiercely independent. That's relevant because by imposing a ceiling of the Swiss franc versus the euro, the SNB has de facto imposed the euro on Switzerland, a step closer to joining the euro -- something many Swiss object to. More importantly, many Swiss may find it inappropriate for what is supposed to be an apolitical body like the SNB to impose policies with major political ramifications.

Not surprisingly, the Swiss government -- which opposes the initiative - does not frame the discussion this way, but instead talks about the flexibility the SNB needs to implement its policies. It also points to the 'losses' incurred in 2013 when the price of gold fell.

Let's look at the initiative and arguments in more detail. The initiative would amend Switzerland's constitution such that:

• Gold reserves of the SNB must not be sold;

• Gold reserves of the SNB must be held in Switzerland;

• Gold reserves of the SNB must be 'significant' and must not fall below 20%.

As transitional measures:

• Switzerland has 2 years to repatriate its gold;

• Switzerland has 5 years to phase in the 20% reserve requirement.

Central bank independence

The Swiss government states the SNB's independence would be at risk if the initiative passed. Former Federal Reserve Chair Alan Greenspan had this to say about central bank independence: "I never said the central bank is independent." He did not imply the government tells the Fed where to set policy on a daily basis, but made it clear that it is the government that sets the rules. He fought back against accusations that the Fed finances huge government deficits, arguing critics have it backwards, as the Fed merely goes along. He then added that the Fed's policies are driven by 'culture rather than economics.'

It should not be surprising that the Swiss government is against any outside restrictions imposed on the SNB, but not because it jeopardizes central bank independence, but because it reduces the flexibility the government has. But that, of course, is precisely the purpose of constitutional initiatives available in Switzerland.

Gold a risk for the SNB? The Swiss government claims that the sharp drop in gold prices in 2013 lead to heavy losses at the SNB. It's sad when the official pamphlet representing the government's view resorts to polemics. Let's get a few things straight about central bank accounting:

• The gold held by the SNB was purchased at dramatically lower prices. If more gold were sold, no losses, but substantial gains would be recorded.

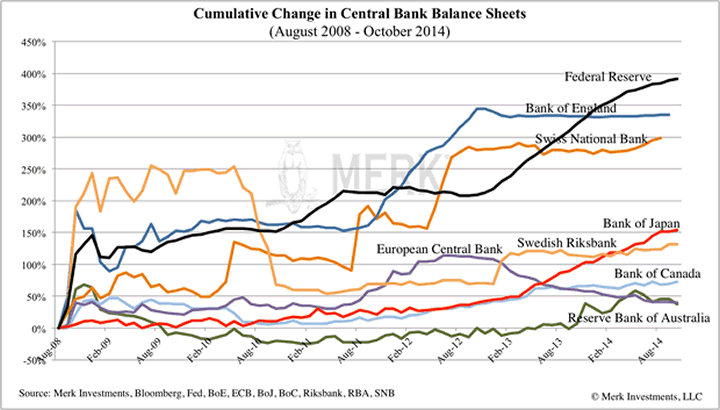

• In an effort to keep the Swiss franc from rising, the SNB has "printed" a great deal of money, as the chart below shows -- almost as much as the Fed:

• Currency isn't actually printed, but the Fed or SNB purchase securities from banks; they pay for these securities by crediting the account of banks with the stroke of a keyboard. Money is literally created 'out of thin air.'

• What most are not aware of, however, is that the more money a modern central bank 'prints,' the more interest bearing securities it buys, the greater the "profit" of the central bank. That's why central banks brag how 'profitable' their policies have been.

• However, while the Fed has only purchased domestic securities (US Treasuries and Mortgage Backed Securities), the Swiss National Bank has been buying Euro and U.S. dollar denominated securities. In doing so, the SNB has truly introduced massive currency risk.

• Except that central banks don't really care about losses: the Bank of Israel, for example, has had a negative net worth for over 20 years. Losses for a central bank make for bad PR, but a central bank can simply 'print' money to pay for its obligations. Some central banks, such as the European Central Banks, have in their statues that member states must pay-in additional capital should the ECB suffer losses.

Gold sales needed in times of crises?

The Swiss government argues a central bank must be able to sell its gold in times of crisis. Let's think about this: such a 'crisis' might occur when a bank is over-leveraged and must be rescued. To facilitate a 'rescue', the SNB is likely to provide "liquidity" (money printing with the promise that it's only for the short-term). If a bank is insolvent rather than illiquid, it might require a capital injection. That capital has to come from somewhere. If gold is sold for this purpose, it is the people's gold that's being sold. The government likes to keep an option open to socialize losses.

We would argue that the very reason "too big to fail" exists is because governments play rescuers that are all too willing to sacrifice the wealth of the public. They say such measures are for the common good -- because depositors might lose their money in a bank. Indeed, when a bank collapses, it is the savers that lose out, as the savers are the folks that have loaned money to the bank.

The way to protect savers, though, is through prudent policies that require those that take risks to be responsible for losses.

Gold is the people's money

Gold is the people's money, not the government's money to splurge. If a currency is backed by gold, then the currency represents the gold. It's not for the government to give away: that's why the initiative argues against selling any of the gold, ever. It's for that reason as well that the gold does not need to be kept abroad: gold is a store of value that ought to back the currency in circulation.

20% minimum backing of reserves

Marc Faber, for example, says he has been asked to publicly support the initiative, but has so far declined to do so because he argues it is a haphazard solution; only 100% backing would be worth supporting publicly. In our assessment, Marc is too quick in discarding the merits of the initiative. Combined with the requirement that the SNB will never, ever, be allowed to sell gold, there are major ramifications:

• Assume that 20% of the SNB's assets are backed by gold and the price of gold drops. The SNB would be immediately required to purchase more gold. As such, over time, the SNB's reserves would likely be above 20%. In our assessment, dynamics may well move them to be closer to 100% over time. Basically, whenever there is a crisis and the SNB might be tempted to 'print money' to bail out an institution, it would chip away at the SNB's flexibility for future bailouts, more gold is held that cannot be sold.

• An activist SNB that continues to buy foreign securities may, over time, have a hard time defending a ceiling on its currency. That's because a ceiling on its currency is akin to a bailout to the country (Switzerland) as a whole, arguing that debasing the currency is good for the country.

Competitive Swiss franc?

The Swiss government argues that the strong Swiss franc is a concern to exporters. No kidding. Other concerns are competitors -- maybe we should get rid of those, too. And those pesky customers that don't always feel like buying gadgets and services that are Swiss made. Kidding aside, we would argue that it is impossible for an advanced economy to compete on price. An advanced economy has to compete on value. Very few low-end consumer goods are exported from advanced economies.

Look at beer, as the one area where low advanced economies have tried to compete with what might be considered as a low-end product: first, beer is branded as a premium product these days. In order to have pricing power there has been massive consolidation in the brewing sector over recent decades in much of Europe; Switzerland has been left behind in this trend -- but note that these are trends that have been firmly in place well before the financial crisis. A weaker Swiss franc wouldn't fix these challenges. The alternative to scale is to then try to be profitable at the local level; indeed, microbreweries with no export market have succeeded in many high cost areas.

Swiss multi-nationals have long learned to have natural hedges in place, matching revenue and expenses in their export markets.

Switzerland usually retains the headquarters, possibly R&D. Switzerland has lots of seasonal workers; policy makers should think out of the box, such as paying seasonal workers in euros. It may be far better to pay workers in a depreciating currency than to throw away one's gold reserves in order to attract more seasonal workers…

Switzerland has always had a tough market. It is said that because of how critical Swiss consumers are, that if someone can have a product succeed in Switzerland, it can succeed anywhere.

We live in a world drowning in debt. The U.S., European Union, Japan, to name a few, cannot afford to pay all the promises they have made. As Alan Greenspan recently said, a welfare state cannot support a gold standard. These other countries will debase their currencies over time in an effort to make their liabilities more affordable.

It won't be easy to sell to countries that have put policies in place that we believe may impoverish their middle class. The solution, however, is not to impoverish Switzerland. It won't be easy, but the sooner Switzerland embraces the reality that competitive devaluation is not in its interest, the better.

Back to reality

Having made the case for Switzerland's gold initiative, note that passing the initiative would only be a first step. Unless policy makers embrace the spirit rather than the letter of the law, it may be an uphill battle. We have already received research reports how the SNB could circumvent its obligations by spinning off assets. The SNB might also engage in derivatives to undermine the spirit of the initiative should it pass.

Let's also keep in mind that the SNB has five years to implement the 20% backing of its reserves by gold. That should allow the SNB to conduct purchases without disrupting markets. In the short-term, the signaling effect might be the most powerful one: the ceiling of the Swiss franc versus the euro may well get tested. Such ceilings are enforceable only when they represent an unconditional commitment. As soon as someone blinks, the market will test the resolve of policy makers. The passing of such tests may well qualify as resolve. The SNB may be well served to start buying gold from day one if they accelerate their purchases of euros.

Ultimately, people should never rely on their government to pursue a gold standard, but consider pursuing their own, personal gold standard.

On that note, we will expand on our discussion of Switzerland's vote to force the Swiss National Bank to hold a minimum of 20% of its reserves in our upcoming Webinar (click here to register), on November 20, 2014. As part of the webinar, we will also discuss how investors can build their personal gold standard.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.